The Reserve Bank of Australia (RBA) proposed eliminating merchant surcharges on EFTPOS and credit cards as part of its 2025 review of merchant card payment costs. The RBA claims this move would simplify payments, increase transparency, and save consumers an estimated $1.2 billion annually. Businesses would also benefit from their proposed lower interchange fees. They then asked the public to comment on their proposal here. They received approximately 85 responses, and as expected, the reactions are mixed, mainly concerning costs and the likely business impact. What I have done here is review many of the responses and provide a summary of their views. The first point to note before I go into the details is that every one of them thinks the existing system is wrong and they want change.

To understand the divide, let's start with consumer views, which primarily support the change.

Consumer Perspectives

Consumer advocates, such as Choice, broadly welcome the proposal. They view surcharges as unpredictable fees that add to everyday expenses in our cashless society. These fees feel like hidden costs. Advocates note that 85% of Australians prefer prices to include everything, rather than having to pay additional fees at checkout. Overall, they believe the public will save money.

Personal Insight

It annoys me too. Furthermore, despite our efforts, many clients don't activate Least Cost Routing (LCR) to cut merchant costs. Often, it's ignored, and many merchants assume that, since customers will cover the fees via surcharges, they do not need to worry about it. I disagree that your higher fees are costing you. Activate LCR now!

SMB Business Views

These express caution, fearing that the ban could force them to absorb the costs. They do not see the fee reduction as adequate. Those in low-margin sectors, such as retail, highlight risks to viability. For instance, if a business operates on a 4% margin and costs rise by 1% due to lost surcharges, that's a quarter of their profit erased. Some are predicting inflationary pressure. They tend to see the EFTPOS and credit card fees as high.

I consider this fear to be justified. Many merchants have no control over the prices. Without surcharges, many in the public will switch to premium cards with even higher fees that the merchant will have to pay. Consider this analogy: the cost of delivery does not disappear, even if someone claims a merchant cannot charge for it. The merchant will pay the price of the goods, or the price will go up. It will undoubtedly be inflationary.

Payment service operators (banks) tend to support some surcharge as they are concerned about squeezed margins. They now view debit and credit card fees as low. I liked the NAB response, which is worth a read.

Fin tech providers tend to prefer a surcharge-free electronic payment method, but they also accept that surcharges are necessary in today's market. Some see opportunities for alternatives, such as account-to-account payments, which some chemists are currently testing, as well as bitcoin.

Visa endorses the ban, as it will reduce consumer confusion, but doubts that the RBA's interchange fees are viable without cuts in services, such as fraud protection.

Industry Group Reactions

Retail and payment industry groups are emphasising potential unintended consequences. For example, the Australian Retailers Association argues that while surcharge removal simplifies operations, it will also obscure payment costs, making competition more challenging in margin-tight environments.

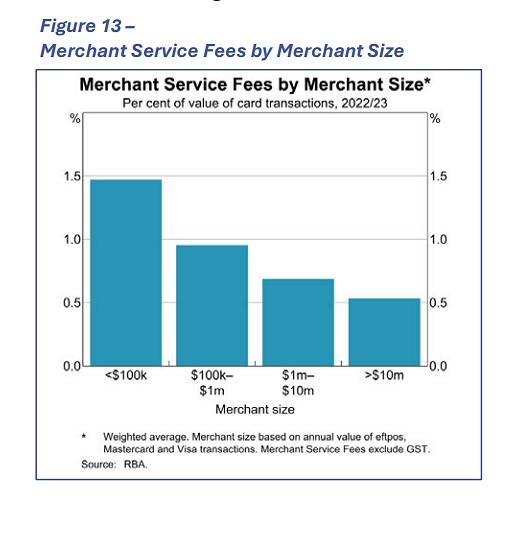

Groups like the Independent Payments Forum stress that the fees are the cause of the surcharges; the result will just be hiding these costs. They also dislike that larger organisations are charged significantly less in bank fees. Please review the graph provided below, which illustrates this point.

For many of our readers the ALNA submission will be relevant and well worth a read too.

Expert and Analyst Opinions

These are generally positive, e.g. Professor Steve Worthington describes himself as "delighted," noting it ensures "the price you see is the price you pay,". They point to the UK's experience with a surcharge ban, which led to a slight increase in inflation but improved transparency.

However, some caution that without robust enforcement, costs could shift to unregulated areas, such as Buy Now Pay Later services. I have my doubts about that. BNPL generally now has no customer surcharges but very high merchant fees.

Impacts of RBA Surcharge Removal

We have divided opinions here.

On a personal note, I would like to see the RBA examine the existing fees in detail to determine whether they are high or low.

What do you think of the RBA proposal?

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.