AI Data Accuracy in Financial Reporting in SMB Businesses

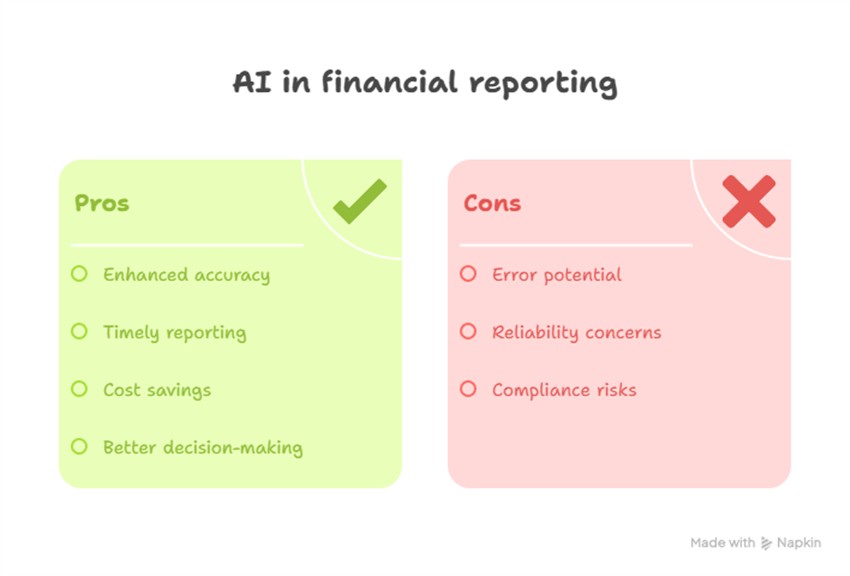

Today, it is said that integrating Artificial Intelligence (AI) into financial reporting processes has enhanced the quality of financial reports by significantly improving accuracy, timeliness, transparency, and compliance and has much promise for SMB Businesses that cannot afford a full-time accountant. However, when we tested AI on financial reports here, we found many errors. Others who followed our advice and duplicated what we did told us it was beneficial, but they picked up several errors.

AI-powered financial report generators rapidly transform how many Australian retailers approach accounting, reporting, and business analysis. As these technologies have become accessible and affordable, many SMB Business owners are increasingly looking into them to cut costs and give them better and more intelligent decision-making. However, the critical question remains: How accurate and reliable are these AI financial reporting tools in real-world retail scenarios? This review thoroughly assesses different AI models, drawing on our independent research and real-world testing to help you make informed decisions for your business.

The Importance of Reliable Financial Reporting in Retail

Financial reporting is a compliance requirement for many retailers, but should be the backbone of sound business management. That is what it is designed to do. Financial reports can help with inventory planning, cash flow forecasting, and business decisions. However, even minor errors can lead to problems. The quality of the information here is critical.

In-Depth Analysis: How Each AI Financial Report Generator Performs

Now, we fed the six models listed below with unaudited reports of two years of financial statements and asked them to assess the company's financial position. A discussion of the test done is here. We will soon test using the reports in our POS to integrate into the financial reports.

Here, what we are trying to assess is

How well did each AI do at pointing out errors

This is important as if you can correct the figures before giving them to the accountant, you can save them a lot of work. Save them a few hours that could save you a thousand dollars off your accounting bill. AI error reduction is a big plus.

The errors in the AI

The biggest problem with AI today is that it will produce errors. Most of these errors are classed as hallucinations; a better description is going off track. Some AI promoters claim that their system does not suffer from this, but I do not believe them. Humans make mistakes; AI makes mistakes. Neither humans nor AI are infallible. With today's technology, human oversight remains essential.

Grok

From this perspective, Grok emerged as a leader in AI financial report generators. After reviewing the figures, we gave the data a precision rate of 97%. Grok was particularly effective at identifying business risks and discrepancies, such as figure mismatches and unusual reporting patterns. However, it did not always flag significant structural errors, such as negative liabilities in the books and misclassifying a loan. For accuracy, Grok was the best.

Google’s AI

Google’s AI tools are widely known and used for financial reporting. I think you will find it the easiest to use. Its accuracy was good; we gave it a 95% data precision rate. I was not too happy with some of its tax advice. We liked that it explicitly called out odd liability presentations and discrepancies. Maybe it could have beaten Grok if we had corrected that, fed it back in, and redid the report.

Claude

Claude, we gave it a 93% data precision rate. Claude missed some critical errors in liabilities and equity and did not flag many errors, all of which could mislead SMB business owners.

ChatGPT

ChatGPT was unexpected, as we had read an academic research paper showing it was better than human analysts in financial statement analysis. That may be true, but in our tests, it scored 85% in data precision. Interesting for something highly thought of after it made some structural accounting errors. It did not flag anything as an error.

Qwen

Qwen is designed for enterprise applications, not SMB businesses, and we found it had an 83% data precision. It lacked precision in ratio calculations and left an incomplete reconciliation between the trial balance and profit and loss statements. We are not sure if it is programmed well with Australian accounting standards.

DeepSeek

DeepSeek is a favourite now as it's so cheap. It got 80% data precision. I suppose you pay for what you get here.

Common Pitfalls and What Retailers Should Watch For

Across all models, the most common errors flagged included data inconsistencies, business risks like revenue decline, and fundamental reconciliation issues. However, even the top performers tended to miss or underplay critical structural errors such as negative liability balances, misclassified loans, and negative opening equity. These are significant issues for retailers, as they can lead to unreliable reports and poor decision-making if not addressed.

Conclusion: Choosing the Right AI Financial Report Generator for Your Retail Business

The comparative analysis shows that while AI financial report generators are advancing rapidly, none are flawless. Grok and Google’s AI currently offer the highest accuracy for retail financial reporting, but even these leaders require human oversight to catch critical errors. Still, by alerting the owner to mistakes in their books, both Grok and Google AI could have saved about a thousand dollars in accounting costs.

Best Practices for SMB Retailers Using AI Financial Tools

I recommend that SMB retailers conduct quarterly financial analyses using these AI tools, export data from their accounting software (e.g., MYOB and QuickBooks), and review AI-generated reports for trends, risks, and recommendations.

We suggest combining outputs from multiple AI models (as we did) and merging their reports for a more robust analysis.

Learn how to review these AI outputs.

I am sure doing this can provide you with timely business insights.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.