Catching and Stopping Duplicate Invoice Payments

Duplicate invoice payments plague SMB retailers, draining profits through accidental overpayments. Picture this scenario in your shop: you receive your stock, along with an invoice. You promptly settle. Days later, another version of the same invoice arrives in the mail. You process it again without realising the duplication. Such oversights can go undetected. This isn’t just a theoretical risk. In my years advising Australian retailers, I’ve seen it happen frequently.

For instance, during a system upgrade, we found a newsagent client who had paid a supplier three times for a delivery. First, a paper invoice with the goods was provided, which was paid for. It was followed by an emailed version, which was paid. Finally, a statement with a credit listing showing the two prior payments with a credit. That the credit was also paid. You would not even dream of such an error occurring, but it did.

The problem is that, as an SMB business, you often juggle multiple roles, including stock management and customer service. It's a lot of work and requires a great deal of thought; sometimes we miss things. To be fair, I have seen these mistakes occur even in larger organisations with dedicated accounting teams. The best result is unnecessary cash outflows, strains on supplier partnerships, and time lost in fixing. The worst and most common result is a loss of money for your company, as the loss is never found.

To safeguard you, let’s first uncover why duplicate payments happen so frequently.

Understanding the Common Causes of Duplicate Payments

To effectively address duplicate invoice payments, we must identify the underlying causes of these issues.

Here are the main causes in my experience:

-By far, data entry errors are the big ones. When manually entering an invoice, even a minor typo, such as an incorrect number, can result in errors. Say you are 99% accurate; well, that makes several errors over a year, each potentially costing your business.

-The same invoice can arrive many times in various formats, from emailed PDFs to printed slips accompanying deliveries or follow-up statements, making it easy to accidentally put them in if you are not careful.

-Today, using AI for invoice processing can be a real time saver, but it can also introduce errors. We often find several errors in the AI reading of the invoice. Based on our experience, we believe that this AI technology is not yet fully developed; however, once it is, it will be a real game-changer.

-Suppliers sometimes revise invoices for credits or discounts. This creates a new-looking bill that’s really just a variation of the original. In one case from my experience, an incorrect curtain measurement led to an adjusted invoice, which was processed twice because the person entering it saw it as two different invoices.

-Multiple staff members handle invoices without coordinated communication, and double entries become very likely.

A modern POS system should extend beyond transaction processing and can help you in this regard.

Strategies to Prevent Duplicate Payments Effectively

Here are my practical approaches to help minimise duplicate payments.

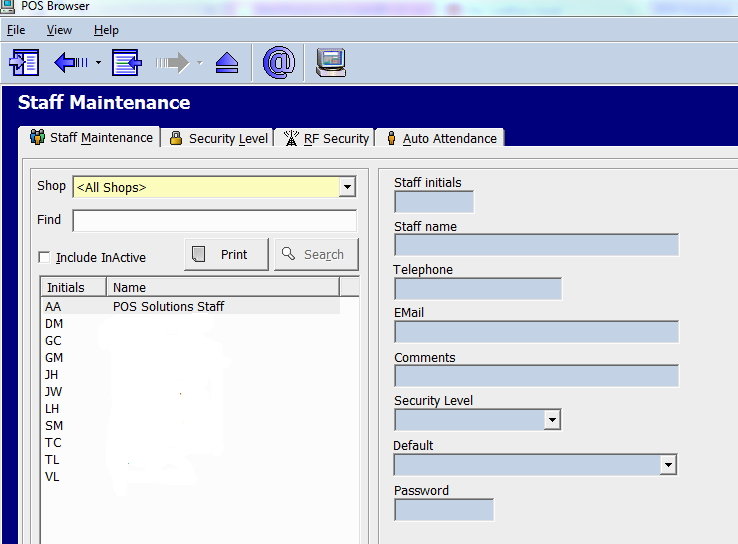

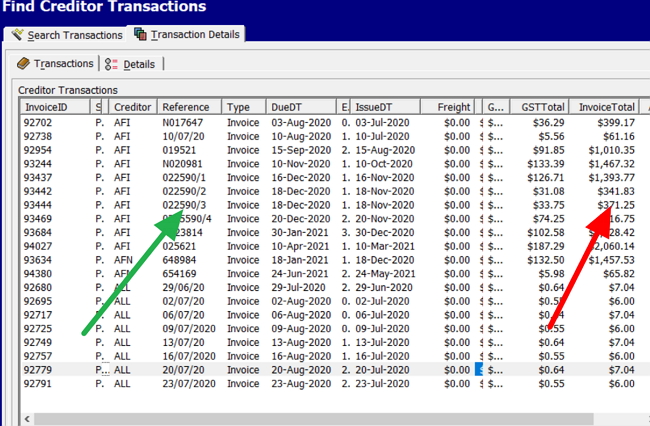

-Start by using the supplier's reference number over any internal coding you might use. You already have internal coding in your POS system. Doing this will create a consistent, traceable identifier that simplifies discussions with suppliers. In our POS system, attempting to enter the same reference number triggers an automatic alert, acting as a safeguard during data entry. If unsure, cross-check the invoice amounts, as duplicates often share identical figures; however, variations can still occur. That is why our POS System includes a dashboard with colour-coded highlights for recent entries, offering visual cues that quickly reveal matches.

-Establish an expected spending budget for each supplier to serve as an early warning mechanism. For example, if your monthly outlay totals around $500 but suddenly spikes to $1,000, investigate. It could signal a duplicate.

-Have one person to do all invoice entries if possible. It minimises confusion from shared responsibilities. If that is impossible, split the invoice entry into a logical order so no one enters the details of someone else.

-Enable logging features in your software to record who inputs data. It gives accountability.

-Adopt a two-system verification process: input data into your POS first, and then check that it matches your accounting software.

-Ensure your financial system aligns with your supplier statements by comparing figures.

Taking the Next Steps Towards Better Invoice Management

Now is the ideal moment to take control of your invoice processes.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.