RBA Card Surcharge Changes

What Australian Retailers Need to Know About the Upcoming Payment Reforms

The Australian government's election promise was that debit card surcharging would be banned. Most in parliament agree, so it's almost sure that this will happen. Now, the Australian Reserve Bank (RBA) wants to stop stores from charging surcharging fees for Visa and MasterCard credit cards as well. These changes, the RBA claims, would save customers about $1.2 billion each year. The first question is who pays for this $1.2 billion savings: the banks, the business community or the consumer (banks are talking about increasing fees for having a card).

Here is what I know now, and if I find out more, I will let you know here. To read our submission to the RBA on the issue, click here.

Frequently Asked Questions

Q: When do the changes start?

A: I wrote an article about that and when I sent it for verification was soon contacted and assured that the EFTPOS surcharge bans will probably start on July 1, 2026. Credit card surcharges are still being discussed. The Reserve Bank has suggested banning these as well.

Q: Can I still charge fees for direct debit payments after the surcharge ban?

A: Yes, you can still charge fees for direct debit payments. Direct debit is different from card payments because it uses bank account details (BSB and account number) instead of card networks like EFTPOS, Visa, or MasterCard. The surcharge ban only covers card payments made through these specific networks. Direct debit fees must still be reasonable and not exceed your actual processing costs, following current consumer protection rules. It means that businesses offering direct debit can continue charging processing fees for this payment method even after July 2026.

Q: What happens if stores keep charging banned fees?

A: Stores that keep charging EFTPOS fees after they're banned will get in trouble with the government. The competition watchdog now has the power to investigate complaints and fine businesses that break the rules.

Q: Which Cards Are Covered?

A: What types of card payments might be banned?

Confirmed:

- EFTPOS debit cards (tap, swipe, or insert)

Strong Possibility:

- EFTPOS payments online

- Visa and MasterCard credit cards

Unlikely:

- Phone payments like Apple Pay and Google Pay

- Overseas premium cards like AMEX

Q: Will stores still be able to charge fees for American Express?

A: Yes, they can still charge extra for cards that come from overseas. But American Express cards that come from Australian banks might be included in the ban. I suspect that cards like Union Pay can probably still have fees. If you are wondering why, well, so am I.

Q: How Should Stores Get Ready?

A: First, figure out how much money you make from EFTPOS fees each month. Look at your payment reports from the last six months. In particular, look at your low-margin departments.

Next, think about whether you can:

- Raise your prices a little bit to cover the costs

- Pay the card costs yourself without changing prices

Q: What should stores tell customers who complain?

A: EFTPOS fees are still legal until the ban starts. If customers complain about fees, explain that the changes haven't happened yet. You should have a printed notice explaining when things will change. Many customers think all card fees are already banned because of news stories. Having clear information helps avoid arguments.

Q: Do the rules apply to online stores too?

A: It depends on which payment method customers use. The surcharge ban will apply to both in-store and online transactions, but the rules are different for different card types:

- EFTPOS online: Since it is rarely used for online shopping, this won't affect most websites

- Visa and Mastercard online: These surcharges are still being discussed and may be banned, but no final decision has been made yet

- American Express online will probably still allow surcharges

- Direct debit online: Not covered by the ban, so you can still charge fees for this

Q: Do small businesses get different rules?

A: No, the rules will be the same for all businesses.

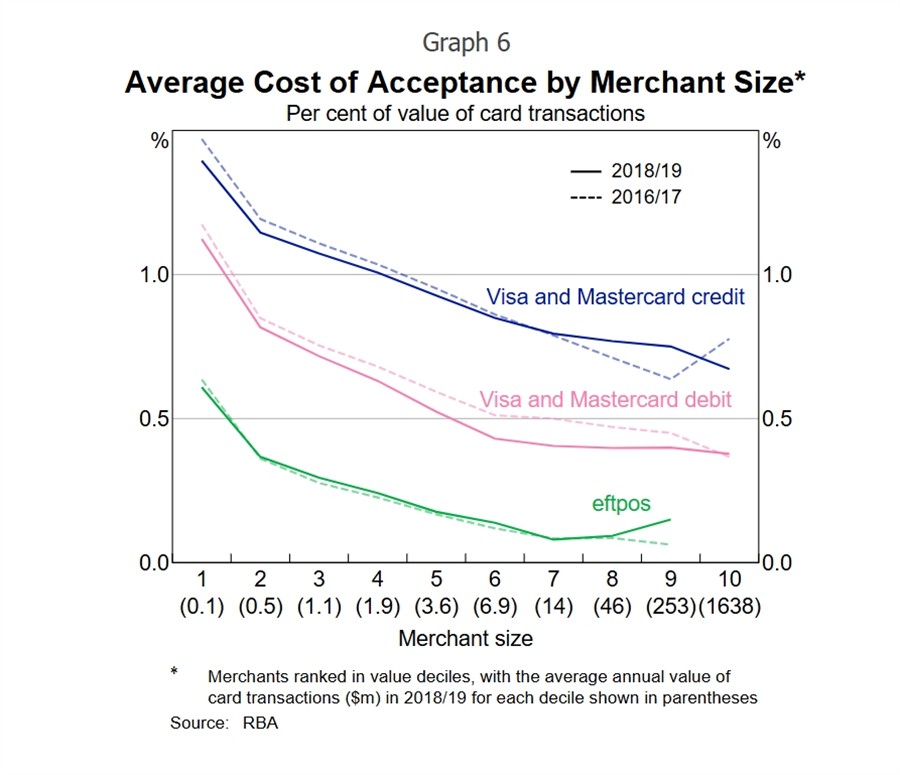

Q: Will bank fees go down?

A: The Reserve Bank wants to lower the interchange fees that banks charge businesses for processing card payments, whether this will result in bank fees going down I think is dubious. One question I would like to ask, if the RBA were to call me up to testify, is why merchant fees have increased in the last six months since the RBA looked into it?

How Are We Preparing for the Change

I doubt there is much we can prepare for. When we know what is happening, we will need to make some significant changes to our POS Software.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.