Instant sales analysis

Did you know that retailers who monitor real-time sales experience a significant increase in daily revenue? By transforming your daily sales data into actionable insights, you could unlock the key to boosting your sales. A study shows this here.

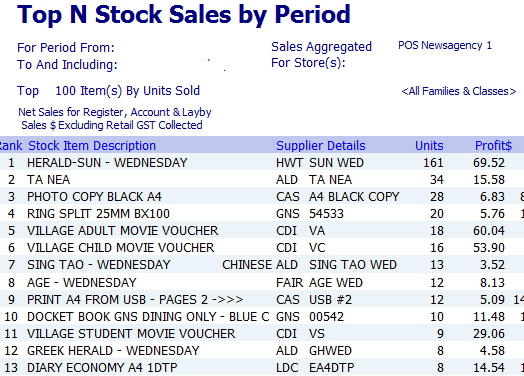

Most people look at the end-of-day till roll, but that does not tell you how to identify your current top-selling items.

What we want to know.

Do you know what the most popular items in your shop are right now? Understanding this can significantly impact your sales performance. What are now the most profitable items in my shop? What is hot in my shop right now?

Now, we have a quick and straightforward way of getting these items immediately.

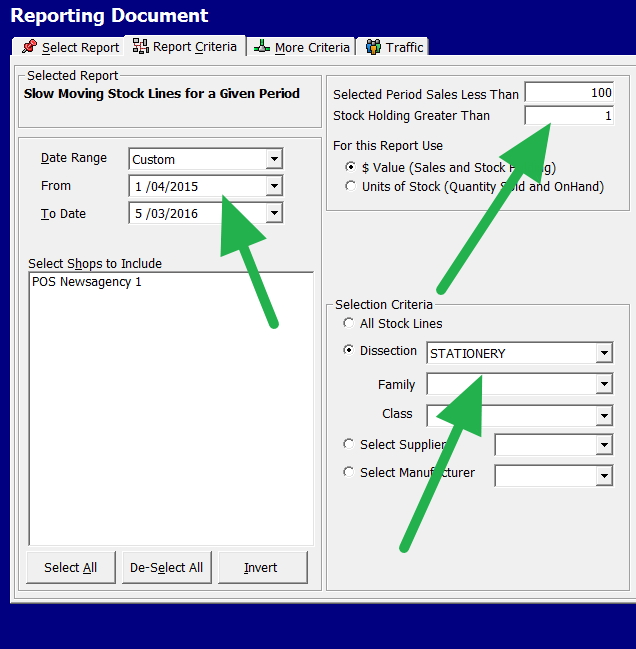

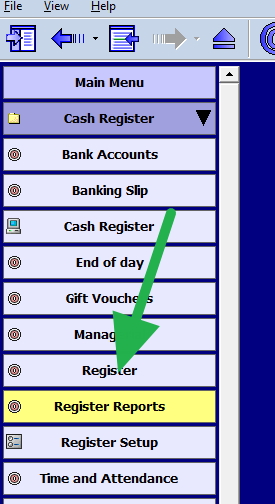

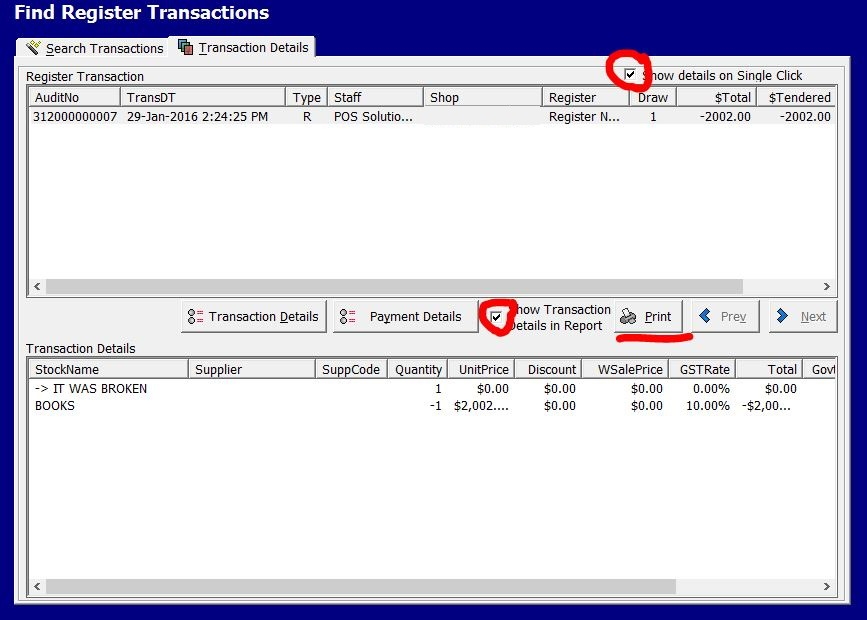

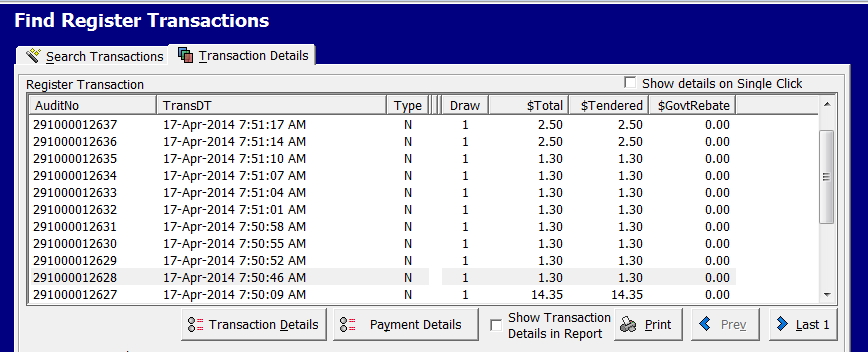

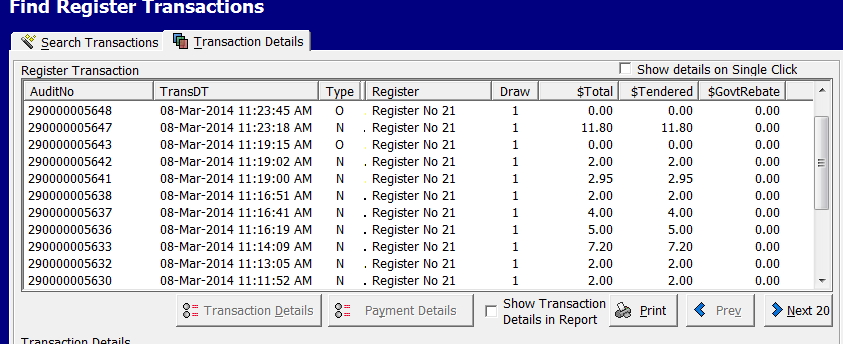

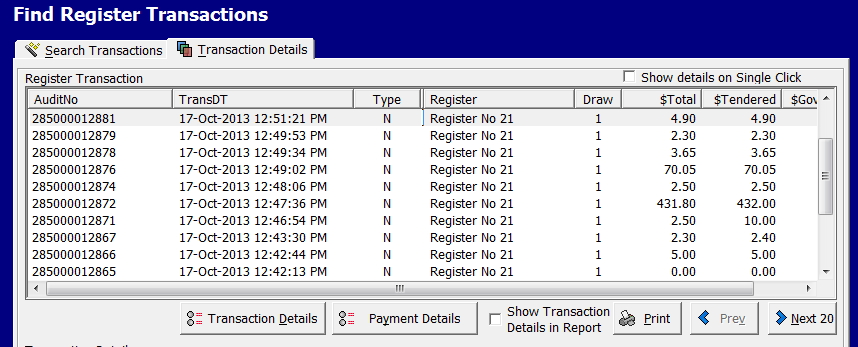

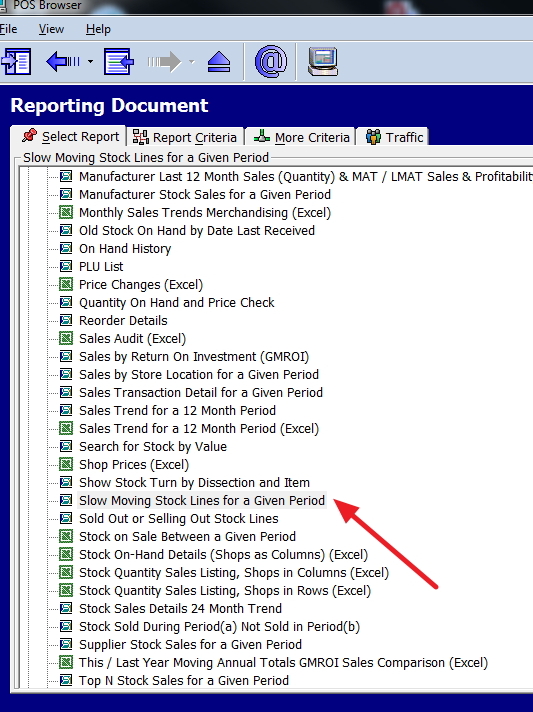

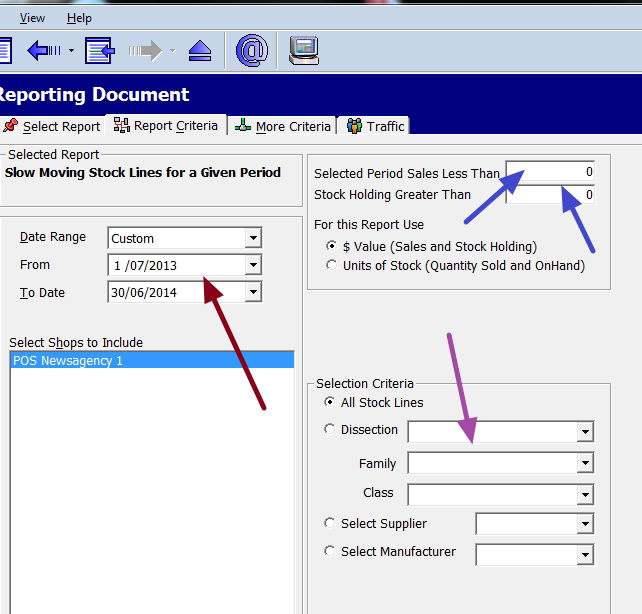

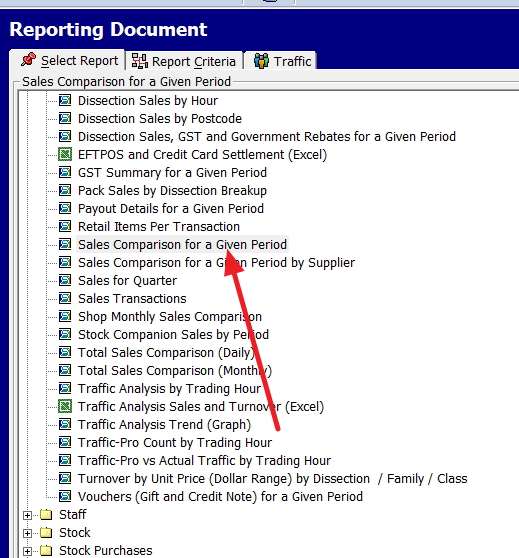

How to Accessing Instant Sales Analysis on Your POS

Analysing cash register and sales data, employee sales, and stock performance is the key to running a modern retail business.

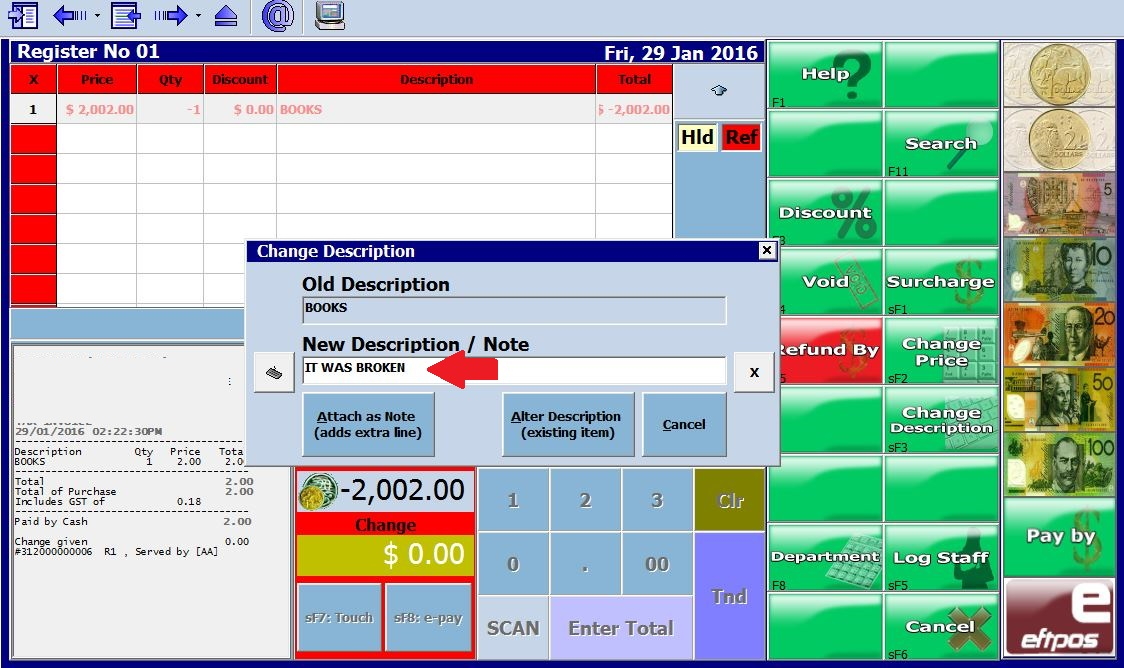

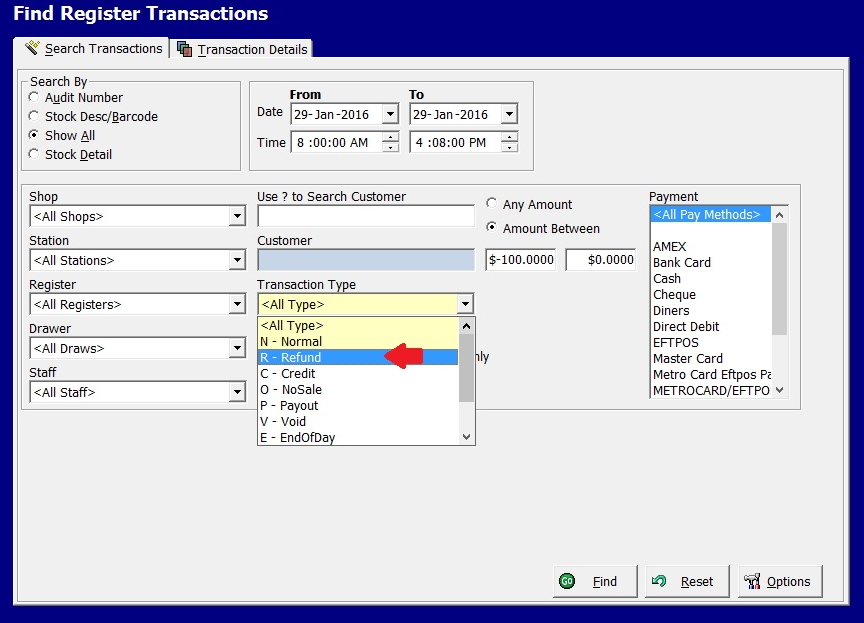

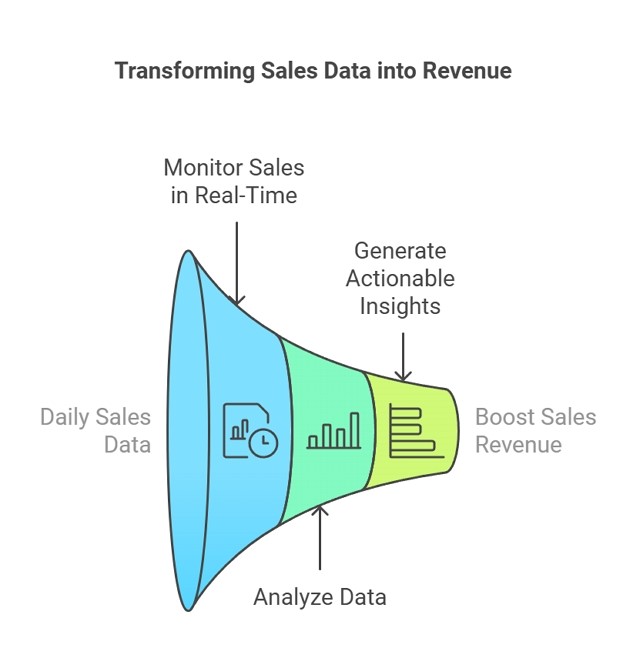

Sometimes, you need these figures instantly, e.g., how much money is in the till now, what departments are now selling, are items being scanned now, etc. Here is how you get these figures and more. In your cash register, there are function keys; look for the one called "Sales Analysis"; it generally is on the second page at the bottom. Now click it.

Now, you get a screen with heaps of analysis. Say I was interested in sales analysis today. So, on my screen, I pressed the button marked with the orange arrow below.

Now, I get an instant analysis.

But here’s something exciting

Press each of these light blue buttons marked with green. These are filters, and you will see that my graph changes as I press the buttons.

It is worth experimenting to work out what is happening.

And this is just the beginning.

Once you have done that, check out the buttons marked in dark blue and green. These give you other types of information.

This gives you a massive database of instant reporting information that provides insights into your shop's current situation. Try it.

Navigating the Sales Analysis Dashboard

The dashboard presents you with a wealth of data. Here's how to make sense of it all:

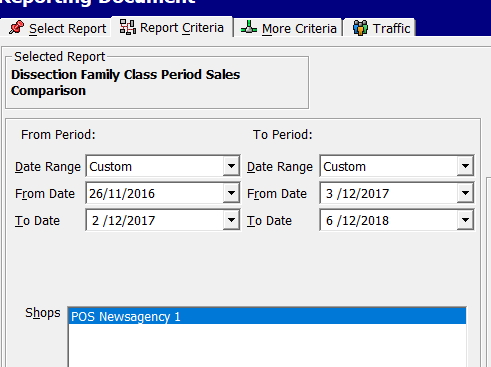

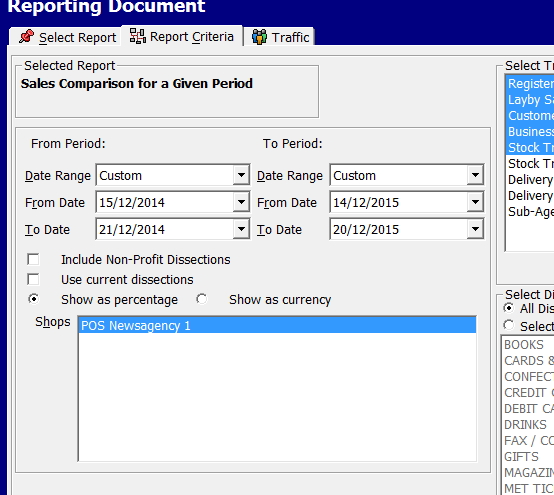

Choosing Your Timeframe

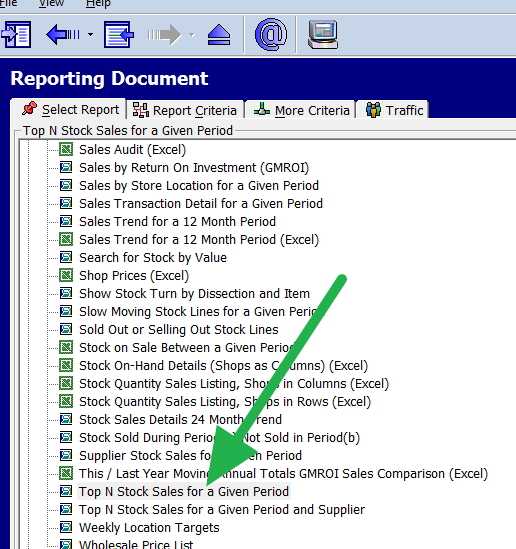

To get started, select the timeframe you're interested in analysing. For instance, look for a "Today" or "Current Day" button to see today's performance. Click on this to filter your data to show only today's sales. I recommend the last two days to get an immediate view. Our studies show that most items on the top-selling items yesterday will be in your top ten sellers today. So we need to know them to get more sales from these items.

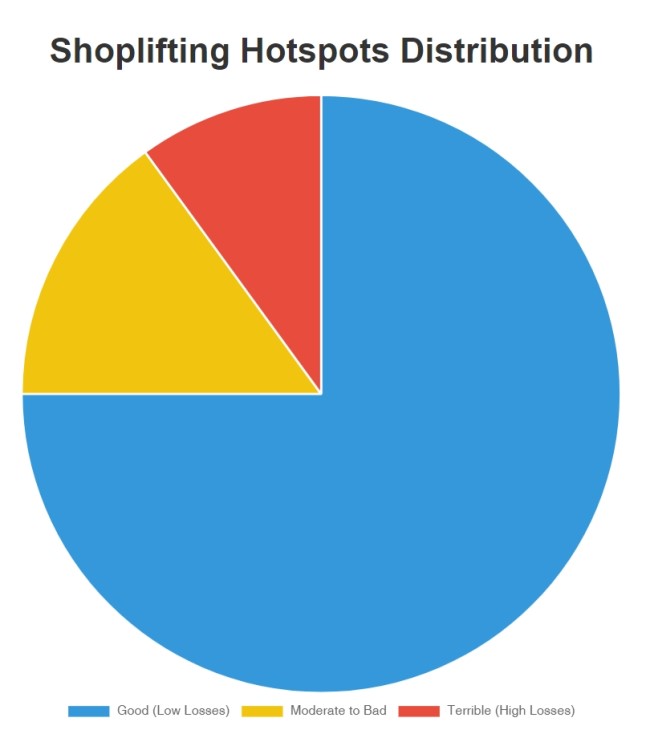

Understanding the Graph

Your POS system will display a graph representing your sales data. This visual representation can help you identify trends and patterns quickly.

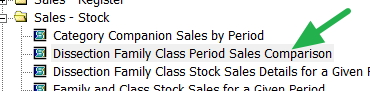

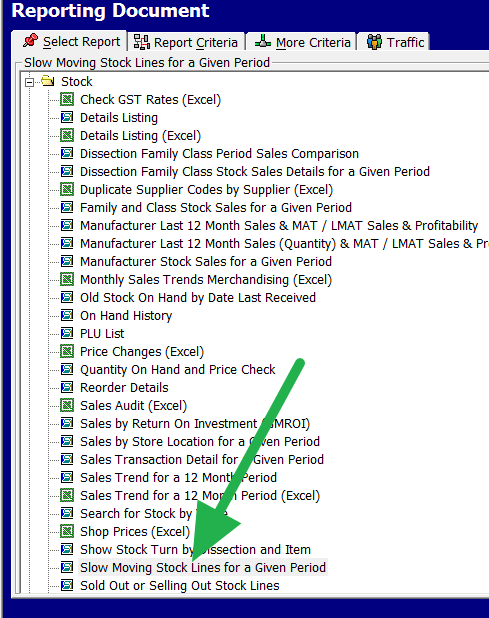

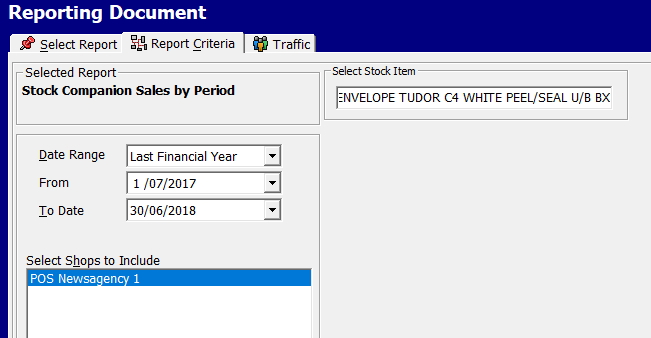

Other types of Instant Analysis Available

Our POS system offers several types of instant analysis. Here are some common ones you might find:

1) Sales by Department allows you to see which areas of your store are performing best.

2) Top-selling items help you identify your most popular products at a glance.

3) Employee Performance tracking lets you see which team members excel in sales.

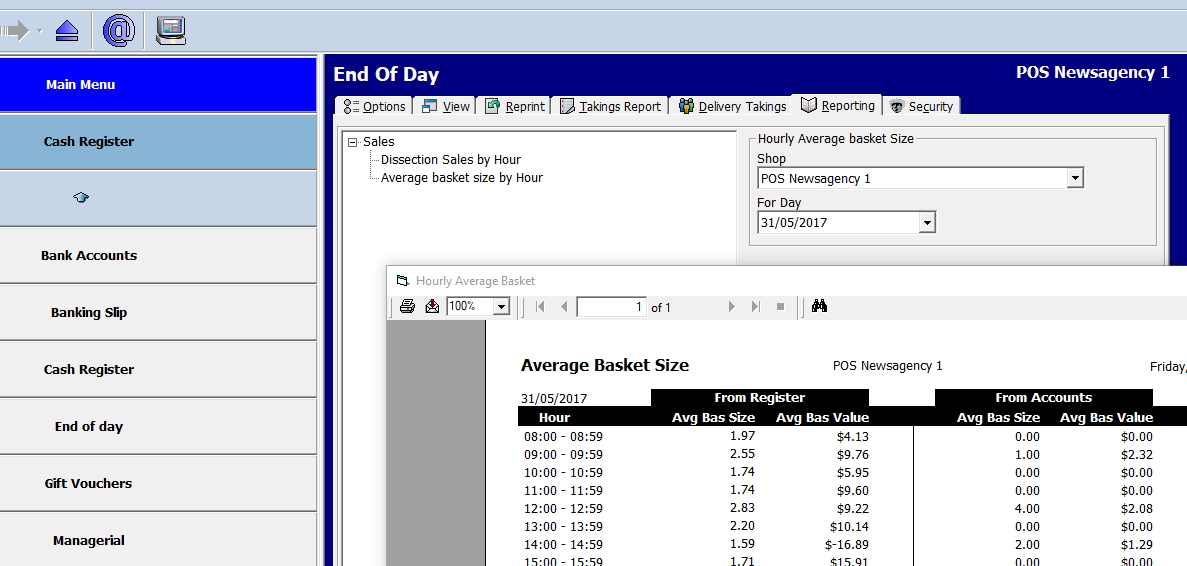

4) Hourly Sales Trends help you understand your busiest (and quietest) times of day.

5) Stock Level monitoring allows you to keep track of inventory in real-time to prevent stockouts.

Making the Most of Instant Sales Analysis

Now that you grasp the power of this tool, here are some tips to help you maximise its potential:

Check regularly by reviewing your instant sales analysis first thing in the morning. Act on insights using the data to make immediate decisions, like restocking hot items or moving best sellers up front where people see them. Also, look for patterns that can effectively shape your long-term strategy.

Setting SMART (Specific, Measurable, Attainable, Relevant, Time-bound) goals.

I love it as establishing SMART (Specific, Measurable, Attainable, Relevant, Time-bound) goals is a way to ensure your efforts are focused and measurable.

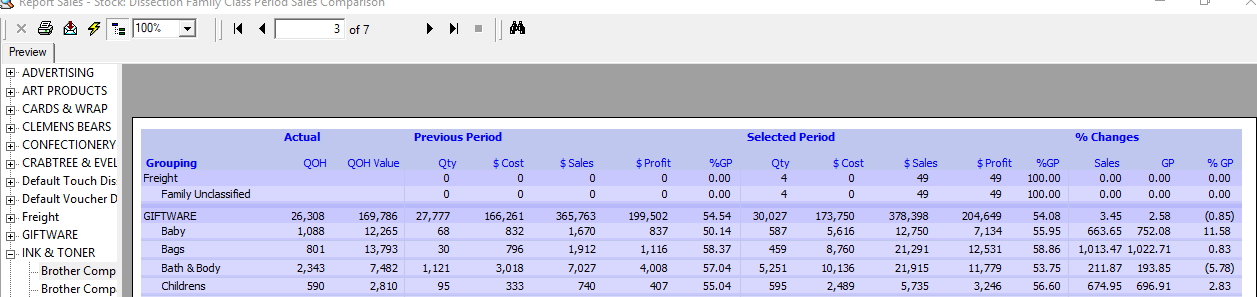

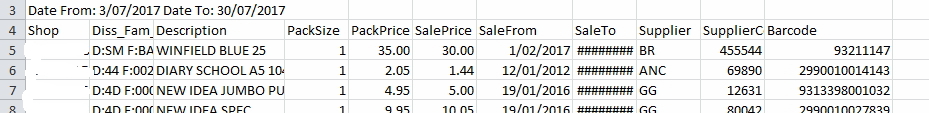

Product Performance Analysis

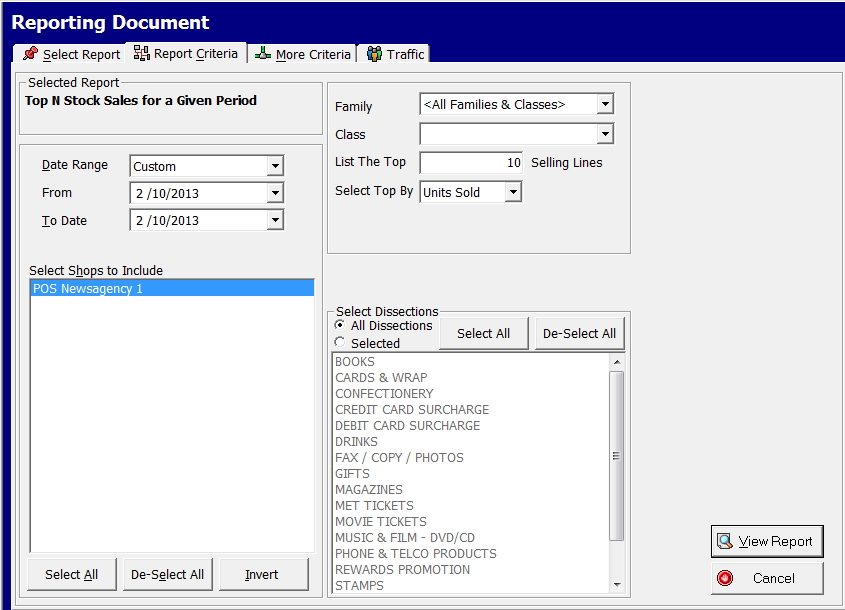

Track metrics like best-selling items by category, profit margins by product, frequently bundled items, seasonal trends, and vendor performance.

Predictive Analytics

Use historical POS data to forecast inventory needs, optimise staffing levels, plan promotional campaigns, and identify emerging trends. One trend that is not done enough by my customers is weather. Please be sure to look for products that sell in different weather conditions and plan in the morning for today's weather forecast.

It's crucial to avoid common POS analysis mistakes. One common pitfall is failing to take action on insights gathered. What is the point of knowing if you do nothing about it? Please be careful and always follow through on your thoughts.

Failing to take action on insights gathered is a common pitfall. What is the point of knowing if you do nothing about it?

Another is basing your judgment on one event.

Real-world implementation example for a Morning Routine

Check yesterday's top 10 sellers. Review stock levels of these items. Adjust display positioning so customers can see these sellers. Brief staff on what these top-seller items are.

The Bottom Line

Instant sales analysis can help you quickly make informed decisions, stay ahead of trends, and improve your profit margins.