About your superannuation

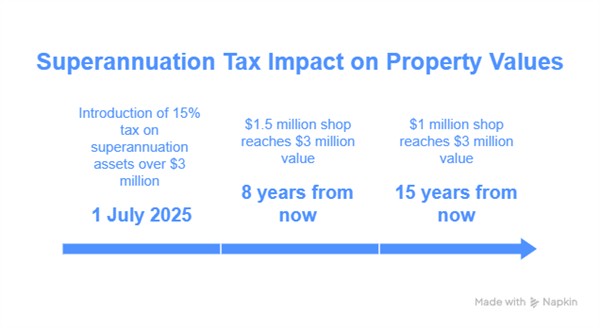

The Australian government will introduce a 15% additional tax on superannuation assets exceeding $3 million from 1 July 2025. With Labor's parliamentary majority and crossbench support, this legislation will likely pass. Most of us will not be affected now but the plan clearly is to expand it over time as the plan lacks inflation indexation.

If you hold your shop in your superannuation funds in a typical neighbourhood strip shop has values typically ranging from $500,000 to $1.5 million, a $1 million shop today would be about $3 million within 15 years, a $1.5 million shop would get to $3 million in 8 years based on current market projections. Most of us plan to be around for more then that.

I would suggest that many of you consult our financial advisor particularly as the tax is on the assets as once the fund goes over $3 million gets over $3 million you will face a particular challenge, as this tax is on assets. So whether you have the cash or not you need to pay the tax. Now unlike say shares, where you can always sell a few shares to pay the tax, a property cannot be easily divided, yet you will need the cash to pay it.

The other issue is that the more complex accounting burdens on the superannuation will certainly create more accounting costs.

Written by:

Bernard Zimmermann is the founding director at POS Solutions, a leading point-of-sale system company with 45 years of industry experience. He consults to various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.