RBA Reforms 2026: Protect Your Retail Margins

Running a supplier review every now and then is fine, but we are focused on the RBA card reforms decision, which is due in March 2026. Our submission is here. Now I can guarantee you, your margins are under attack from both hidden supplier costs and the likely ban on surcharging, which will result in many of you seeing a drop in margins.

If you are not careful, your best-line costs can creep up quietly, leaving you stuck with products that no longer cover their costs. This guide shows you how to use supplier analysis and your POS system to protect profit and reduce risk.

How to do a supplier analysis

What you are looking for is a supplier that delivers strong sales and profits.

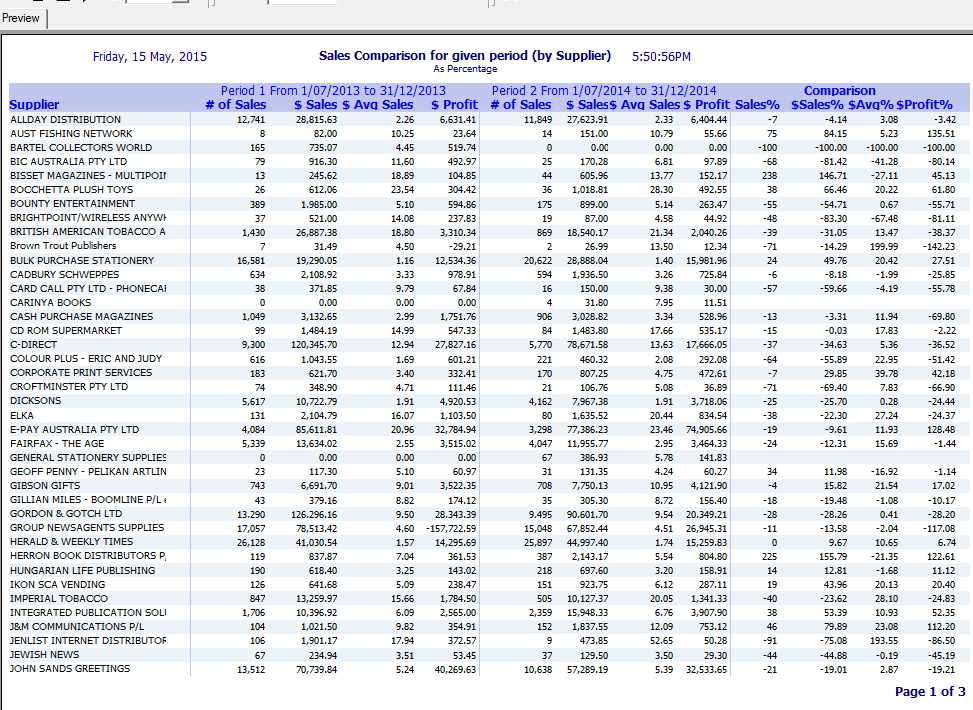

Go to register sales reports and then go to "Sales comparison by supplier"

I recommend using the previous 12 months for comparison with the last 12 months.

For the initial run, use the percentage.

Then a report like this pops up.

Try it now, it only takes a second.

Your POS system has an invaluable tool for managing supplier relationships and improving operational efficiency. I suggest running it again with absolute figures as well.

Look at the profit figure. Today, we are seeing significant downward margin creep. This report is an excellent place to see it. Downward margin creep has many causes, often a mix of changing customer habits and supplier price shifts.

Action: Identify underperforming suppliers and address concerns directly. Then, strengthen relationships with high-performing suppliers.

Put supplier analysis first (do not use supplier loyalty)

Do not measure your supplier by how much you buy from them; instead, focus on what they deliver to your business: profit, sell-through, reliability, and support.

I think it's best that you clarify your relationship with your supplier. Understanding your position can help you tailor your approach, such as negotiating better terms and/or diversifying your supplier base.

Suppliers tend to prioritise larger retailers because of their greater spending power. This often leaves Small to Medium Business (SMB) retailers struggling to secure favourable terms. The other issue is that they know SMB retailers often lack the accounting expertise of larger chains and try to capitalise on this. You need to verify their figures. As a general rule, the information they give you is the information they want you to know. This is where your POS System is a big help, as it knows your figures and has no agenda in what it shows you.

Card payment reforms: why margin visibility matters now

A major financial change is on the horizon, making it urgent to know your margins.

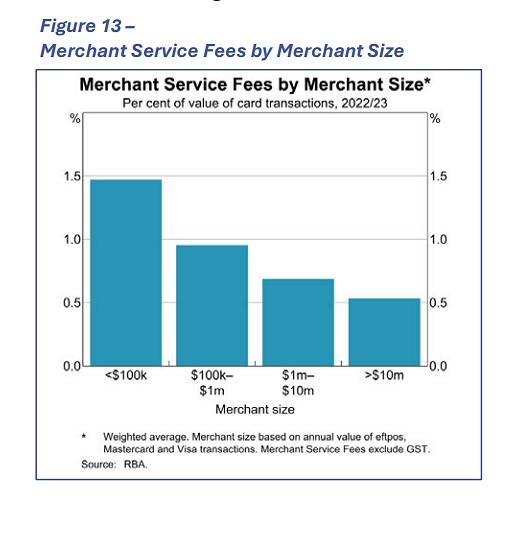

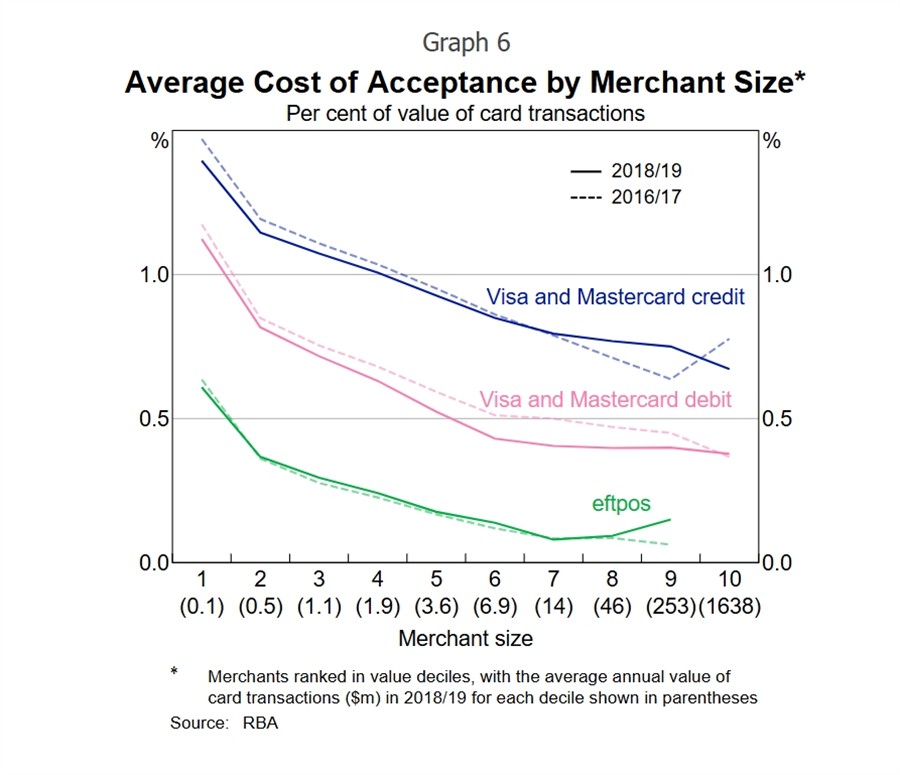

With the Reserve Bank of Australia (RBA) due to make its final decision on card payment reforms in March 2026, you should prepare for a likely change: that you will almost certainly be banned from adding surcharges on debit cards, and possibly credit cards too.

If surcharging is banned, the impact is immediate:

- Merchant fees become a direct business cost rather than a pass-through to the customer.

- Shelf prices must rise to cover this gap.

- Safe pricing becomes impossible if you don’t know your exact margins right now.

You cannot make safe pricing decisions if you don’t know your exact profit numbers by product and supplier.

Verify the “margin help” promises.

Some suppliers are already aware of these changes and may promise to adjust their pricing structures to increase your margin to cover these costs. Do not just take their word that they will do this they do not tend to see it as you lose a percent but that they have an extra percent. You must verify that this actually happens, because based on past experience, I rarely see suppliers do it, and if they do, it's only partial. If they do it, it will come through a “margin adjustment” that you need to check to ensure it delivers the extra percentage points you need.

What you should do:

- Measure your card costs: Work out exactly what you pay in merchant fees as a percentage of sales.

- Track the change: If a supplier claims they have improved your margin to cover these fees, run your “Sales Comparison by Supplier” report for the period after the change.

- Compare the reality: Did your profit margin on their line actually go up? If the data shows the margin has dropped, you are absorbing those card fees yourself and may need to raise your prices immediately to compensate.

- Document your reason: You may possibly need to justify price rises later. Knowing your data now will allow you to say: “We adjusted prices to keep the business viable as costs shifted.”

Diversify to reduce risk.

Relying on a single supplier puts your business at considerable risk, including stock shortages or price hikes. You should consider diversifying your supplier base.

The benefits of diversification are clear:

- You reduce dependency risks.

- You gain leverage in negotiations by having alternative options.

- You ensure consistent product availability.

- You have a wider selection of products.

- You’re not left stranded if one supplier faces disruptions.

Actionable Step: Use your POS system to track supplier sales performance. Could you identify which suppliers are underperforming and explore alternatives to fill gaps?

Negotiate beyond “just price”

Sometimes you may find the salesman has little flexibility on price, but they typically have room to manoeuvre on other points. Negotiation isn’t just about securing the lowest price; it is about more. Often, the seller has more flexibility than initially disclosed; you must be willing to ask.

- Quality

- Range

- Extended payment terms (e.g., 30-day credit).

- Bulk discounts or promotional pricing.

- Marketing support.

- Shipping Terms.

For example, I once told our supplier that we were going to a show. In exchange for showcasing their products, they provided me with their advanced UPS.

Conduct independent research

Suppliers may present information that benefits their agenda, but verify everything independently. Ask your customers, visit similar shops, examine the advertising, use your POS reports, and do Google searches.

I find that Amazon's top-selling lists in Australia are a valuable resource for seeing what is actually trending, regardless of what a rep tries to sell you.

These are some items to check:

- Compare sales data for similar products between Supplier A and Supplier B.

- Assess whether each supplier's margins meet your financial targets. Some suppliers hide their margins, which can be a problem.

Is your POS ready for March 2026?

We do not have much time, so don't wait for the RBA decision to catch you off guard. Log in to your POS today, run the ‘Sales Comparison by Supplier’ report, and verify your true margins before costs shift.

Don't guess your margins. POS Solutions gives you the exact reporting tools you need to negotiate with confidence.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.