Executive Summary

The following analysis examines retailer experiences with EFTPOS systems in Australia, based on survey data collected in April 2025. Before addressing the detailed findings, several critical insights deserve immediate attention:

Key Findings Highlight

- Integration Landscape: Linkly (most major banks) dominates with 43% market share, followed by Tyro (26%) and non-integrated solutions (23%).

- Reliability Crisis: Despite being the highest-rated factor (9.6/10), reliability remains a problem, with 68% of retailers experiencing at least one outage in the past year.

- Provider Comparison: Tyro users report significantly better reliability (45% with no outages) compared to Linkly users (21% with no outages), with Linkly users experiencing disruptions three times more frequently (31% had three or more outages vs. 10% for Tyro).

- Fee Handling Divide: 72.5% of retailers absorb EFTPOS fees rather than passing them on to customers, despite being cost-sensitive.

- Factor Correlation: Reliability and fast settlement to retailers are seen as operational necessities.

Survey Methodology This report analyses responses from 120 Australian retailers, not all of whom are our customers, who were surveyed in April 2025. Data includes integration types and importance ratings, with 10 being the highest. We asked them in our newsletter if they could fill out our online survey. It did take a long time to go through the analysis below. I want to thank Garth for his help in this survey.

Detailed Findings

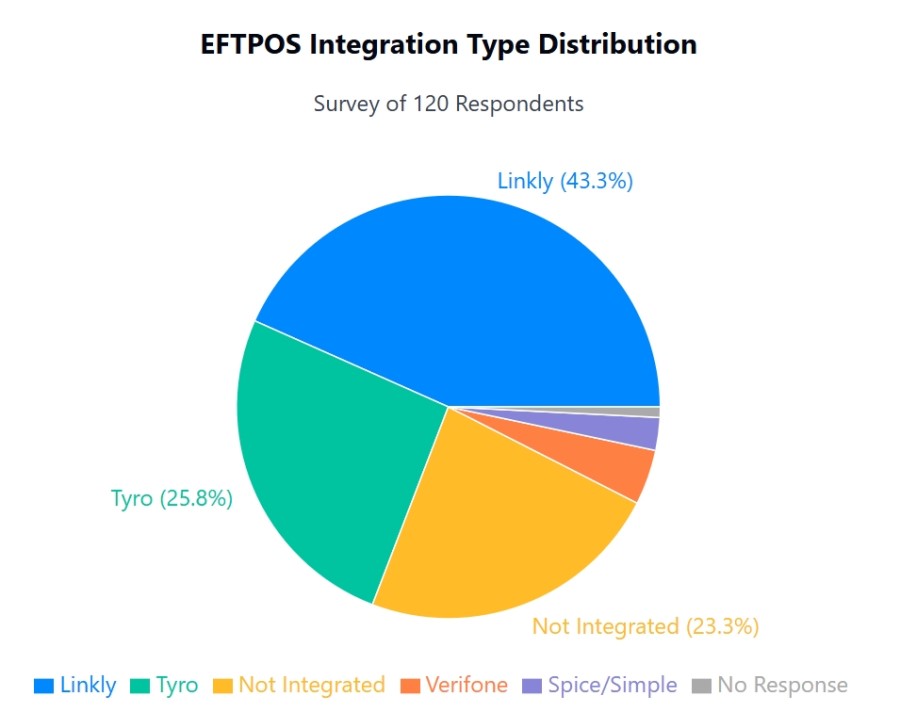

What EFTPOS Integration Do You Use?

What it’s about:

This question asked retailers which EFTPOS system they use and whether it’s integrated with their POS (Point of Sale) software.

What retailers said:

- 43% use Linkly (the system behind most major banks’ terminals)

- 26% use Tyro

- 23% don’t integrate their EFTPOS with their POS at all

- The rest use smaller providers like Verifone or Spice/Simple.

What does it mean:

Linkly dominates despite being generally the most expensive system because it’s bundled with most banks.

How Important Is Integrated EFTPOS to You?

What it’s about:

Retailers rated how important it is for their EFTPOS to be connected directly to their POS system.

What retailers said:

- Integrated users: Gave it a 9 out of 10 or higher score.

- Non-integrated users: Only 2.3 out of 10.

What does it mean:

If you have an integrated EFTPOS system, you love it mainly because it saves time and reduces errors. If you don’t, you probably can’t justify the cost.

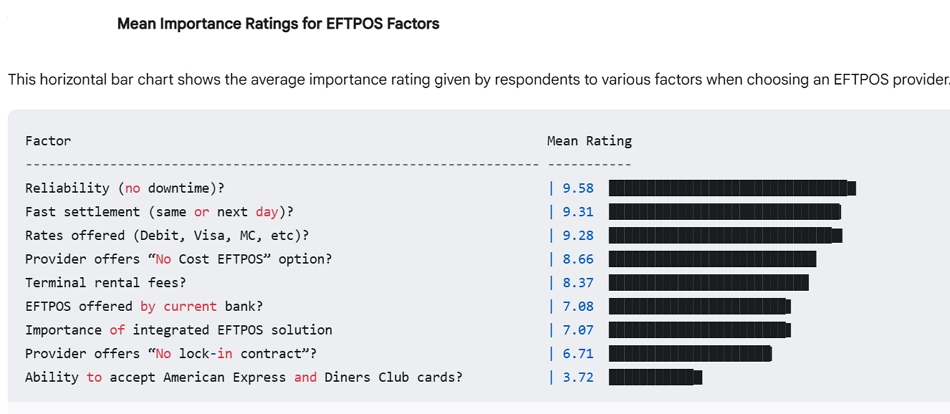

How Important Is Reliability (No Downtime)?

What it’s about:

Retailers rated how critical it is that their EFTPOS always works.

What retailers said:

Average: 9.6 out of 10

Reliability is the highest-rated factor.

What does it mean:

Retailers can’t afford for their payment systems to go down. It was the most critical issue.

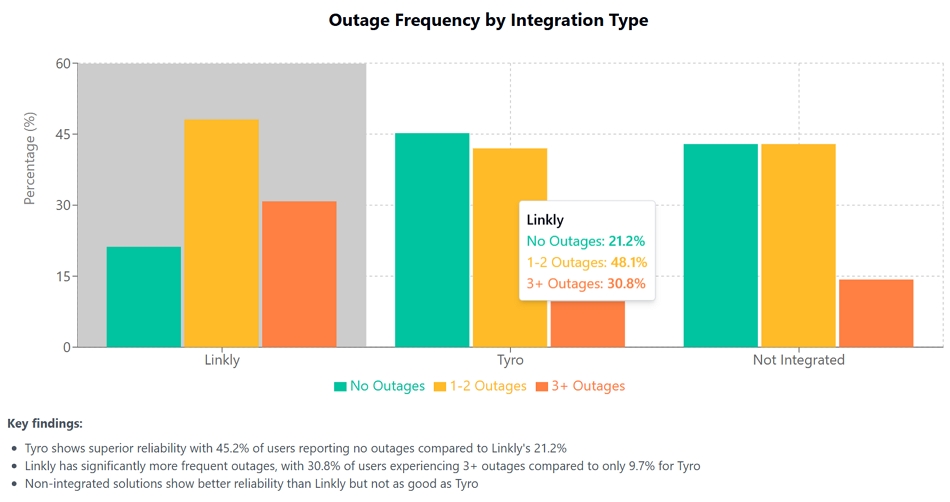

How Many EFTPOS Outages Have You Had in the Past Year?

Now, let's look at reliability in detail.

What it’s about:

Retailers reported how often their EFTPOS system stopped working in the last 12 months. What we found interesting here is that everyone remembered the outages.

What retailers said:

Outage frequency across all respondents shows major reliability issues; 68% of retailers experienced at least one outage in the past 12 months, with nearly a quarter suffering frequent disruptions (three or more outages). This is particularly problematic, given the top importance rating assigned to reliability above.

Integration method significantly impacts outage experiences:

| Integration Type | No Outages | 1 Outage | 2 Outages | 3+ Outages |

|---|---|---|---|---|

| Linkly | 21.2% | 26.9% | 21.2% | 30.8% |

| Tyro | 45.2% | 32.3% | 9.7% | 9.7% |

| Non-integrated | 42.9% | 25.0% | 17.9% | 14.3% |

Tyro users report substantially fewer outages than Linkly users, with more than twice the percentage experiencing no outages at all. Linkly users suffer from the highest rate of frequent disruptions, with 30.8% experiencing three or more outages, three times the rate of Tyro users (9.7%). This suggests significant reliability advantages for Tyro.

What does it mean:

Outages are common across all retailers and can seriously disrupt business, especially for those relying on Linkly.

Tyro users:

- Nearly half (45.2%) of Tyro users reported no outages, the best among the three options.

- Only 9.7% of Tyro experienced two or more outages, significantly lower than other options.

- This suggests Tyro is the most reliable integration type in terms of uptime, aligning with its reputation for robust, integrated EFTPOS solutions in Australia.

Non-integrated users:

- 42.9% reported no outages, similar to Tyro and much better than Linkly.

- The proportion of users experiencing three or more outages (14.3%) is comparable to Linkly.

Linkly users:

- Only 21.2% of Linkly users had no outages, the worst on the list.

- A significant 30.8% experienced three or more outages, which is not good.

If reliability and minimising payment outages are your top priorities, Tyro appears to be the superior choice among the options compared. Non-integrated systems performed reasonably well, while Linkly, despite its dearer cost, showed a higher risk of outages based on this data.

How important is it that your bank offers EFTPOS?

What it’s about:

This asked if it matters whether their EFTPOS comes from their current bank.

What retailers said:

- Average importance: 6 out of 10.

- Only 38% rated it as “critical.”

What does it mean:

Retailers are open to using non-bank providers and are prepared to consider other providers if they offer better features, such as reliability.

How Important Are the EFTPOS Rates (Visa, Mastercard, Debit)?

What it’s about:

Retailers rated how much they care about the fees charged for EFTPOS transactions.

What retailers said:

- Average rating: 9.2 out of 10

What does it mean:

Transaction fees were among the top concerns for retailers, where every cent counts today.

How Important Is Accepting Amex or Diners?

What it’s about:

Retailers rated the value of being able to accept American Express or Diners Club cards.

What retailers said:

- Average rating: 3.7 out of 10

What does it mean:

Most retailers here are not that concerned with Amex/Diners

How Important Is Having No Lock-In Contract?

What it’s about:

Retailers rated how much they care about being free to leave their EFTPOS provider at any time.

What retailers said:

- Average: 7.6 out of 10

What does it mean:

Flexibility matters; retailers don’t want to be tied down.

How Important Is Fast Settlement (Same/Next Day)?

What it’s about:

This asked how much retailers value getting their EFTPOS money quickly.

What retailers said:

- Average: 9.3 out of 10

- 87% want funds within 24 hours.

What does it mean:

A fast cash flow is vital; retailers want their takings in the bank as soon as possible. No one likes large sums of money somewhere in the banking cloud. They need it now, where they can use it.

How Important Is a No-Cost EFTPOS Option?

What it’s about:

This asked about the appeal of “no-cost” EFTPOS systems. Although generally dearer, it passes the cost from the retailer to the customer.

What retailers said:

- Average: 8.1 out of 10

What does it mean:

Retailers like the idea of not paying fees themselves, but there are trade-offs: It raises their prices. Overall, it was not highly rated.

How Important Are Terminal Rental Fees?

What it’s about:

Retailers rated how much terminal rental costs matter.

What retailers said:

- Average: 8.5 out of 10

What does it mean:

Ongoing device costs are a consideration, but other issues are more critical.

Are There Any Other Factors That Matter to You?

What it’s about:

This was an open-ended question for anything not covered.

What retailers said:

- Only 17% filled in this question here

- A few mentioned things like terrible customer support and Telstra's coverage in their area. We could see no pattern.

What does it mean:

The low figure and many responses here suggest we covered most mainstream issues.

How Do You Handle EFTPOS Fees?

What it’s about:

Retailers explained whether they pass EFTPOS fees to customers, absorb them, or consider a change.

What retailers said:

- 72.5% currently absorb the fees

- Of those absorbing fees, 32.1% are thinking about charging

What does it mean:

Most retailers absorb card fees, but many consider passing them on to customers. Now this was surprising, which was not expected when we looked in detail, that although Linkly is generally the most expensive system, our analysis reveals an unexpected relationship between EFTPOS providers and fee-passing behaviours:

Tyro Users:

- 57% currently absorb the fees

- Of those absorbing fees, 67.4% are thinking about charging

Linkly Users:

- 80% currently absorb the fees

- Of those absorbing fees, 25% are thinking about charging

Why should a dearer EFTPOS have a lower charge rate? You tell me. I think it might be because this ability is inbuilt in Tyro, but this needs more research.

Summary Table: What Matters Most to Retailers

The disparity in technical performance across integration types is significant. Tyro demonstrates superior reliability, with 45% of users reporting no outages compared to just 21% of Linkly users. Conversely, Linkly users report the highest rate of frequent disruptions, with 31% experiencing three or more outages, compared to 10% for Tyro and 14% for non-integrated solutions.

Satisfaction Drivers Analysis

The survey data indicates a clear hierarchy of factors that drive retailer satisfaction with EFTPOS systems:

The ranking reveals retailers prioritise operational efficiency (reliability, settlement speed), followed closely by financial considerations (rates, fees). The relatively low importance of Amex/Diners acceptance suggests most retailers view this as optional rather than essential.

Analysis of Key Metrics

This is done to see if any overriding themes emerge from the survey; the closer the value to 1, the more they fit into a theme.

| Factor Pair | Correlation |

|---|---|

| Reliability ↔ Fast Settlement | 0.72 |

| No-Cost Option ↔ Fast Settlement | 0.37 |

| No-Cost Option ↔ Terminal Rental Fees | 0.34 |

| Rates ↔ Reliability | 0.29 |

| No Lock-in Contract ↔ Fast Settlement | 0.29 |

The extremely high figure for reliability with fast settlement indicates that retailers view these as the most critical points.

Other factors, although important, fall into the optional category.

Conclusion

The survey data reveals critical insights.

- Reliability and fast settlement times are non-negotiable for most retailers.

- Integrated EFTPOS is highly valued by those who use it.

- Outages are common, especially for Linkly users. Our poor electronic infrastructure will cause problems in cloud solutions.

- Most shops absorb card fees, but many are considering passing them on.

- Cost matters, but not at the expense of reliability and fast settlement.

If you’re a retailer, reliability and quick settlement will guide your system choice, even before considering transaction fees or rates.

If you’re an EFTPOS provider, the strongest levers for market share are minimising outages, offering transparent and competitive rates, and settling quickly.

If you’re a bank, bundling with Linkly may not be a long-term defence against competitors' better reliability and feature offerings.

Final note

I want to thank those retailers who helped us make this survey.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.