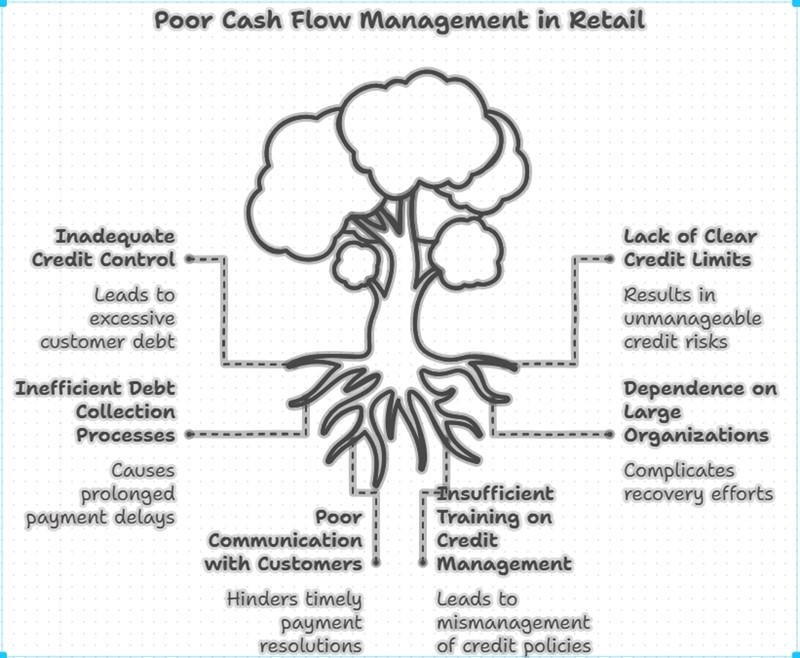

In Australia, most business failures stem from poor cash flow. Poor credit management is a critical survival skill for Australian retailers. While extending credit can help build valuable business relationships, it's a delicate balance that requires careful management. Many retailers find themselves challenging as some customers need credit to trade with them. These arrangements can quickly become significant debt collection problems if not adequately controlled.

For this reason, establishing clear credit limits using your Point of Sale (POS) system is critical from day one. This proactive approach prevents a typical scenario of customers accumulating more debt, which can lead to costly and time-consuming collection efforts later.

One point I want to make here is that, from personal experience, just because an organisation is large or a government authority, the problem goes away. I have been in government agencies chasing debts long overdue and complaining about nonpayment. I have had government department cheques bounce. I have had a government department take forever to pay their debts. What makes it very hard with these large organisations is that they have policies they follow, and often, despite your best efforts, they still need to change them. The other problem with large organisations is that threatening them with legal action usually does not work as it often does not worry the person personally, and all it means to them is that the problem will get transferred to another department. In these situations, keep your cool.

Understanding Credit Management

Credit management in retail isn't just about offering payment terms—it's about protecting your business while maintaining strong customer relationships. A study by the Australian Retailers Association stated that businesses using strict POS-based credit controls are 60% less likely to face serious debt collection issues.

Why Credit Limits Matter

- Protect against excessive credit exposure

- Create clear boundaries for customer spending

- Automate credit decisions through your POS

- Reduce the risk of debt creep

- Make a plan for the total amount of money you trust Joe Blow. Use that as a benchmark.

- A credit limit should only be increased if required and if the customer consistently pays. They must earn a higher credit limit.

Credit Policy Development

-Set up a well-structured credit policy in your POS system that should include:

-Clear payment terms (30, 60, or 90 days)

-Specific credit limits are based on customer history and needs.

-Make a formal approval process for limit increases

-Set a warning threshold for your business, typically at 70% of the credit you are willing to give.

-Preventing Over-Reliance on Credit

-Consider alternatives; today, with widespread credit and BNPL cards, consider whether the customer needs credit.

Early Warning Systems

-Customers are approaching credit limits.

-Overdue payment patterns

-Unusual purchasing behaviour

-Payment promise breaches

POS System Setup & Features

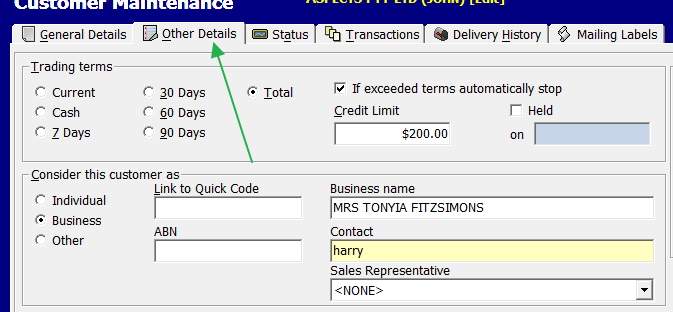

In your system, click on the main menu to customer > customer maintenance.

Now call up a customer, and click Other Details. (see green arrow below)

There are two options that I would like to run through with you.

You can select a credit limit for a period, a big problem with majors is that they have the money, but they take a long time to pay, so in this case, you may want to give them a large credit limit but watch if they go over time.

The next option is to decide whether the account should be stopped if it exceeds the credit limit or the operator should be warned so you can be notified. Collecting the debt while they are in front of you and want the goods is the cheapest and best place.

Trust me. It’ll all be worth it to do this.

Allow people to get more credit limits over time, start them small and let the amount build up.

I also recommend that every year, you review your credit limits.

Conclusion

Managing credit limits effectively through your POS system is crucial for retail success in today's competitive Australian market. While it might seem easier to be flexible with credit limits, the short-term convenience isn't worth the potential long-term headaches. Our POS system removes emotion from credit decisions and consistently enforces your policies, helping build a more robust, more profitable retail business with healthy cash flow and minimal credit issues.