How to sort of determine the Age of Your Computer

Recently, a client brought an almost-new computer, it was claimed, but it turned out to be an old one. Interestingly, the client himself is very computer-knowledgeable, and he was fooled.

Here, you can discover how to protect your investment and avoid getting scammed when buying a computer with these expert verification techniques. I always recommend purchasing only from reputable vendors. Note that this means more than just big ones, as many small vendors are reputable.

The Importance of Accurate Age Verification

Outdated systems disguised as new can create multiple problems:

• Performance issues affecting daily operations

• Compatibility problems with modern software

• Potential security vulnerabilities are threatening your business.

Consider these statistics:

- The average lifespan of a new system is 3 to 5 years; a two-year-old computer gives you 1 to 3 years, and a three-year-old probably has about a year left.

- Outdated systems will have higher repair costs.

- Performance degradation in older systems will lead to slower transaction times.

The Bigger Picture

While determining the exact age of a computer system is crucial, it's not the only factor to consider when upgrading your POS setup. The reliability, compatibility with your chosen Best POS software, and the vendor's support are just as crucial.. A slightly older, well-maintained system that's fit for purpose might serve your business better than a brand-new system that needs optimisation for retail operations.

Consider these key factors:

- System reliability and uptime

- Compatibility with modern POS software

- Vendor support and warranty options

- Overall performance for your specific retail needs

Serial Number: Your First Line of Defence

The serial number is your most reliable age indicator.

To locate it:

• Check the back of desktop computers

• Look under Computer

• Inspect the battery compartment.

The Difficulty of Changing Stickers

Now it's not impossible to change a sticker if it's there, but its not easy for anyone trying to do so deceptively:

-

Designed for Tamper-Evidence: Manufacturers often use special adhesives and materials that cause the sticker to tear, shred, or leave behind a "VOID" pattern if peeled off.

-

Hard to Replicate: The stickers are printed with specific fonts and layouts, and often include barcodes that are difficult to reproduce.

-

Physical Imperfections: Check if the sticker is peeling at the corners, isn't aligned correctly, or has bubbles underneath it.

For Windows-based systems, use the Command Prompt.

"wmic bios get serialnumber"

It might display the serial number if it is in the BIOS.

Once you have the serial number, visit the manufacturer's website or contact customer support. Many companies can provide manufacturing date information based on the serial number.

However, many computers today do not have the serial number here, so you get a "Default String."

While serial numbers can be reliable indicators, sometimes they're not accessible. In such cases, the BIOS date provides another verification method."

BIOS Date: A Window into the Past

Look for the "BIOS Version/Date"

This date shows when the computer's BIOS was last updated. Now, some manufacturers or tech-savvy sellers might update the BIOS before selling, which could mask the system's actual age. So, like always, buyer beware.

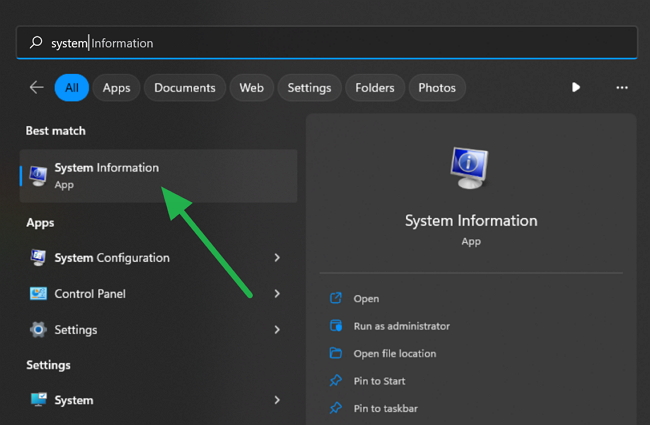

Another way I prefer to determine the approximate time your computer was assembled is to check the BIOS date here. You can check the system information in Windows. To access this, type "system information" in the Start menu's search bar, then run it; a window will pop up showing details about the computer, including the BIOS Date.

What you will get is

This will only work if the computer's BIOS has not been updated since the initial installation.

Here's how to check it:

- Open the Command Prompt (search for it in the Start menu).

- Type one of these commands and press Enter:

While you are there, look at the processor. Doing a net search, you can quickly find when the manufacturer first released that computer. It will not tell you how old the computer is, but it will tell you the oldest possible age.

Windows Installation: A Clue, Not a Guarantee

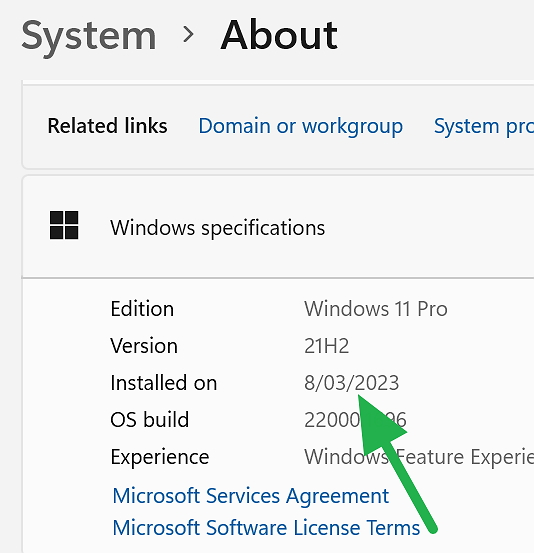

In Windows settings > About, it will tell you the Windows version and when Windows was installed. Again, it is no longer a guide, as a new version of Windows may have been installed on that computer.

Checking the Windows installation date can tell you its setup date, but it does not always indicate the hardware's age. Here's how to find this information:

- Go to Windows Settings (use the Windows key + I shortcut).

- Navigate to System > About.

- Scroll down to find the Windows version and installation date.

However, someone may have reinstalled Windows by upgrading it. Again, this date might reflect that not the computer's age. However, it can be a helpful piece of the puzzle when combined with other verification methods, as it can reasonably be assumed that the computer is older than this date. I can only emphasise that a computer cannot be older than its processor.

Check the Hard Drive

While the methods above help determine the age of the computer's core components, a savvy buyer should also inspect the components themselves. The hard drive is, I think, the most important as an old, heavily used drive is just real trouble.

How to Check Power-On Hours

You will need a free third-party tool to get this. CrystalDiskInfo is pretty good. It's the one I mainly use, but there are others. Download, install, and run this program. It will automatically scan your drives and display their health status and detailed information, including the "Power-On Hours" value.

Interpreting the Results

By comparing Power-On Hours with other clues, such as the CPU release date, you can uncover the computer's true history. Let us say the laptop is 2 years old; one would expect the hard drive to be used about (2 years) x (250 days) x (8 hours) = 4,000 hours.

-

Scenario 1: New Drive

The hard drive has only 50 Power-On Hours. This suggests the hard drive was recently replaced. I would not complain about that. -

Scenario 2:Problems

The seller claims the PC was "lightly used," but the Power-On Hours are really high (e.g., over 15,000). Something does not sound right. -

Scenario 3: A Consistent Story

The drive shows around 4,000 Power-On Hours. This story adds up.

By checking the Power-On Hours, you move beyond simply finding the computer's age and start to understand its history, condition, and actual value.

Component Inspection: Devil in the Details

For those with more technical know-how, inspecting individual components can reveal much about a system's age, but this raises another problem. I have seen people replacing components with older ones. If you open the computer, you may find stickers that can help you.

Summing up

It is not easy to find out. These methods, at best, can only help.

It's important to note that a computer's age is not always an accurate indicator of its performance or lifespan. An older computer that has been well-cared for often functions perfectly for many years. New computers that are lemons are not uncommon, either.

FAQ

Q: How can I tell if a computer is new?

A: Check multiple age indicators: serial number verification, BIOS date, CPU model release date, and Windows installation date. No method is foolproof, so various verification techniques provide the best assurance.

Q: What's the most reliable method to check a computer's age?

A: The serial number is the most reliable indicator when available. You need this number when contacting the manufacturer to obtain the manufacturing date.

Q: How do you find out how old a computer is?

A: Use multiple verification methods above.

Q: How do you find the date on the computer?

A: Access dates through System Information (systeminfo.exe) to find the Original installation date and BIOS Version/Date, or check Windows Settings > System > About for the installation date.

Q: What is the age of the computer System?

A: Generally, computer systems are typically categorised

- New (1-2 years)

- Middle-aged (3-5 years)

- Aging (5+ years)

Most businesses value a computer for five years, and after that, it has no book value.

Q: How old is my computer in human years?

A: This is an awful measure, but it is commonly stated that a computer ages at five human years for each actual year.

Q: Can the BIOS date be manipulated?

A: The BIOS can be updated, which changes its date. That's why using multiple verification methods is essential rather than relying solely on BIOS information.

Q: How do I check the Windows installation date?

A: Access Windows Settings > System > About. While this shows when Windows was installed, remember that Windows could have been reinstalled on older hardware.

Q: What should I do if I discover my "new" computer is used?

A: Document all evidence, contact the seller immediately for resolution, and if necessary, file complaints with consumer protection agencies.

Q: How often should I replace my computer?

A: Replacement for business and POS systems is typically recommended every 3-5 years. Systems older than this are often prone to performance issues and security vulnerabilities.

Q: Can I trust component inspection?

A: Component inspection can be helpful but requires technical knowledge. Be aware that components can be swapped, so this method should be used alongside other verification techniques.

Q: What if the serial number shows "Default String"?

A: This is common in modern computers, where the serial number isn't stored in the BIOS. In these cases, check the device's physical serial number or use alternative verification methods.

Q: How can I verify the age of individual components?

A: Use system information tools to identify component models, then cross-reference their release dates with manufacturer specifications. However, keep in mind that components may have been replaced over time.

Updated: I was asked some questions by a client a few days ago, so rather than answer them, I decided to rewrite this article and give my readers here an answer too.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.