The current BrownTrout catalogue file is now available

The current BrownTrout catalogue file for calendars is now available for download.

For this and other supplier files, please visit our download supplier section.

The current BrownTrout catalogue file for calendars is now available for download.

For this and other supplier files, please visit our download supplier section.

Running a retail shop in Australia can pose financial challenges that even the most experienced business owners may not anticipate. One of my clients, after spending thousands reorganising the financial structure of their new shop, was told that the costs were not tax-deductible. Actually, they were claimable as Blackhole expenditures, but it was a problem they did not expect. It paid them to get a second opinion from me

They’re real business capital expenses like legal fees or feasibility studies that don’t produce something you can touch or easily depreciate. Because of that, they can feel like money disappearing into a financial Blackhole.

What is Blackhole expenditure ATO?

Blackhole expenditure refers to specific expenses that are neither tax deductible for a business under the general deduction rules nor otherwise recoverable as the cost of a depreciating asset or CGT asset. Such expenditure may be claimed over a 5-year period if they satisfy certain criteria.

Retailers often miss these costs on their tax returns, since, say, a Point of Sale (POS) system is tangible. A payment for a shop fit-out plan that you never built isn't. Let’s look at why these differences matter and how to manage them effectively.

Under Australian tax law, Blackhole expenditure refers to capital costs that can't be deducted elsewhere and don’t form part of a tangible asset’s value. They’re legitimate and often essential for your business to function or expand, but they don’t fit the usual depreciation or immediate deduction rules.

For example:

These costs often appear at three stages of a retail business journey:

Before you even make your first sale, bills start piling up. Business name registrations, legal contract drafting, and trust or company setup costs are classic Blackhole expenditures. Without these, you can’t operate—but they don’t result in a tangible asset.

Sometimes research or consulting leads nowhere. Perhaps you pay a deposit for a shop fit to open a second shop, then cancel the project. You have nothing to show for it. These non-productive outlays are Blackhole costs.

As your shop grows, you might transition from a sole trader to a company for liability or tax reasons. The accounting and legal fees involved don’t create an asset, but they do qualify as Blackhole expenditure.

Thankfully, the Australian Taxation Office (ATO) now recognises these situations, as you can sometimes deduct eligible Blackhole expenditure evenly over five years, provided it’s not otherwise deductible.

Example: If you lose a $10,000 deposit on a shop fit above because you cancel the project, you may claim $2,000 each year for the next five years. It’s a slower recovery, but better than nothing.

Info: If your business closes or you sell the enterprise before the five‑year period ends, you generally lose the ability to claim the remaining deductions because there’s no longer any income to claim off.

To qualify, you need to keep detailed records showing the expense was genuinely incurred in running or establishing your business.

Physical assets, like shelving or POS terminals, generally qualify for faster, depreciation‑based deductions or even instant write‑offs. Blackhole expenses don’t, because there’s nothing physical to depreciate.

If you can reasonably classify a cost under another depreciation rule, you'll usually gain faster tax relief. However, be careful as misclassifying an expense can cause problems. When in doubt, get professional advice.

What we suggest is that if you qualify as an SMB business with an annual turnover below $10 million, you can often take advantage of the $20,000 instant asset write‑off, which is valid through to 30 June 2026. It lets you immediately deduct the full cost of eligible physical assets if you qualify.

Some expenses, such as legal or accounting costs to set up a new business or register with ASIC, may also be immediately deductible if they relate directly to establishing a business, but unfortunately not for a business restructure. Always check this with your accountant before claiming.

Blackhole expenditure often sneaks up when projects don’t go as planned. Before committing large sums, consider how each expense fits into your long‑term strategy. Ask some extra questions:

Tax law is detailed, highly qualified and tightly regulated. While this will provide you with a practical overview, you should always seek advice from a qualified tax professional before making claims, something I am not and do not pretend to be.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

If you run a local shop or community business, imagine walking into your store and hearing your very own theme song playing — created in minutes and completely free. Google's Gemini app now lets you generate a theme song with a simple text prompt or even a photo, complete with lyrics and a video image. In this guide, I'll show you how to use it step by step, share ready prompt examples, and explain the rules so you can use the music in-store and on social media.

It's called Lyria 3, a computer-generated music creator now rolling out in the Gemini app. It quickly creates a music track and lyrics for your song.

For retailers, the value is simple: you can test small bits of branding and marketing without paying an agency or a music band. What I like is that you can make it feel local and personal.

Here's what it can produce right now:

Prompt tip that actually works: Start with “create", "write", or “compose", then add genre + mood + what the song is about.

This is the easiest way I found to do it now.

What you'll need:

Steps (desktop):

Example prompts you can copy:

“Create an upbeat folk song for a friendly local newsagency: warm community feel, magazines, cards, gifts, and a cheerful chorus.”

“Create a country and western song for our local pet shop: Where Every Pet is Family.”

You don't need a “perfect” song for this to be useful. You just need something that fits the moment and gives customers a reason to smile or share.

Here are practical ways I'd use it for a typical Aussie shop:

A simple rule: keep it fun, short, and clearly “you".

Try these exactly as written, then tweak one detail at a time (genre, mood, instruments, or theme).

I tested it by feeding it my business story: "POS Solutions company has empowered thousands of small and medium-sized retailers across Australia with reliable, industry-specific Point of Sale software and hardware. Since 1983, we've specialised in retail sectors including newsagencies, pet shops, and pharmacies, helping our clients streamline operations, boost sales, and adapt to an evolving digital landscape."

I experimented with a few different music styles before deciding on “cinematic,” as I like a bold, dramatic sound. I then told it I wanted music and a song by a powerful diva singer. After a few attempts and redos, I then changed the music styles and see what you think. Please let me know which one you liked best.

Info: If you try only one improvement: Add a single line that defines the voice you want, like “friendly, local, not salesy” or “energetic but family-friendly”.

Here’s the clever part: on your Point of Sale (POS) system, you already have the best content prompts sitting in your sales history. Your POS data tells you what customers actually buy, and when they buy it, so your marketing can match reality, not guesswork.

Use your POS system to spot patterns, then turn those patterns into short music ideas:

This is the practical link between back-of-house operations and front-of-shop marketing: your POS system tells you what to promote.

For casual in-store use or social posts, you’re generally in low-risk territory — just follow Google’s Terms and policies. Google says the music generation is “designed for original expression” with filters that check outputs against existing content.

Two practical points matter most:

If you don't see “Create Music” yet, it may still be rolling out to you, its really new.

Go to https://gemini.google.com on your computer

Click Tools → Create music,

Test a prompt with something current, revise it a few times to get something you like and post it to Facebook or Instagram.

Then see what your clients think.

Then let me know, as I am very interested in using technology to improve SMBs.

Happy music creation.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

I reviewed the latest RBA Economic Snapshot this morning, and it said a lot. On the surface, our economy grew by 2.1%. That sounds acceptable, but Australia has experienced 1.5% population growth. The math is simple but scary. When you subtract the population increase (1.5%) from the economic growth (2.1%), real economic growth per person is just 0.6%. Now add that Inflation (3.8%) is currently running higher than Wage Growth (3.4%), and we are down to almost zero (0.2%). Before you think that's bad for your shop, not necessarily, read on.

If you want to review the figures yourself or run RBA comparisons, you will find them here. One trap with the comparisons is to check the dates for each comparison, as the RBA provides the latest available figure, which may be well off the date you are looking at.

What does this mean for your shop? It means more people are buying but the average customer walking into your store doesn't have more money to spend than they did last year.

The Retail Reality Check:

See what is happening in your shop, review your POS System, and compare revenue and basket size. These figures suggest that many of you will find that you are serving more customers to maintain the same profit. In other words, you are working harder for the same result. If you want to know how to check your basket size and some ideas on how to improve the basket size click here.

The Cash Rate is sitting at 3.85%. Historically, people might say, “That's not high.” People my age can remember the 17% days in the 70s and 80s. But that is a dangerous assumption. Today's mortgages are much larger than they were then. A 3.85% rate today sucks a huge amount of cash out of the local economy. Every dollar your customer hands to the bank for their mortgage is a dollar they cannot spend in your shop.

We can also see that the Household Saving Ratio is good (6.4%). It indicates that your customers have money but are worried. They are choosing to hoard cash for a rainy day rather than spend it on non-essentials. They aren’t broke; they are just scared.

The unemployment rate is 4.1%. This is okay, but see that new job creation is slowing.

In this environment, big-ticket purchases suffer. People will put off buying new furniture or taking expensive trips. If you are not in this type of business, the situation might actually be good for you: when times are tough, and people still have money, they still want to treat themselves. The trip is gone, but they will still buy a $25 paperback book or a gift. It is a guilt-free dopamine hit that fits in their budget. Market yourself as the budget-friendly alternative.

While Mum and Dad are hammered by mortgages, don't forget the grandparents. They often own their homes outright and are unaffected by interest rates. They are the “shadow economy” of your newsagency. Make sure your kids' toys, books, and art supplies are front and centre for them. They are still willing to spend on the grandkids even when parents can't.

People might stop buying for themselves, but they rarely stop buying for others. Your Greeting Cards and Gift lines are your recession-proof anchor. Today, people will often buy a premium card to “elevate” a cheaper gift. It makes a $20 gift look like a $30 gesture.

Today, more customers are rushing past your shop. You need to break that rush. Place low-cost, high-impulse items (such as children's magazines or clearance books) at the entrance. Offer them a low-risk, high-reward treat that doesn't require a finance plan.

Do you know if your basket size is dropping, or are you just guessing? Do you know what is happening in your shop? The only way to find out is in your shop, in your POS System.

Data is your best weapon.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

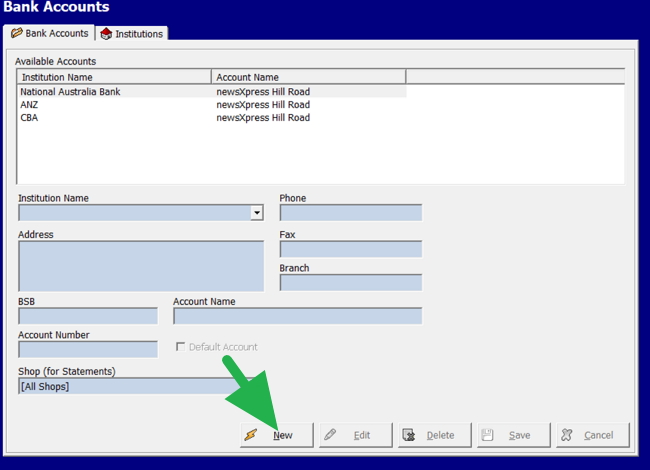

Managing a retail business in Australia now requires financial agility. While many shops start with a single bank account, growth often demands juggling funds across multiple institutions to secure the best loans and merchant rates. However, without a central information centre, this strategy can cause issues. Over the years in retail, I've seen the challenges owners face when reconciling transfers across different banks. It's called Banking Chaos, but it's easier to use our POS System.

Retailers rarely choose this complexity; business necessity drives it.

We all need a business loan at some point in our ventures. Different institutions offer various interest rates and terms. Often, the best financing deal may not come from our current bank. If we choose a better offer, we need to open a secondary account solely for loan disbursements.

We all want to save on merchant fees. Sometimes, a third-party EFTPOS provider offers a much better rate or service than your main bank. To get that 0.5% saving or faster transaction processing, you often need to settle funds into a specific account provided by the EFTPOS provider.

Experienced retailers often place GST, PAYG withholding, and superannuation into a separate holding account to avoid accidentally spending this money.

This leaves many retailers splitting their finances. But this doesn't have to be a major headache. You can keep it under control by using your point-of-sale system as your financial hub, managing as many bank accounts as you need.

Beyond external bank accounts, you also need to manage our fund allocation. Think of your revenue like a stream of water. If funds are mixed, it becomes difficult to determine the intended purpose. It looks like you have a lot of money, but a lot of that money might already be spoken for. This is a common problem with GST and lotteries.

Maintaining separate accounts simplifies your tracking for accurate cash flow analysis even if physically they sit in the same account.

This is where a modern POS system shines. It acts as your central dashboard. It doesn't matter how complex your banking is in the real world; your software should make it as simple as possible.

Our system allows you to define all these different accounts, loans, savings, trading, and tax holding rights in the setup.

When a customer pays at your counter, our system allows you to receive the payment to the specific bank account the funds will be deposited into.

If they pay using a specific card terminal that settles into Bank A, the POS System records the payment for Bank A. If they pay cash and you deposit it into Bank B, the system records it as a Bank B deposit. This means your records match reality in real time.

We have designed this to be as painless as possible. Adding a new bank account or a new "bucket" to your POS system is quick.

That is all there is to it!

The POS stores these details securely. You can access any linked account at any time.

With the ability to add unlimited accounts and switch between them at will, your POS software makes managing your business banking easier.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

Your retail work does not end just because the Valentine’s Day 2026 rush is over. While the roses have wilted, effective post-holiday analysis is critical for maximising future profits. While the February 16 rush is over, some customers are still purchasing what remains. Control your instinct to pack away the displays and immediately shift your focus to Easter. Also, you need to determine what went right and what went wrong for Valentine’s Day.

Here is how to effectively measure your Valentine’s Day 2026 performance.

First, a tactical reminder: keep your displays up. Many Valentine's Day purchases are impulsive or made at the last minute. We often see a “long tail” of sales from people who forgot the date or are celebrating a bit later.

Action: Maintain a condensed Valentine’s display for another week.

Opportunity: This is the prime time for bargain hunters. Use this period to clear leftover stock immediately rather than storing it. Cash in the till today is better than dead stock in a box for 12 months.

While you clear the physical floor, it is time to turn your attention to the digital footprint left by yesterday’s shoppers.

Once the physical floor is sorted, you must shift focus to the hard data sitting in your POS system.

You cannot improve what you do not measure. Go to your POS system and run a comparison report for February 14, 2026, versus February 14, 2025.

Do not look at the total revenue figure alone. Drill down into specific departments that drive our local traffic, specifically Cards, Gifts, and Books.

Did you beat last year? If so, was it driven by higher transaction counts (more people) or by what many reported as a higher average transaction value?

The following KPI metrics tell you how well you sold it.

Did your Valentine’s display earn its rent? First, measure the length of your seasonal display. Next, compare the GP dollars generated by that space against your standard mix, such as stationery. If the love hearts didn’t outperform the ballpoints, that space was wasted. You might need to condense the footprint next year to maximise return on investment.

Review your roster for February 13th and 14th. Calculate your total revenue divided by the total labour hours paid.

If your revenue per hour was too low, you may have over-rostered. If it was too high, you likely burnt out your team and missed sales due to long queues. Sustainable labour costs are key to long-term viability.

Every item left on your shelf tells a story.

These are your most expensive mistakes. If you ran out of specific card captions (e.g., “Wife” or “Husband”) by 2 PM, you capped your own revenue. Plan to increase these specific lines next year.

These items highlight what did not resonate. Was it the price point? The design? Make a note now. If you are left with too many red candles, do not repeat the order in 2027.

Use this post-event lull to run a store-wide dead stock report. Identify items that haven’t moved in six months. Clear this inventory to free up cash flow for higher-margin categories like gifts or new book releases.

Did your team handle the pressure? Review your employee. Identify who did well on that day and who struggled. Use this data to plan your Easter rostering.

The difference between a “busy day” and a “profitable day” is data. By moving away from habit-based buying and using evidence to guide your decisions, you ensure your business remains valuable and relevant.

7 Comprehensive Sections:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

```

Valentine’s Day is almost here. Consider setting up a pet display now, or you might miss a good opportunity. This may sound counterintuitive, but over the last 15 years, we have seen a massive change in consumer behaviour. Industry data and our sales analysis show a significant increase in pet spending among consumers celebrating Valentine’s Day. Today, many purchase gifts for their pets, and most of those are on impulse, right at the last minute.

Our industry data confirms this isn’t a fad. In 2020, we estimated that approximately 20% of consumers purchased Valentine’s Day gifts for pets. Other POS Companies do not see it, but we do, thanks to our unique ability to analyse big data. Today, when I checked, I saw projections for 2026 indicate this has risen notably to about 35%.

Experts say this growth is stimulated by the “humanisation” of pets. As birth rates decline and people delay having children, owners increasingly view their pets as family members deserving of holiday recognition. In Australia specifically, engagement is often even higher, with some surveys suggesting up to 80% of pet owners buy gifts for their “fur babies”.

This is where your specific location might come in handy. If you are in a family-oriented hub or suburban centre, you have a distinct advantage over big stores, as your customers are likely already in your shopping centre purchasing their weekly groceries. They are in “chore mode,” but they are also seeking small emotional boosts. This presents a clear opportunity to leverage your greeting card and gift sections to drive impulse purchases.

If you sell gift lines, adding small, low-cost pet items serves as an easy “add-on” for these customers. These people are unlikely to make a special trip to a pet warehouse to buy a $10 toy for their pets, but they may buy while lining up for the Superdraw ticket this week. $80 million is quite a drawcard. Do not underestimate the draw power of the lotto in a shop.

You don’t have time to order new stock. You need to merchandise what you have to capitalise on this pet economy immediately.

Prominently display pet-related cards. The ones I like are:

Don’t leave pet books in the hobby section. Move them to the front counter display.

Since you sell gift lines, consider adding small, low-cost pet items, such as plush toys or treats, near the POS system. These serve as easy impulse buys. If you have any red plush toys, heart-shaped items, or small curios, re-purpose them as “Pet Gifts” with a simple handwritten sign.

This segment is resilient. Even when consumers cut back on other discretionary spending, they often continue to treat their pets. It is a safe category for your store to expand into because the “guilt factor” of leaving the dog out is a compelling motivator.

Even at this late stage, your POS system remains vital.

It’s not too late. The customers are walking past your door right now. Put the dog books on the counter, flag the pet cards, and capture additional sales.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

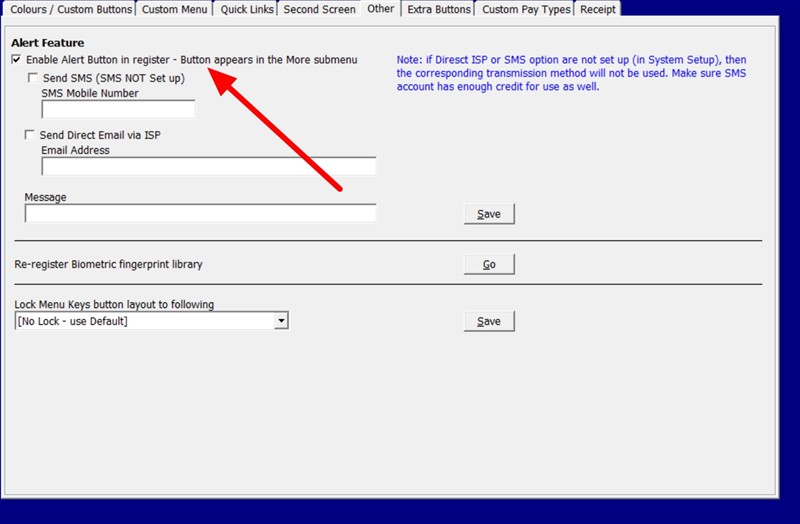

I was reading when two men posing as delivery drivers tried to bust into a coin shop in Clayfield, Queensland, with hammers last month. They hit the owner with a hammer, and the 68-year-old owner, Andrew, was quickly fighting for his life. Check the video. He barely managed to push them out. Then he grabbed a machete to defend himself. He was lucky his neighbours heard the commotion and rushed over to help. When the offenders saw the neighbours, they fled.

Unfortunately, many shop owners will not get that chance. There were 800,000 retail crime incidents in 2025. Violent events jumped 66% year-on-year.

Thieves look for when you are most vulnerable. They will try to ensure no one is close enough to hear them. For many shop staff, that's the real risk. With retail crime involving weapons up 66% in 2025, say they are working late when someone suddenly threatens them, shouting may not bring help quickly enough.

You need a way to call for help. Most phones have emergency buttons. They are, in practice, cumbersome to use. You have to reach for the phone, find the right spot, and send an alarm. For this reason, few set it up.

Let’s be honest: a dedicated, professionally monitored hidden silent alarm from a security company is the gold standard. If you have the budget for a 24/7 security team watching your back, stick with it. It is the best protection money can buy.

But for many independent shops, that ongoing expense is hard to justify. Does that mean you should go unprotected? Absolutely not.

This is where your POS System panic button fits in. It is infinitely better than being isolated with no way to signal for help. It bridges the gap, ensuring that even without a security contract, you are never truly facing a threat alone.

Don't Have Emergency Protection Yet?

Setting up an emergency alert button in our POS software is easy. Once set up, it sits in the cash register and sends instant SMS or email alerts to your nominated contacts when activated.

Here is how our POS-integrated feature works in practice:

To get the most from your panic button for small business safety, follow these simple tips:

These simple steps ensure your system works when it matters.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

We all store confidential information on our computers. For example: supplier pricing lists, customer contact details, payroll information, private and business documents, etc. Too many underestimate how easily this sensitive information can fall into the wrong hands, especially on shared devices that most businesses now rely on. Think about it: to keep your POS system running, you probably have staff and repair technicians accessing it many times. Each of them has plenty of opportunities to access it, and today it only takes them a moment. This has been a problem for years, and our preferred solution is VeraCrypt.

In most retail businesses today, information in the system is shared with many people, including staff. While this is great for the business, it creates weak points in your data security. Here are some everyday risks you face:

These risks mean even honest mistakes or casual curiosity can expose confidential information. That's where a simple tool like VeraCrypt provides a safety net, even when devices slip out of your control.

At POS Solutions, we've recommended VeraCrypt for years as one of the simplest and most effective tools for securing confidential retail data. How can you keep your information secure in your business?

VeraCrypt is a free, open-source program that protects your privacy.

You can think of it like a digital safe on your device. You simply drag your private files into it, such as staff wages, supplier price lists, agreements, customer lists, and financial spreadsheets. Without your password, no one can open or read a single file inside. Even if a curious staff member tries to get in or a thief steals your laptop, they see only a locked, meaningless file. Your business secrets remain encrypted and safe. Only you can read it. If I were on the front computer and you were on the back computer, you could read this information, but I could not.

VeraCrypt delivers practical protection tailored to retailers. Here's how it helps you every day:

These features mean you can share devices confidently while keeping critical information private.

There are two prominent court cases that demonstrate its mathematical resilience.

The Target: Daniel Dantas, a Brazilian banker, was suspected of financial crimes.

The Incident: In 2008, Brazilian police seized five hard drives from his apartment during a raid. The drives were fully encrypted using TrueCrypt (older version of VeraCrypt).

The Effort: The Brazilian National Institute of Criminology (INC) attempted to crack the drives for five months using dictionary attacks but was unsuccessful. They then enlisted the FBI for assistance. The FBI spent 12 months attempting to break the encryption, but ultimately admitted defeat and returned the drives to Brazil still locked.

The Target: Francis Rawls, a former police sergeant suspected of possessing illicit material.

The Incident: In 2015, Philadelphia police seized his devices, including two hard drives encrypted with TrueCrypt/VeraCrypt.

The Effort: Forensic examiners from the Regional Computer Forensics Laboratory (RCFL) and, potentially, federal partners attempted to decrypt the drives but were unsuccessful. They could not brute-force the password.

The Outcome: Unlike in the Brazilian case, the U.S. legal system invoked the All Writs Act to order Rawls to unlock the drives. He refused, pleading the Fifth Amendment. The court held him in civil contempt and jailed him for more than 4 years (he was released in 2020), during which he never unlocked the drives. The government never accessed the data.

Based on this, VeraCrypt is very secure.

Give me a call if you have any problems or want some pointers.

Get VeraCrypt from its official website here. It's free and easy to set up.

Even simple tools like VeraCrypt work best with good habits.

Follow these, and VeraCrypt becomes a reliable daily shield.

VeraCrypt is one piece of a strong defence. Combine it with these quick wins:

These steps take little time but pay off big.

I know I am going to get questions as why I prefer VeraCrypt to BitLocker. I have tested them both and both are very good, why I prefer VeraCrypt:

Who Holds the Code?

VeraCrypt: Only you. No backdoors, no cloud storage.

BitLocker: Microsoft. Recovery keys are automatically backed up to your Microsoft Account by default. You need to remove this to ensure security. Its not hard, just something else you need to do.

Trust Factor

VeraCrypt: High. Open-source code audited by independent experts.

BitLocker: Low. Closed-source. You must trust Microsoft.

Detection

VeraCrypt: Looks like regular information when locked, so people will find it hard to know it's there.

BitLocker: Easy to detect.

Employee Protection

VeraCrypt: You must unlock it.

BitLocker: Automatically unlocks at startup, allowing staff to access all data.

Speed

VeraCrypt: A bit slower.

BitLocker: Somewhat faster.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

Beyond standard navigation, I find it very useful in a mapping program to visualise the route before departure, including turn-offs and the final destination.

However, for business owners, another plus is vetting the people you are about to do business with. I might be ordering stock from a wholesaler in China or arranging delivery to a new customer I have not visited. It is invaluable to review them in advance.

Using mapping software isn't just about finding your way; it allows us to virtually “visit” a location before we commit to anything:

To help you perform this due diligence effectively, we first tested mapping software with our POS Software back in 2009. That was a long time ago, so I decided to revisit the market to see what has changed and what is best mapping tools for retailers today.

I tested the top six free mapping tools currently available. My goal was simple: to find the best free mapping tool for my clients. Here is why most failed, and why Google Maps, the one we picked, is still the undisputed leader.

I looked at a mix of the six most highly rated mapping apps today:

I quickly rejected the professional tools: Copernicus Browser, ArcGIS Viewer, and ArcGIS World Imagery. While these are incredible pieces of technology for earth observation, they fail the retail test.

You can safely ignore these professional tools for retail purposes.

This is where the real battle lies.

Years ago, we integrated Google Maps into our POS software. It was a move that compelled our competitors to emulate us; rather than doing their own research, they simply copied our approach. We used it because it worked the best. Today, I feel Google Maps remains the best all-rounder for business use, and it comes down to three key factors.

Info: Always check the image date at the bottom of Google Street View to ensure you aren’t viewing outdated data.

I noticed that Apple Maps has improved significantly. Its “Look Around” feature is visually stunning, often smoother and clearer than Google’s Street View. It will certainly get you where you want to go.

However, it falls short on business intelligence.

Bing ranks third in general use. I generally find that Google has much more information about Australia than Bing does. This is a real problem for Aussies. On the plus side it does use the google maps for business information.

But it has one function I really liked: Bird's Eye View. Unlike standard satellite views that look straight down, Bird’s Eye looks from a 45-degree angle. This lets you see a building's height and the layout of its side entrances. If you can’t get a clear look at a supplier on Google, try Bing’s Bird’s Eye view. It might reveal a loading bay or side door that was hidden on other maps. I recommend checking it out; it is very good.

So, how should you use this in your daily operations?

Although Apple and Bing are both usable, I would recommend:

If you are using our software, here are instructions for using it integrated with our POS Software.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

Running a supplier review every now and then is fine, but we are focused on the RBA card reforms decision, which is due in March 2026. Our submission is here. Now I can guarantee you, your margins are under attack from both hidden supplier costs and the likely ban on surcharging, which will result in many of you seeing a drop in margins.

If you are not careful, your best-line costs can creep up quietly, leaving you stuck with products that no longer cover their costs. This guide shows you how to use supplier analysis and your POS system to protect profit and reduce risk.

What you are looking for is a supplier that delivers strong sales and profits.

Go to register sales reports and then go to "Sales comparison by supplier"

I recommend using the previous 12 months for comparison with the last 12 months.

For the initial run, use the percentage.

Then a report like this pops up.

Try it now, it only takes a second.

Your POS system has an invaluable tool for managing supplier relationships and improving operational efficiency. I suggest running it again with absolute figures as well.

Look at the profit figure. Today, we are seeing significant downward margin creep. This report is an excellent place to see it. Downward margin creep has many causes, often a mix of changing customer habits and supplier price shifts.

Action: Identify underperforming suppliers and address concerns directly. Then, strengthen relationships with high-performing suppliers.

Do not measure your supplier by how much you buy from them; instead, focus on what they deliver to your business: profit, sell-through, reliability, and support.

I think it's best that you clarify your relationship with your supplier. Understanding your position can help you tailor your approach, such as negotiating better terms and/or diversifying your supplier base.

Suppliers tend to prioritise larger retailers because of their greater spending power. This often leaves Small to Medium Business (SMB) retailers struggling to secure favourable terms. The other issue is that they know SMB retailers often lack the accounting expertise of larger chains and try to capitalise on this. You need to verify their figures. As a general rule, the information they give you is the information they want you to know. This is where your POS System is a big help, as it knows your figures and has no agenda in what it shows you.

A major financial change is on the horizon, making it urgent to know your margins.

With the Reserve Bank of Australia (RBA) due to make its final decision on card payment reforms in March 2026, you should prepare for a likely change: that you will almost certainly be banned from adding surcharges on debit cards, and possibly credit cards too.

If surcharging is banned, the impact is immediate:

You cannot make safe pricing decisions if you don’t know your exact profit numbers by product and supplier.

Some suppliers are already aware of these changes and may promise to adjust their pricing structures to increase your margin to cover these costs. Do not just take their word that they will do this they do not tend to see it as you lose a percent but that they have an extra percent. You must verify that this actually happens, because based on past experience, I rarely see suppliers do it, and if they do, it's only partial. If they do it, it will come through a “margin adjustment” that you need to check to ensure it delivers the extra percentage points you need.

What you should do:

Relying on a single supplier puts your business at considerable risk, including stock shortages or price hikes. You should consider diversifying your supplier base.

The benefits of diversification are clear:

Actionable Step: Use your POS system to track supplier sales performance. Could you identify which suppliers are underperforming and explore alternatives to fill gaps?

Sometimes you may find the salesman has little flexibility on price, but they typically have room to manoeuvre on other points. Negotiation isn’t just about securing the lowest price; it is about more. Often, the seller has more flexibility than initially disclosed; you must be willing to ask.

For example, I once told our supplier that we were going to a show. In exchange for showcasing their products, they provided me with their advanced UPS.

Suppliers may present information that benefits their agenda, but verify everything independently. Ask your customers, visit similar shops, examine the advertising, use your POS reports, and do Google searches.

I find that Amazon's top-selling lists in Australia are a valuable resource for seeing what is actually trending, regardless of what a rep tries to sell you.

These are some items to check:

We do not have much time, so don't wait for the RBA decision to catch you off guard. Log in to your POS today, run the ‘Sales Comparison by Supplier’ report, and verify your true margins before costs shift.

Don't guess your margins. POS Solutions gives you the exact reporting tools you need to negotiate with confidence.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

Cafe owners nationwide are pushing prices to $7 a cup for newsagency coffee, claiming $5–$5.50 leaves them unable to survive. Customers hate it, and many simply won't pay. For Australian newsagencies, convenience stores, and boutiques, this backlash creates a massive opportunity. You can capture frustrated caffeine seekers, boost foot traffic, and lift impulse sales on magazines, gifts, books, cards, and stationery, as they do not have the crippling cafe overheads, which are killing them. This practical guide explains the cafe crunch, why retailers might win big, and delivers a 6-step checklist to launch a profitable coffee department that complements your business.

Overall, Australia's $3.5–4B coffee market rivals the books market ($3–5B) and dwarfs the newspapers market ($2.9B).

Yet Australian cafes today face severe economic conditions in 2026.

Labour now accounts for about 35–45% of every revenue dollar. What hurts is the weekend/public holiday penalties.

Rent/utilities take 20–25%.

Ingredients cost 20–30%

The $200k–$500k setups incur $0.30–$0.80 in depreciation per cup.

Raw flat white ingredients run ~$0.90 (beans/milk),

Full costs hit $4–$6.60

At $5.50 per cup, it's insufficient to cover 300–400 cups per day. They are looking at $6.50+ to survive.

The problem is that many will walk away from $7.

You skip cafe killers: no massive fit-outs, no barista wages, no seating headaches, and this position you perfectly to capture $ 7 shock shoppers, funnelling people your way for value.

The Winning Traffic Shift:

Pre-$7: Shoppers linger at cafes, some spilling to your shop.

Your Win: Capture an estimated 25% shift; 20–50 cups/day at $4 yields $15k–$38k extra profit yearly (70% margins).

High street newsagencies near bus stops and railway stations are in the perfect position.

Skip supplier hype. I've seen retailers thrive (and crash) on these.

Centre leases or council rules often block food additions. Check first.

Action: Email: "Low-volume coffee machine as counter add-on, no seating, minimal waste."

Reality: 1–2 sqm + 10–15amp power.

Checkout the prices and availability in your area. What you are looking for is whether a $4 coffee is viable.

Skip pods, Aussies want proper coffee.

Check which machines are available to you. I would suggest going into a partnership with a coffee supplier. Make sure you have an exit path, even if it costs slightly more. Most coffee machine suppliers offer a trial period; make sure you take advantage of it.

What I suggest you look at is 2 to 6 cups per hour.

Your staff will need about 30 minutes to operate the coffee machine.

Daily setup is about 5-minutes

Probably another 10 minutes for cleaning.

Waste disposal takes another 10 minutes.

For some unknown reason, coffee made with the same ingredients can taste different; you need to monitor the taste.

Please review the maintenance terms for the machine carefully. It's the biggest problem most of my customers with such machines tell me: the machine has been out for ages. Ask whether they provide replacement machines while yours is being repaired.These machines break down a lot.

Loyalty Hack: The coffee costs $2, but customers perceive it as worth $4–$7. That is a powerful combination.

Coffee bundles can build loyalty, such as

Family: coffee and a magazine

Gift: Coffee + greeting card ($4.50).

Reading: For newsagencies say $7 for a coffee and 30 minutes free browsing of magazines. Why not let them browse for free if they buy coffee? They may actually buy a magazine too at the end.

As with everything, monitor your coffee sales in your POS System. You need hard facts!

Low-quality receipt paper causes problems besides looking unprofessional; it often jams and fades. That is why it's important to choose quality thermal paper rolls. Here are some tips for smart buying thermal paper rolls.

Before you commit to a bulk purchase, order a small quantity to test the quality. I have seen retailers stuck with bad-quality receipt paper.

When your larger order arrives, do not just sign for it and throw it in the storeroom. Inspect the packaging and rolls immediately.

Verify the rolls match your hardware specifications.

Using the wrong paper size is one of the quickest ways to get a headache.

The best POS thermal paper rolls come with features that make your life easier. Look for:

Quality thermal paper reflects well on your business. By taking the time to find a good supplier and inspecting your stock, you save yourself headaches and ensure your POS system makes a professional impression.

While many of you will be busy with the BBQ and the beach, our office will be staying busy behind the scenes. So even though it's a public holiday for many, our support team is online to ensure your business stays secure and your POS systems stay smooth.

![]()

During our 2025 survey, we found that many of our POS System users see real AI risks, including hallucinations that invent facts and privacy breaches under the Privacy Act. Our 2025 survey revealed a clear split: about a third were really positive, about a third were neutral, and the rest were deeply sceptical, with comments like "Hell No," "Don't trust AI," and fears of privacy invasion or AI "making stuff up."

Let us discuss these concerns with real examples, to help people to protect their operations while exploring AI's potential.

Everyone makes mistakes, your accountants, your electricians, etc. AI stands out because it makes so many errors (hallucinates). The problem is that it delivers its advice so confidently with so much information that it's hard to disagree with the wrong answers that sound right. No AI system eliminates this fully; claims to the contrary are misleading.

Real Retail Impacts:

Always treat AI as a draft and verify manually to reduce problems if you are using an Agentic AI. Never let the AI act until you check the answer.

Survey users flagged "invades privacy," and they're spot on. Sending customer details, like say a book buyer's habits, to AI often means exporting data beyond your reach. This risks breaching Australia's Privacy Act.

Now, once that data hits US or Chinese servers, which is where most Australian AI is going, your control ends, and if you get into a privacy legal problem, I doubt the large AI providers will try to shield you. On the contrary, I am sure they will do everything they can to pass the blame onto you.

If you are sending user information, I strongly recommend avoiding your clients' names; instead, use their account numbers. You know their account numbers; no one else does.

Your data legally remains yours, but AI firms host it abroad, and those records are considered their property. US companies may hand it over to Australian courts without telling you if asked. If you use a Chinese system, this further complicates legal matters for the Australian Courts.

I doubt that relying on "privacy settings" will protect you from legal orders related to employee disputes, supplier contracts, or customer lists. Secret AI accounts and VPNs might help if you want privacy.

AI is still new. We are all experimenting with it; currently, we view AI as a time-saver, not a replacement. You need human oversight to supervise.

Simple Steps for Your POS:

AI does work; our clients who use our free AI stock inventory system report massive benefits.

Info: If you have any concerns, I am happy to discuss.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

Are you wondering whether to open your store on Australia Day, Monday, January 26, 2026? I've spoken to a few of my clients across Australia facing the same dilemma. Some told me that they would skip trading due to high penalty rates. Others will open. One told me that my business cannot afford not to open, but it will be staffed by family only. Another told me that, as they are a licensee near an official Australia Post office, which will close on January 26, they expect to get some of that traffic.

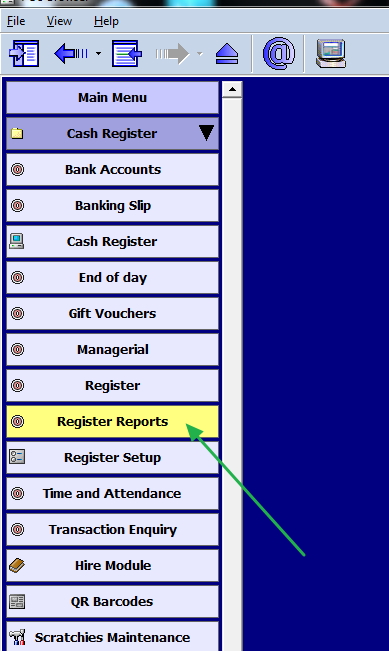

If you are unsure, use your POS System to run a few reports to see what your traffic and profit are on such days. The dissection profit report is worth looking at, as it shows traffic, sales, and profit.

I had a few laughs at Woolworth's Australia Day backflip. In 2024, they ditched flags after low sales, with what I thought was one of stupiest retail marketing decisions ever, which sparked boycotts and even vandalism. Now, they've stocked up on an "Australia Day section". Woolworths is now highlighting "Aussie-made" food products and specific Aussie-made flags.

If you do not intend to sell Australian Day items, say nothing; there is no point in offending 70% of the Australian population. But I think that most retailers can put together some Australian items on a stand and post a sign that reads "Gifts for Australia Day," at no cost.

If you are going to be making Australia Day work for your store.

Start planning now.

Info: Make sure you have a clear sign that you are "Open Australia Day". What hurts is when you stay open, but few come because no one knows you are open.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

Thanks to everyone who completed our survey! Your feedback helps us focus on what matters most to you.

For 40 years, our annual survey has guided decisions on our products and services. It helps us learn what's working, improve areas, and enhance your experience. Most importantly, it lets you shape the direction of our software. Your feedback ensures updates and features meet your retail needs.

We're still analysing all the responses (and there were a lot of interesting comments, thank you again!), but here are a few early highlights that stood out:

We especially loved reading comments that our support team continues to deliver outstanding service. Thanks, it means a lot to us. Your positive experiences remind us why we do what we do together.

Many of you gave thoughtful suggestions about improving reporting features, and we're already considering this feedback.

We're thrilled to share that our Net Promoter Score (NPS) reached 72 this year. I could not believe it. I double and triple-checked it because it was so high. That score is in the stratosphere.

A Net Promoter Score (NPS) is a KPI that measures customer loyalty by asking customers how likely they are to recommend an organisation. The final score is from -100 to +100. It shows customer satisfaction.

Some of you shared ideas and asked for feedback, but didn't include contact details. If that was you, please reach out to us directly, as we do not know who to reply to.

Your feedback is the driving force behind everything we build. Whether it's a smoother checkout experience, richer data insights, or better customer support, your ideas keep us focused on what matters most — helping your business thrive.

Want to share more ideas or ask a question about upcoming features?

Contact our team today. We are here to hear from you!

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

```

Everyone says to "get more customers," good advice. This is both time-consuming and costly. A faster way is to increase profits by selling more to existing customers, increasing the basket size.

The retail basket size is a well-known KPI that measures the average number of items a customer buys in a single visit.

Get 1 in 10 customers to add an extra $5 item to their basket, and your bottom line grows immediately.

Getting the first sale is hard work; you have to win their trust. But the second item? That's pure psychology. Remember, it's often not just them, as often people come as families, and the first item and the second item are usually an impulsive buy by another person in that family, a treat for a child.

A Service Anchor is anything that brings people into your shop purely for a task. This includes:

While these services drive foot traffic, they often yield low direct margins. Your goal is to convert this 'few-second' service interaction into a retail sale. Check your POS Companion reports to see which anchors currently convert best, then optimise the others.

The Strategy:

Still, if these customers walk in, do their task, and then walk out, you do not want them to walk out.

Pro Tip: Never hide your impulse items. If a customer is waiting for a lottery ticket, they have 30 seconds of idle time. Give them something interesting to look at—and buy.

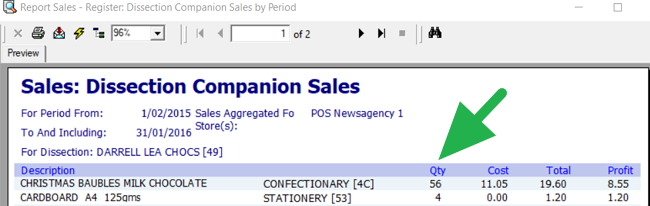

What helps is to identify products that naturally go together. In retail, we call this Cross-Merchandising.

You need items that sell with other products. What you will see are these products in your companion reports. Consider these recommendations.

Navigate to Sales-Register > Dissection Companion Sales by Period in your POS software.

Try looking for the items that sell more than other products. You should ensure that these items are prominently displayed. To maximise sales, major retailers often display these items across many locations under different categories. For example, a Christmas Card can be shown in the Card department and the Christmas section.

In your POS software

Go to Sales-Register > Dissection Companion Sales by Period.

Look for items that sell well with other departments. It is beneficial because it can help you select a product to display prominently near a department. This is a well-known method of increasing incremental sales that all majors use.

You take items that sell well with that department and place them in that department's area. There is nothing wrong with a good seller having a few spots in the shop.

Also, moving products by type rather than supplier, e.g. moving some of the chocolates other businesses produce closer to Darrel Lea Chocolates, could result in many more sales. Darrel Lea might not like that, but...

As you can see here by the green arrow, the books should be close to the stationery.

Now, if you've found these things, you should look at the following:

Don't just shelve books. Try other products near the book. You aren't selling a book. What about some bookmarks?

This idea works well. Often, people buy items as gifts; if so, they need a birthday card, maybe some gift wrap, or a small gift bag. Put these items on a stand.

How to find your companions:

You don't have to guess. Your POS system holds the answer.

Run a "Companion Sales report" in your software. This will tell you exactly which items are frequently sold together.

Once you have the right products next to each other, the next challenge is keeping the customer in the store long enough to notice them.

You must compete on discovery.

The longer a customer spends in your store (Dwell Time), the more they are likely to buy. Studies show that a 1% increase in dwell time can drive a 1.3% rise in sales. You want to create a "sanctuary" where they can slow down.

Ensure your book or gift section has wider aisles.

Brighter lights work for transaction counters, but in the shop, softer lighting encourages browsing.

Too much stock can be overwhelming. Research indicates that reducing assortment clutter by 15% can actually increase basket size by up to 23% by making decisions easier for the customer.

If your store layout is too "clean," customers might walk straight to the counter without looking left or right.

You need Visual Interruptions, which we call speed bumps.

These are small displays or tables placed in the middle of a walkway that force the customer to slow down and walk around them.

By physically slowing their walk, you reset their attention and give them a chance to see something they didn't know they wanted.

In 2026, customers love a deal but also value convenience. Bundling solves both.

Product bundling is when you group related items and sell them as a single unit, often with a slight discount or just for the convenience of "grabbing and going."

This automatically increases the basket size because the customer is buying three items instead of one. It feels like a better value to them, and it moves more stock for you.

Your staff are the final line of defence for basket size.

Many are afraid of being pushy. You need to teach them that suggesting an add-on is actually good customer service, particularly if you can show product knowledge, e.g., "People tell me you need a good battery with that toy; I suggest you consider ...".

Simple scripts to try:

A handy rule I find here is to ask people why they bought the product and what they thought of it; often, that will give you something to discuss.

You cannot improve what you don't measure.

Modern point-of-sale systems are powerful tools. They are not just for ringing up sales; they are for analysing them.

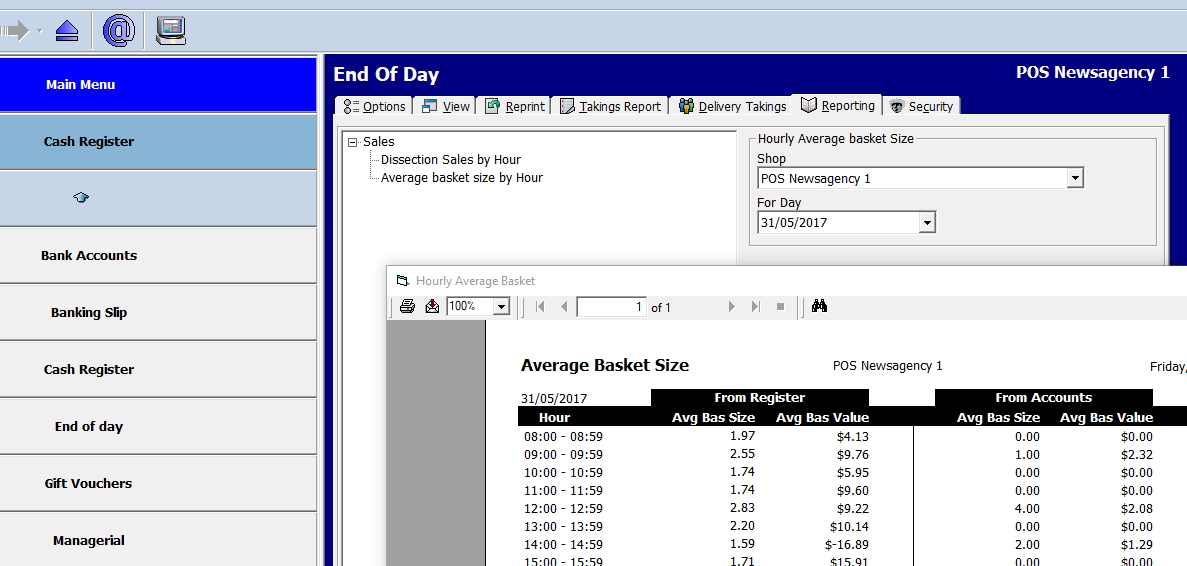

Navigate to End of Day > Reporting > Average Basket Size by Hour.

Then enter a date to see how the size of a retail basket changes throughout the day at your store. The time can be significant. Find out why?

We've broken it down by account and retail sales. Generally, we observe larger basket sizes in account sales.

Make it a habit to check your numbers weekly.

Pick ONE of these strategies to test this week. Check your POS report in a week; if it worked, keep it. Consider the next.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

As we enter 2026, for planning purposes, I created this calendar to show key retail holidays month by month, based on last years list adding a few more and taking out some that did not work and added some merchandising and signage ideas. I based this on actual sales data from some clients.

Key dates:

Merchandising actions:

Signage that sells:

Key dates:

Merchandising actions:

Signage that sells:

Plan ahead: Easter display materials needs to be ready by mid-March.

Signage that sells:

Key dates:

Merchandising actions:

Signage that sells:

Key dates:

Merchandising actions:

Signage that sells:

Key dates:

Merchandising actions:

Signage that sells:

Key dates:

Merchandising actions:

Signage that sells:

Key dates:

Merchandising actions:

Signage that sells:

Key dates:

Merchandising actions:

Signage that sells:

Key dates:

Merchandising actions:

Signage that sells:

Key dates:

Merchandising actions:

Signage that sells:

Download the One-Page 2026 Retail Planner PDF

Ready to track it all effortlessly? Book a demo of our POS system to automate seasonal ordering and print shelf labels in seconds.

Remember to check out fun retail days that align with your brand. For example, 29 January is Puzzle Day, an ideal day to market themed promotions on puzzle books. Visit here for more ideas to spice up your retail calendar.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.

Understanding your actual profit margins is the only way to make a profitable shop. While suppliers often promise healthy returns, the reality of retail with shrinkage, damage, and necessary discounting means your actual number is probably much lower.

For retailers, relying on these "best-case" figures can be dangerous. It's time to stop guessing and use your Point of Sale (POS) system to find the truth.

Suppliers and sales reps usually quote a margin based on a perfect scenario: buying at the list price and selling at the Recommended Retail Price (RRP). They rarely account for the hidden costs that happen in a real shop. Even good sales reps often repeat these "best-case" figures because that is what they have been given. They avoid the "leakage" that happens on your floor. In the real world, your margin shrinks every time a staff member offers a discount, a product is damaged, or stock is marked down to clear.

Consider a gift item you buy for $10 and sell for $20.

If you build your budget on 50% but only bank 33%, your badly overestimating.

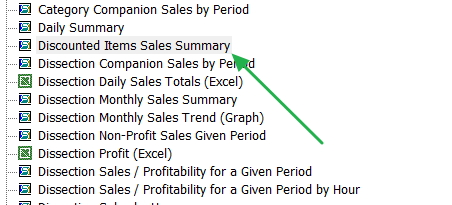

To fix this, verify your margins using your own sales data. The most powerful tool for this is the Discounted Item Sales Summary in your POS software.

Don't rely on total store averages; get specific.

Once you have the report, look for the gaps between the List Price and the Average Sell Price. This report reveals exactly where you are discounting by quantity and by price. [conversation_history:1]

Now in sales, select the "Discounted Item Sales Summary."

Pick a period. I suggest the last 12 months and now check; I would recommend it as a first attempt by the department.

Now you will get a detailed report of where you are discounting by quantity and price.

You will quickly see which products—and which suppliers—are dependent on discounts to move stock.

Making margin analysis a regular part of your business review process is beneficial. Who said today's price and margin are valid tomorrow? By consistently monitoring your actual margins, you can:

Remember, average retail profit margins can vary significantly by department.

Once you know your actual profit margin, you can stop "accidental discounting" and make profitable decisions.

Margin margins move with time often yesterday's price and margin are not be relevant now. By making margin analysis a regular practice, you can identify trends. Don’t rely solely on a supplier's promises based on ideal theories.

Are you ready to uncover your actual profit margins? Start by delving into your POS data today and uncovering the true story behind your product profitability. Remember, knowledge is power in retail, and accurate margin analysis is key to unlocking your store's full potential.

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.