The true costs of an EFTPOS Outage

Our recent EFTPOS Retailer Survey highlights the critical concern for Australian retailers, which resulted in many questions for me from retailers over this survey: When choosing payment solutions, retailers here gave reliability as their top priority, surpassing fast clearance and cost. While fast clearance remains the next most important, uninterrupted payment processing is essential for business continuity.

Payment processing reliability is not just a convenience; it's vital for business continuity. Yet our survey indicates that retailers frequently experience outages and pose a persistent risk. These outages would result in significant financial losses for retailers.

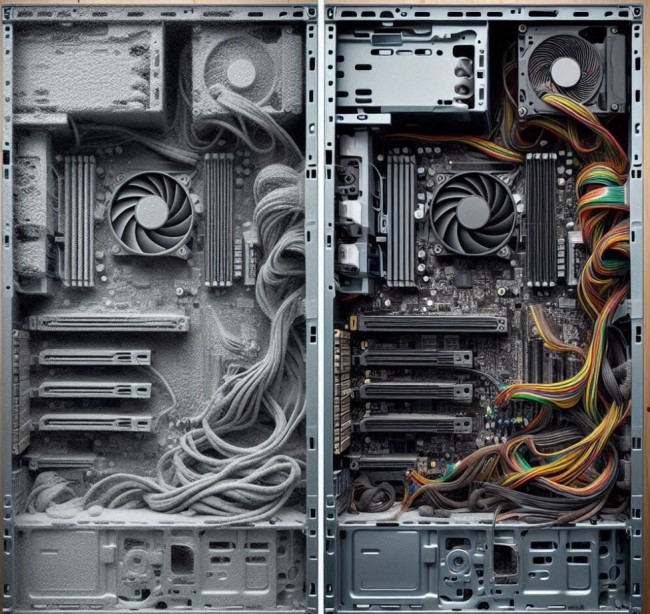

What hurts is that almost all IT infrastructure guarantees an uptime of 99.999% (we call this the five nines), yet no one sees it. A shop, let us say, open 8 hours a day, 300 days a year, would, based on this, have less than 1.5 minutes of an EFTPOS outage a year. I am sure we all have gone through more than 1.5 minutes of an EFTPOS outage.

Incidents involving Telstra and Woolworths demonstrate that even major businesses are not immune to payment outages.

For example, a retailer with $1 million in annual turnover and a 30% margin loses approximately $400 in revenue for every hour of downtime. This figure only reflects immediate losses. Long-term impacts such as damaged customer relationships, reputational harm, and customer attrition will be even more significant, though harder to quantify.

Under Australian Consumer Law, businesses may be entitled to compensation for financial losses caused by EFTPOS outages, even if the provider does not guarantee uptime. To make a successful claim, it will take time as you need to document all losses thoroughly, then you will need to include POS reports comparing affected periods to normal trading to show the loss. I have seen a few people do this, with mixed results. We generally advise that if the EFTPOS provider makes a fair offer, accept it. One problem is that the EFTPOS providers know your figures as well as you do and have more money and experience in these matters.

Calculate the Cost of an EFTPOS Outage

Several direct and indirect factors determine the actual cost of an EFTPOS outage. The following outlines some key variables to help you estimate your potential losses.

Calculation

Average hourly revenue

An outage can occur anytime; take your yearly revenue and work out an hourly rate.

I should say here that Murphy's Law will tell you that outages will occur at the worst possible times, such as during peak trading hours, amplifying their financial and reputational impact.

Outage duration

This is hard to estimate, as customers have been knocked out for minutes, hours, and days. Do your best here.

This one really hurts. Often, you use the downtime to do your books, and you see money going out, while your staff is doing nothing.

Card transaction percentage

Your End-of-Day reports will tell you this, I would expect somewhere between 50% and 80%

Estimated sales lost

Many customers carry little or no cash, and if EFTPOS is down, they cannot buy from you. Many will go elsewhere to buy the product. As a guess, I would say 50%, but I would not be surprised if it's closer to 100%.

Now multiply these out.

(Lost revenue) = (Average hourly revenue) x (Outage duration) x (Card transaction percentage) x (Estimated sales lost)

That is the easy part now, we need to add to this base figure.

Customer Reputational Behaviour

What do the customers think of you? If they cannot buy from you, they will buy from someone else. What chance is that they will switch for good? It is said that if an outage occurs once, it is generally okay, but two or three is something else. What is the cost of losing ten customers a year to EFTPOS outages?

I have seen industry experts give figure

Key Takeaway

The actual cost of an EFTPOS outage extends far beyond immediate lost sales. Reliability is the foundation of trust and operational continuity in retail. Both providers and retailers must prioritise robust systems and contingency plans to safeguard business performance and customer relationships.

As Australia moves into a cashless society, our present government (both sides) will only make this problem worse by not putting more commitment into our electronic infrastructure.