If you are in an industry, you need to know the language and terms. Some of these retail terms are universal, and some are Australian, so what I have collected is our Australian retail glossary that every shop owner should know. As the retail industry is changing so rapidly, it's important to keep up. I've curated the essential acronyms, retail KPIs and shop management terms that every Aussie shop owner needs to master to navigate in our rapidly evolving industry.

From financial KPIs to digital trends, here is your A-Z guide...

A-C

2D Scanner

Unlike traditional laser scanners that only read linear barcodes, a 2D scanner captures images to read QR codes and digital screens. These barcodes can hold significantly more information than regular barcodes and are often essential for digital loyalty cards accessed through smartphones. Experts claim that these barcodes will replace standard barcodes, but I see that as a distant future.

ABN (Australian Business Number)

A unique 11-digit number that identifies your business to the government and community. You need this to claim GST credits and avoid having tax withheld from payments made to you.

Agency Model

A business model used by the Lottery, Parcel Pickups, and laundries, where the retailer acts as an agent. Generally, you earn a fixed commission and cannot set your own prices or margins. Your profit relies entirely on transaction volume.

Anchor Shop (Destination shop)

In your shopping centre, this is the shop that attracts the most foot traffic. Often it is a supermarket, sometimes a bank, and sometimes it is a few shops. Retailers rely on this 'anchor' to generate passing trade. Shopping centres are often so keen to secure these shops that they offer huge discounts to get them to come.

Award Wages

The minimum legal pay rates and conditions for your industry. Most shop assistants fall under the General Retail Industry Award. It dictates base pay, breaks, and rosters.

Basket Depth

The number of items in a customer's basket (as opposed to the total value). In a newsagency, you often have high traffic but low spend. The goal is to increase "basket depth" by getting that newspaper buyer to add a greeting card or a chocolate bar.

Basket Value (Average Transaction Value)

The average amount spent on a single visit.

Big Data

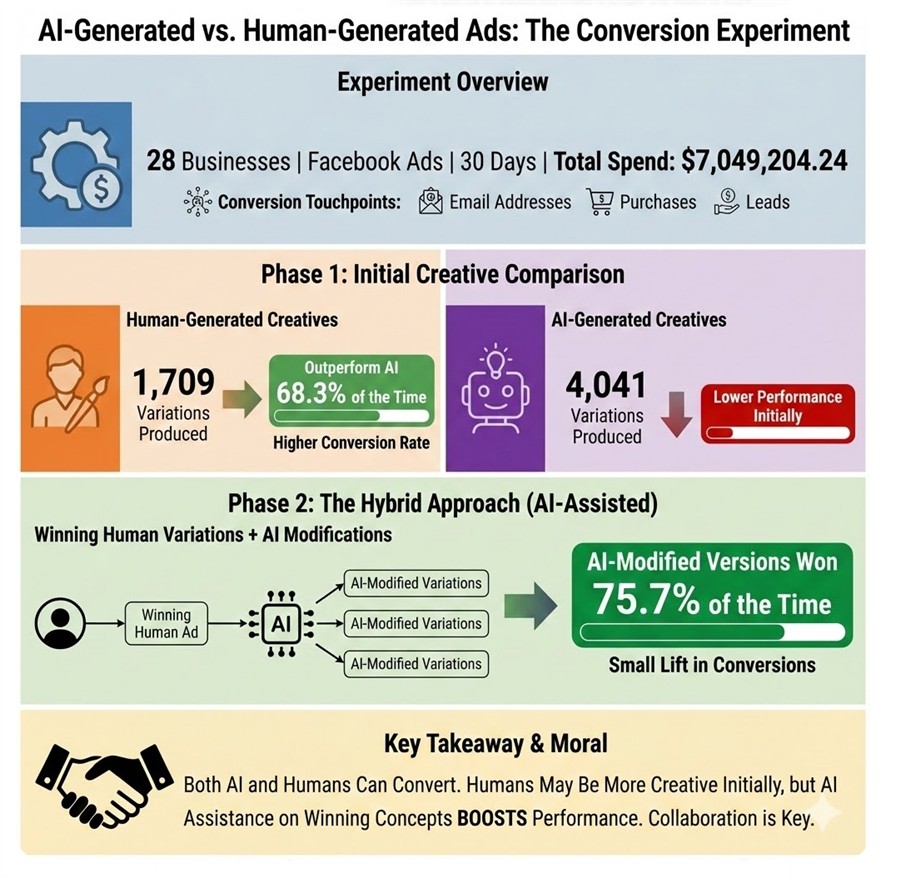

Your shop often has a lot of information in its POS System; big data is a commonly used process that uses computer software to analyse this information to find actionable insights. It is the process of examining large volumes of transaction and customer data to reveal patterns and trends. Many people mistakenly believe that AI is replacing this. Still, AI technology cannot do this yet, partly because it cannot handle so much information and partly because its processing is not as thorough as Big Data Software. What is commonly done now is to feed the Big Data reports we produce into an AI so the retailer can get actionable information. It's a process of turning raw numbers into actionable insights, great for personalised marketing or stock reordering.

BNPL (Buy Now, Pay Later)

A payment service that allows customers to take goods immediately and pay for them in instalments. These services are extremely popular in Australia now.

Brick and Mortar Shop

A brick-and-mortar store is a retail shop with a physical location.

Bulk

Bulk is buying goods in large quantities.

Bundles

Bundles are a few goods and/or services often offered at a lower price than if each item were purchased individually.

Buying group

How many people are buying goods in your shop, for example, a woman and her three kids would be four people, but one buying group.

Capture Rate %

This KPI is the % of passing traffic that actually enters your shop.

Casual Loading

An additional percentage (usually 25%) is paid to casual employees over the base hourly rate. This compensates them for not receiving permanent benefits, such as sick or annual leave.

Chargeback

A chargeback is a charge that's returned to a payment card after a customer successfully disputes a purchase on their account. It can occur on bank accounts or credit cards. There is much criticism of this practice in retail now.

Click and Collect

Customers can order online or by phone and pick up their purchases in the shop.

COGS (Cost of Goods Sold)

The direct cost of purchasing the products you sold during a nominated period of time. It is determined by Opening Inventory + Purchases - Closing Inventory = COGS. Your accountant must have this figure.

Consignment Merchandise

This merchandise in the shop remains the supplier's property.

Conversion Rate

The retail conversion KPI is the percentage of visitors who purchase, relative to the number who enter the shop. For example, if 100 shoppers visit a shop but only 20 buy, the conversion rate is 20 percent. There is often a problem here: many counting scanners count people, while the more advanced ones count a buying group.

Cross-Merchandising

Displaying products from different categories together to encourage add-on sales.

D-H

Dead Stock

Inventory that has not sold for an extended period and is unlikely to sell in the future. Often, it must be aggressively cleared out during a flash sale, e.g., an EOFY sale.

Demand Forecast

An estimate of the future demand for goods and/or services. It uses adjustments for both trend and seasonal factors.

Depth of Assortment

This is the number of each item or product style that a retailer stocks. For example, a shallow product depth, meaning they may only have say 3-5 different types of each product in a stock line.

Destination Department

A category so strong that people will travel specifically to your shop for it.

Discretionary vs. Non-Discretionary

Where stock is divided based on consumer behaviour.

Non-Discretionary are essentials like milk, pet food, stationery, and lottery. What people like them have is that they are often resilient during economic downturns.

Discretionary are gifts, toys, and high-end pens. These are the first to drop when the economy goes South.

Dropshipping

Dropshipping allows retailers to sell products while the supplier handles shipping to customers.

Early Returns

The practice of returning goods to a supplier before their official off-sale date.

EFTPOS (Electronic Funds Transfer at Point of Sale)

The electronic payment system in Australia includes debit and credit cards. It can be confusing because, unlike in other countries, Australians distinguish between "paying by card" and "using EFTPOS."

Electronic Article Surveillance (EAS)

This technology is used to reduce shoplifting. Tags are affixed to high-value goods and removed or deactivated by staff after purchase to prevent them from setting off the alarm system.

Flash Sales

A flash sale is a sudden promotion offered by a shop for a brief period. It encourages impulse buying and is excellent for clearing unsellable stock.

Footfall

The number of people or buying groups coming into your shop.

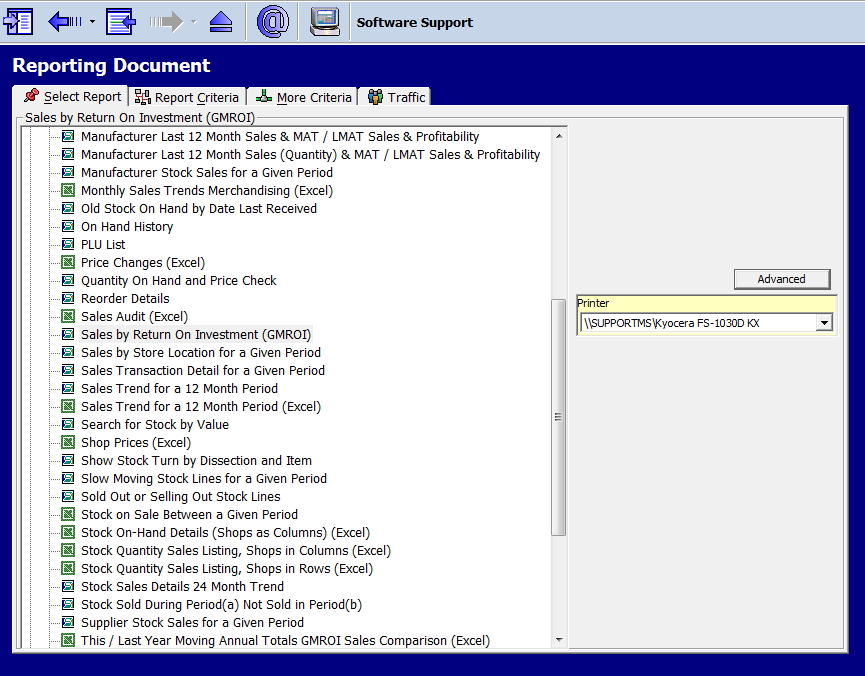

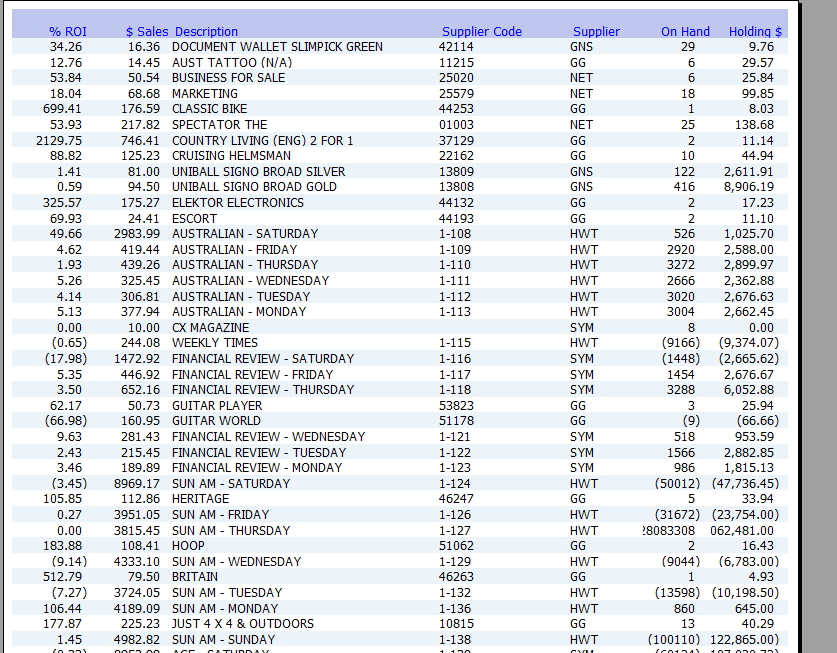

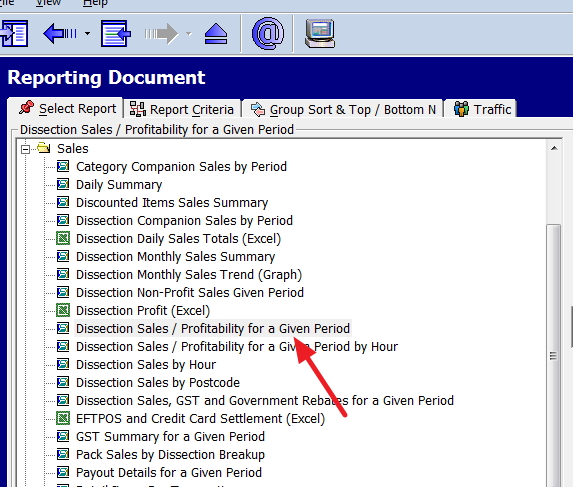

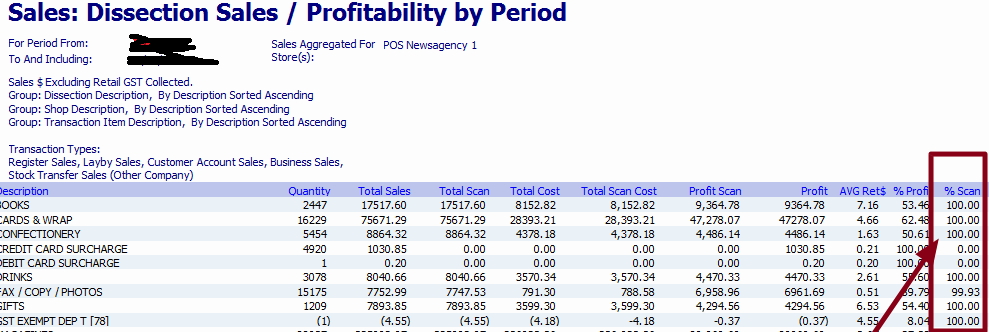

GMROI (Gross Margin Return on Investment)

This is the most important KPI in retail management. It calculates how many dollars of profit you get back for every dollar you invest in Inventory. It's excellent as it gives you a measure that combines turnover and selling margins. A healthy target for most shops is a score of 3.2 or higher.

Gross Margin

The gross margin is total sales revenue minus cost of goods sold, divided by total sales revenue, expressed as a percentage. Use it as a standard KPI in your shop.

High Speed Retail

Customers demand faster service and shorter waiting times; if it takes too long, they walk out.

I-M

Impulse Purchase

Unplanned buying decisions are made at the purchase. Make sure you have items in demand near the cash register.

Integrated Supply Chain

Integrated supply chain management is a specific resource-planning approach to traditional supply chain management. It requires a relationship with your suppliers.

Inventory Management

Crucial for knowing when to restock items, what amounts to purchase or produce, and what price to pay to suppliers. Small businesses can automate day-to-day stock management by adopting POS technology.

Lay-by

A traditional Australian payment method where the retailer holds the goods while the customer pays them off over time.

Lead Time

The lead time is the time between when the retailer places an order and the product arrives at the shop. If you are buying overseas, it might take a month or more.

Legacy Lines

Products that were good but are now in decline.

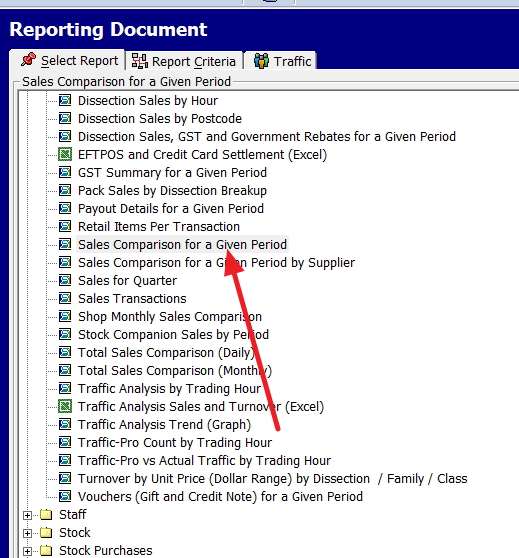

LFL (Like-for-Like Sales)

A commonly used KPI for comparing sales this year to the same period last year (e.g., September 2024 to September 2025). This is considered the best and most accurate measure as it avoids seasonal variations.

Loss Leader

Loss leaders are goods offered at a loss to attract customers into a shop.

Loyalty Marketing

Customers who like and trust a shop buy more. Retailers often encourage this by offering rewards programs.

Markdown

Markdowns are discounts retailers permanently reduce the price of an item from its marked price.

Markup

It is the amount by which a product's price is increased. One reason may be that the retailer thinks they can get more.

Merchant Surcharges

The fees retailers pay to the bank when a customer pays with a card.

Minimum Advertised Price

This is a supplier's pricing policy used to prevent retailers from advertising prices below a specified price. It's disputed whether a retailer can advertise at a lower cost; however, they can sell items in their shop for less. If they do, it may give them problems with their supplier.

Mystery Shopping

A research method used to gather feedback. It can be conducted in person, over the phone, or via online inquiries to collect data on factors such as staff friendliness.

N-Q

Niche Retailing

Niche retailers generally don't appeal to large groups of consumers; they target the particular needs of small groups.

NPP (New Payments Platform)

An Australian Payment infrastructure that enables real-time clearing of payments between banks. Interest in it now stems from merchants trying to avoid card surcharges.

Omnichannel Retail

An approach to sales that aims to get as many customers as possible, by using their shop, e-commerce and the phone. I think most shops should look into this.

On-Sale Date

The specific date when you are allowed to start selling an item. Often, placing these items out early can result in penalties from suppliers.

Penalty Rates

These higher pay rates are mandated by law. They are for unsociable hours, such as weekends, public holidays, or late nights. You need to consider this in your roster.

Planogram

A visual diagram that shows precisely where products are placed on shelves to maximise sales. Often, large suppliers provide their display standards. How to create a planogram is here.

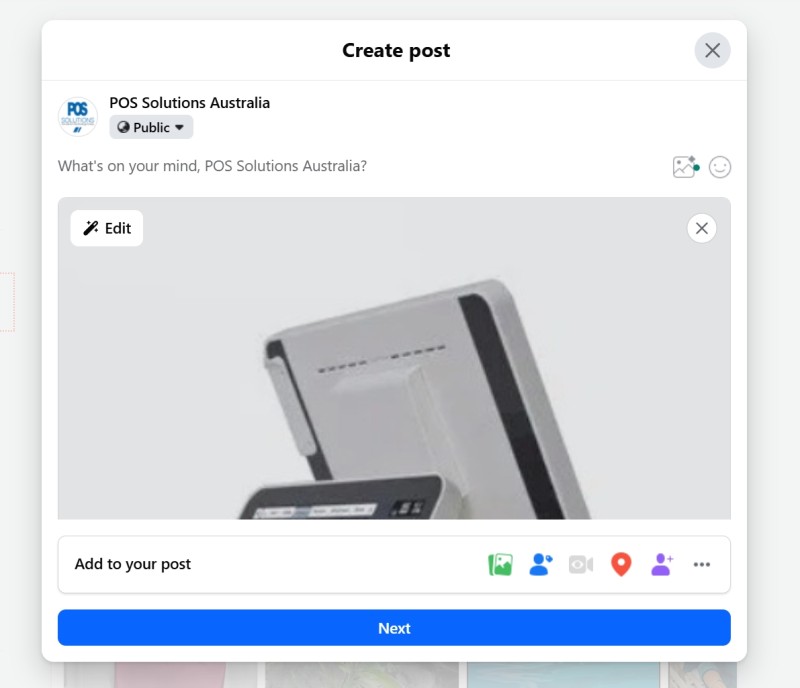

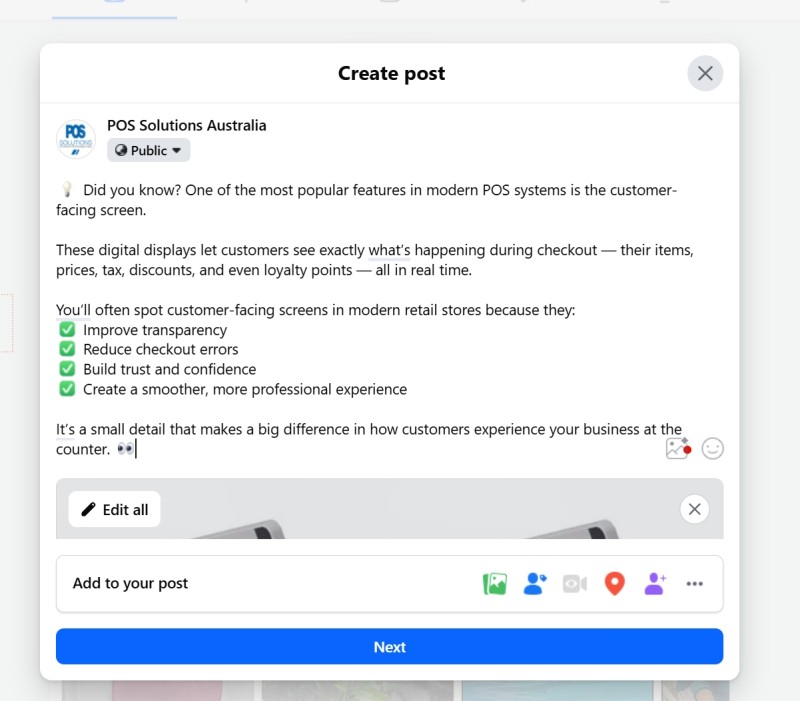

POS (Point of Sale)

The spot where the customer transactions happen. This is the most valuable part of your shop.

POS (Point of Sale) System

This is the method you use to do customer transactions. It can be a computer, a till, or even a cash drawer.

Priority Management

Managing daily operational chaos. The following system can be used, which is assigned a number from 0 to 4 based on priority:

Product Life Cycle

In retail, this is from when a product first goes on sale until it's removed from sale.

Quantity Discount

This is an incentive for the buyer to buy more. The more they buy, the lower the price per unit.

Quantity on Hand (QOH)

It is the quantity of an item that a retailer has in stock.

R-T

Rain Check

A written commitment to a customer to sell an out-of-stock item at the sale price once you get it back in stock. Under Australian Consumer Law, if you advertise a sale, you must supply the item or offer a rain check. Because of this, many retailers include a clause in their advertisements stating that the offer is valid only while supplies last.

Roster

A list that outlines the specific days, times, and duties each employee is required to work in the shop.

RRP (Recommended Retail Price)

The price a supplier suggests a retailer should charge customers for a product. In many Australian states, you are free to set your own prices. In some states, if the product is advertised, you can charge less but no more than the RRP. You need to check.

Sales Strategy

The strategy for presenting your products to your customers.

Sale or Return

An agreement with a supplier that means you can return unsold items for full credit.

Showrooming

Showrooming is when a customer visits a shop to see a product but then purchases it from an online retailer as it's cheaper. You become a showroom for an online retailer.

Shrinkage

This KPI measures inventory loss, generally due to shoplifting, employee theft, or administrative error.

SKU (Stock Keeping Unit)

A unique code used to identify each distinct product in a product line, e.g., a blue pen and a red pen may have the same barcode but different SKUs.

Stockturn (Inventory Turnover)

Not so commonly used today, but what it measures is the number of times you sell and replace your stock over a year. High stockturn is generally good (fresh stock), but it can also mean that you do not have enough stock of an item, while low stockturn means cash is tied up in dusty products.

Supply Chain Management

The activities needed to plan, control, and deliver a product to the final customer.

SWOT Analysis

A typical strategic planning technique used to evaluate businesses today. Business agents, analysts and banks typically use it.

U-Z

Webrooming

This term refers to a customer who browses products online before visiting a physical store to examine them in person.

Wholesaler

A wholesaler acts as a "middleman" by purchasing items in bulk from a supplier and then selling those products to retailers.

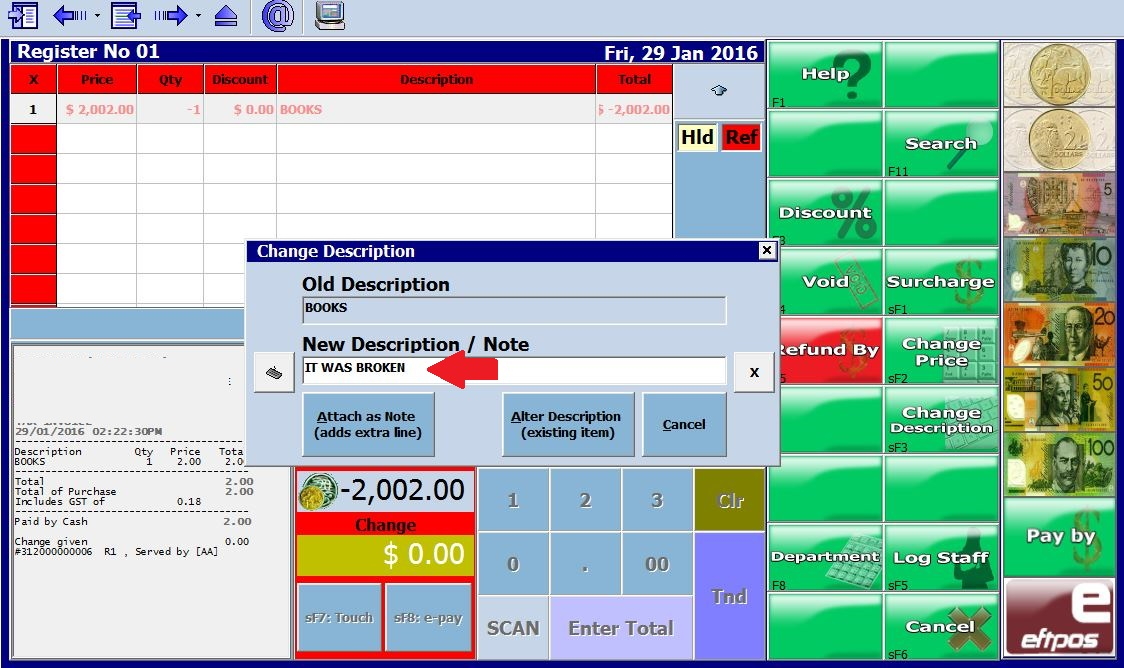

X-Off

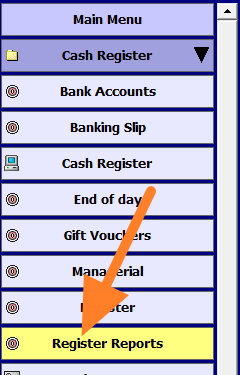

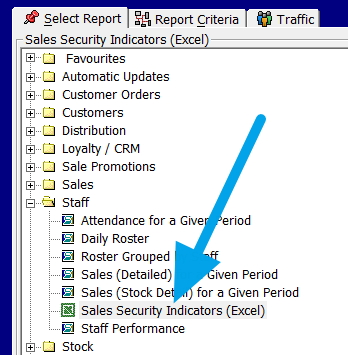

An X-Off report is generated to compare the actual cash in the cash drawer with the amount recorded by the POS (Point of Sale) system. This report helps identify any cash discrepancies immediately at any time.

Z-Off (End of Day)

At the end of each shift, a Z-Off report is created to compare the actual cash in the cash drawer with the amount calculated by the POS system.

Importance of These Terms

Understanding these terms is crucial for effective communication with your colleagues.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.