The new Cash Mandate 2026: Are You Truly Exempt?

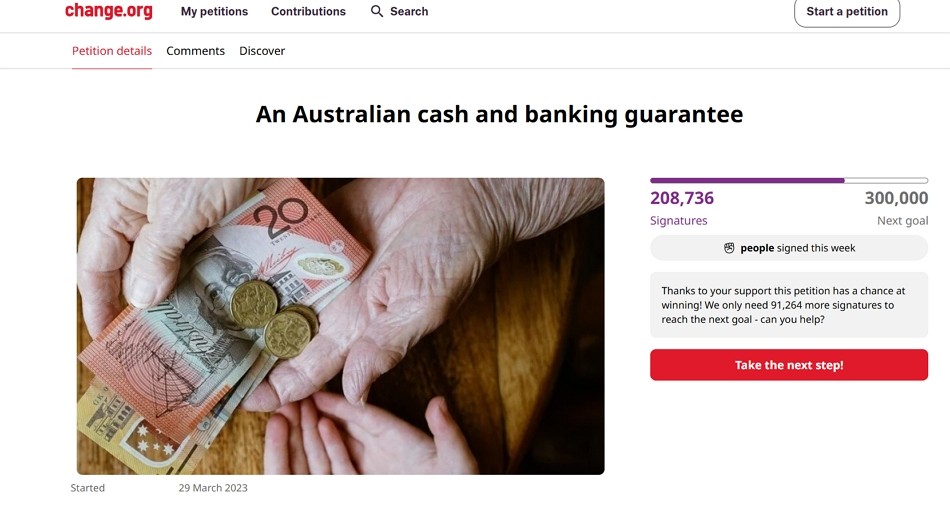

A new law mandating cash acceptance for essential businesses, the clock begins on 1 January 2026. The final legislation is much less of the initial government proposals. While most of our clients already accept cash and intend to continue doing so, a growing number are considering a cashless model and need clarity about their rights.

Crucially, retailers must understand that government rules are part of the picture. Many have contractual obligations to their suppliers as well.

The Government

The federal law mandates certain businesses to accept cash payments for goods and services. However, the scope is unexpectedly limited, far less than originally promised, and several exemptions still apply.

Business Category

It targets explicitly retailers of "essential" goods, primarily supermarkets and fuel stations. It does not automatically apply to businesses that sell items such as stationery, books, or pet food.

Small Business Exemption

The law includes a significant exemption for small businesses, generally defined as those with an annual turnover below $10 million.

"Part of a Group" Rule

If your business operates as part of a larger group or franchise (e.g., a branded service station), you are likely required to accept cash regardless of your individual turnover.

Primary Purpose

Your obligation is determined by your primary business category, not the specific item being sold. For instance, if fuel is your primary revenue source, you must accept cash for all items in the store, including non-essentials.

Transaction Limit

The requirement to accept cash only applies to transactions up to $500. For any sale over this amount, you can legally refuse the money.

While the government may exempt you based on turnover or category, your suppliers likely won't. This brings us to the most overlooked aspect of the new mandate: your commercial contracts.

The Commercial Reality

Even if the law gives you a pass, your most important business partners may require you to handle cash. Before considering a cashless policy for any product, you must check your existing agreements.

Australia Post

Licensed Post Offices (LPOs) operate under a different mandate that defines them as essential service providers. You will be required to accept cash for all postal transactions, such as stamps and bill payments.

Lottery Services

Your lottery retailer agreement requires you to accept cash for ticket sales and pay out smaller prizes in cash. You cannot provide this service without money in the till.

Transport Ticketing

If you are an agent for public transport ticketing, your contract likely designates you as a cash access point for the network, obligating you to accept cash.

Payment & Parcel Services

Third-party bill payment or parcel drop-off services want you to accept cash from customers. Refusing cash could be seen as a breach of your service agreement.

The "Split Counter" Nightmare

Implementing a hybrid policy that accepts cash for some items but not others will create significant operational and customer service issues.

Customer Friction

Refusing cash for a greeting card while accepting it for petrol at the same counter invites customer conflict and erodes goodwill.

Operational Complexity

A mixed policy is difficult for staff to enforce during busy periods, increasing the risk of errors. It also complicates compliance with card surcharging rules, frustrating customers who have cash ready.

Your Action Plan

For those considering a move to a cashless system, a review of your legal and commercial obligations is essential.

If you intend to operate a hybrid "cards only" policy for specific items, be prepared for logistical headaches. A better solution is a dedicated "cash only" station, a typical and effective practice in modern retail.

Frequently Asked Questions (FAQ)

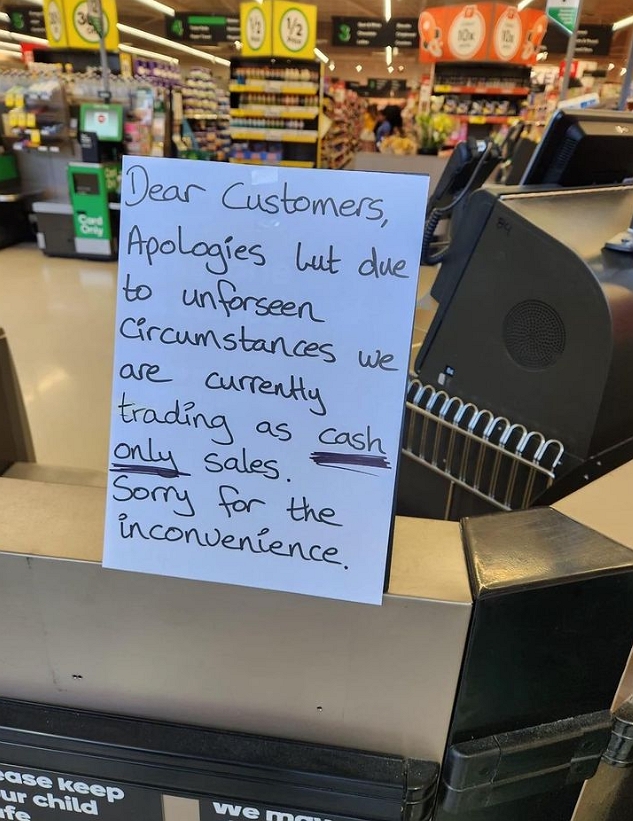

Q: If my business goes cashless after 1 January 2026, do I need a sign?

A: Yes. Under the Australian Consumer Law (ACCC), you must clearly disclose your payment terms before a transaction to avoid misleading customers. Put a prominent sign at the entrance or point of sale, such as "Card Payments Only."

Q: My insurer requires me to minimise cash holdings. Does the law override this?

A: The law does not void private contracts. You must negotiate with your insurer to find a solution that balances your legal mandate to accept cash with your contractual insurance obligations.

Q: Can I surcharge for cash payments?

A: Surcharging for cash is legally risky; adding a fee to a cash payment could be viewed as misleading pricing under Australian Consumer Law, which assumes prices are listed in cash.

Q: My local bank branch closed. How can I comply if I can't deposit cash?

A: The collapse of our cash infrastructure is a growing problem. The law requires you to accept cash but does not compel banks to remain open. You may need to find an alternative bank or consider paying for business expenses in cash at other local retailers.

Note, I am not a lawyer and do not pretend to be, and I suggest you seek professional advice before proceeding with any proposed action on this...

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.