Curent Toy Trends

September is a challenging month for the toy industry, covering four separate marketing seasons. Grasping these seasons is essential for toy retailers aiming to boost their profits. Contrary to what many say, toy sales rarely occur organically; it is artificial, coming from marketing campaigns. Recent late August data confirms this.

Four Critical Toy Sales Trends Happening Now

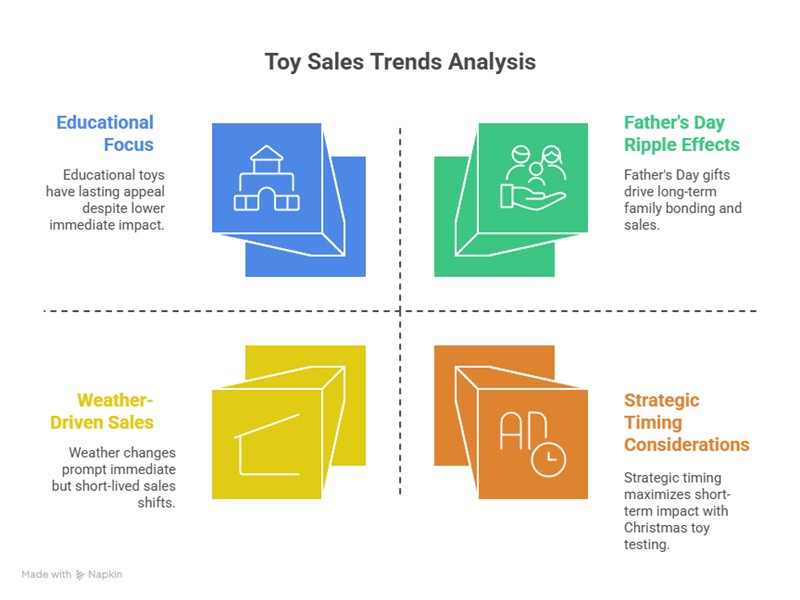

Father's Day Ripple Effects

Father's Day's impact extends far beyond the day itself, generating sales for quite a while. What happens is that Dad receives a game as a gift, the family bonds with it, and other families learn about it through word-of-mouth marketing, wanting these games too. Not only that, but as children enjoy playing games with Dad, they actively request similar toys for themselves. Savvy retailers should examine toy products that align with popular Father's Day gifts. Based on last year, board games, building sets, and interactive toys have consistently shown increased sales now.

Strategic Timing Considerations

Major toy suppliers are currently testing their Christmas product lines to gauge consumer response before placing massive holiday orders. What retailers are now seeing are experimental Christmas toys released in limited quantities to measure market reception. Suppliers want to identify which products to push for the holiday season. While this presents learning opportunities about upcoming trends, you should exercise caution in getting too much involved. If the suppliers do not push them over Christmas, they will not sell.

Weather

Australian families are moving from winter indoor activities to spring outdoor play, though weather patterns remain unpredictable, especially in Melbourne. This shift creates two immediate required actions. This is your final opportunity to clear winter stock at attractive prices, and we must now shift our focus toward outdoor toys.

Educational Focus

Parents are increasingly looking at the educational benefits when choosing children's toys. They want toys that do learning with entertainment. Most importantly, they are prepared to pay higher prices for toys they see as educational tools rather than just for fun.

Current Best-Selling Categories

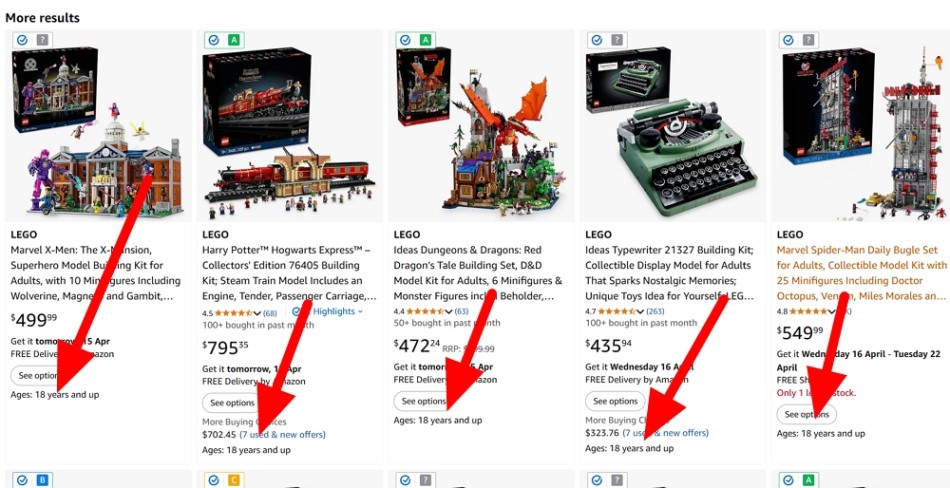

LEGO Dominates Market Performance

LEGO products are currently topping the toy sales charts, with Minecraft-themed sets performing strongly. This success comes from LEGO's unique position at the crossroads of education and entertainment. Parents see LEGO as tools for educational growth. Kids view them as fun and engaging. This dual appeal sustains steady sales across various price ranges and age groups.

Arts and Crafts

Drawing and art supply sets are now experiencing exceptional sales growth throughout September. These products function as bridge items between traditional stationery and trending creative toys. This positioning allows retailers to capture customers from both groups while getting reasonable prices.

Board Games and Strategy Games Trending Together

Multiple board game and card game categories are trending well, demonstrating the Father's Day ripple effect in action. Families who discovered games together continue seeking similar products for ongoing entertainment.

This trend supports broader inventory investments across the board game category rather than focusing on individual titles.

Premium vs. Value Positioning

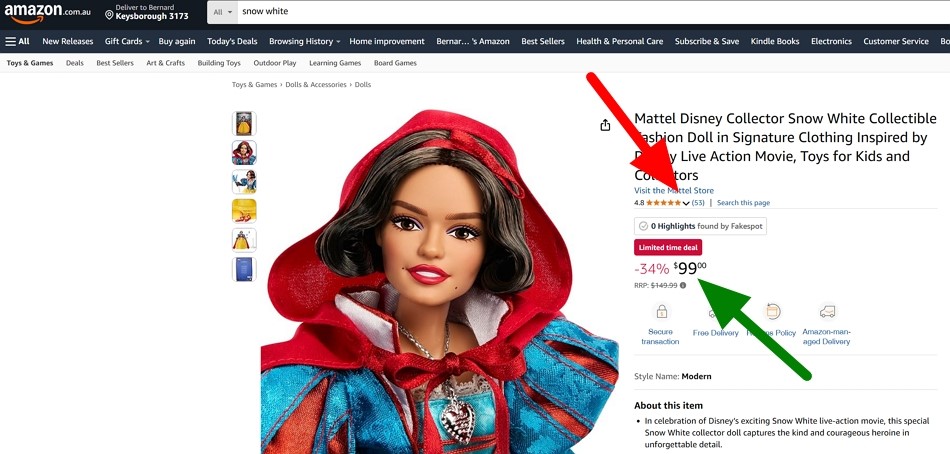

Action figures and collectables from various franchises are performing well due to coordinated industry-wide promotional campaigns. Collectables work particularly effectively as impulse purchases when positioned near point-of-sale areas.

Strategic Product Recommendations for September

High-Profit, Space-Efficient Options

Puzzle games and brain teasers will deliver excellent profit margins while requiring minimal storage space. These products appeal to multiple age groups and maintain consistent year-round demand. Card games, including strategy games and family options, provide compact storage solutions with high profit potential. Pocket-sized games give an added value as travel-friendly options for active families. These products can also serve as a backup source of entertainment if weather conditions change unexpectedly.

Premium Investment Considerations

Large construction sets, particularly LEGO products, can generate substantial profits if you can get reasonable prices. However, these items require significant floor space.

Premium toy investments depend heavily on specific market demographics and available retail space. Retailers in affluent areas with adequate space can successfully capitalise on premium demand.

Your Next Steps

September toys are difficult to navigate. You must plan strategically.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.