Why Choose Local POS Software in Australia?

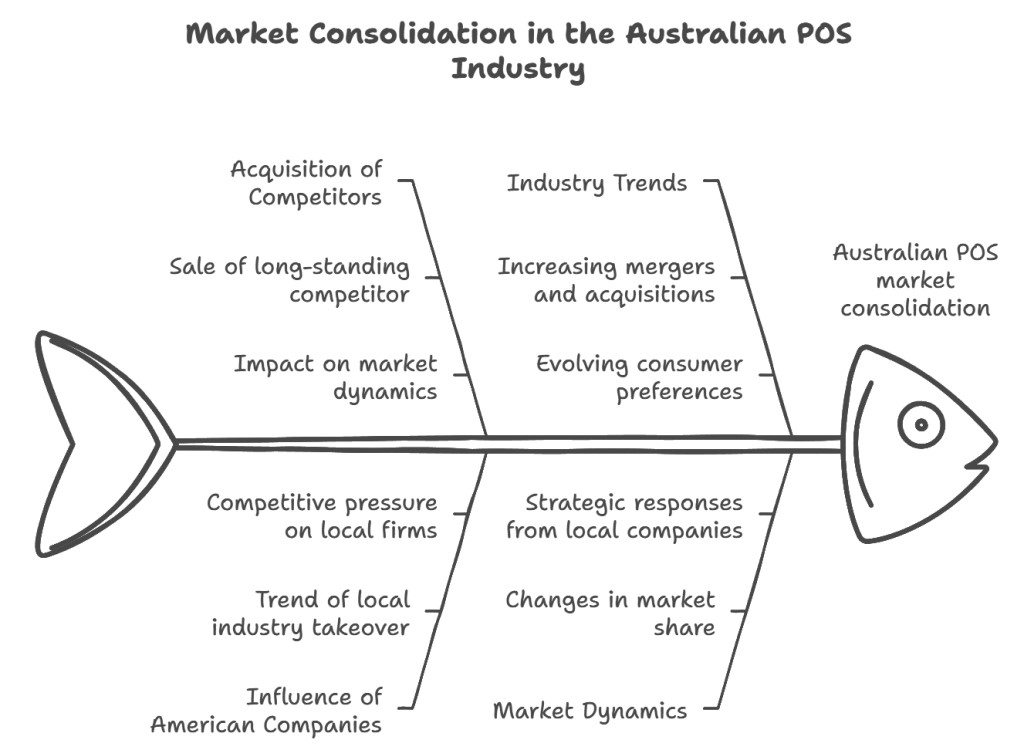

A Canadian firm's recent acquisition of a significant Australian POS software provider in our marketspace raises essential questions about the future of local retail software solutions. For Australian retailers, this development underscores the importance of choosing POS software that truly understands our unique market.

A Canadian firm's recent acquisition of a significant Australian POS software provider in our marketspace raises essential questions about the future of local retail software solutions. For Australian retailers, this development underscores the importance of choosing POS software that truly understands our unique market.

There are many advantages to buying from a local Australian Company.

Running a successful retail business in Australia comes with unique challenges. While other countries may face similar issues, their solutions often don't translate well to our market. From GST management to contactless payments, Australian retailers need systems built for local conditions.

Why Australian-Made POS Solutions Matter

Unique Challenges, Unique Solutions

The Australian retail environment presents several distinctive challenges:

- Our GST system requires specific reporting and calculation methods

- Australia leads in contactless payment adoption globally

- Many retailers offer unique services like bill payments or lottery sales

- Some retail markets, such as newsagents, don't exist overseas

- We use different terminology and financial layouts compared to international standards

These factors mean that off-the-shelf international solutions often fall short. Local POS software, however, is built with these Aussie quirks in mind.

Deep Understanding of Local Business Needs

Local POS providers live and breathe the Australian retail environment. They understand our market nuances, terminology, and regulatory requirements. This intimate market knowledge ensures their software directly addresses Australian retailers' daily challenges. From managing complex GST calculations to integrating with local payment systems, Australian-made POS software streamlines your operations in ways that global solutions can't match.

Agility and Responsiveness

Local POS software companies take a more nimble approach to development and customer service. Focused on the Australian market, they implement changes and updates more quickly in response to local market shifts. It means you're not just getting a product but investing in a solution that evolves with your business and the Australian retail landscape.

Benefits of Local Support

Tailored Solutions for Specific Retail Niches

Some local providers specialise in specific retail niches, offering highly tailored solutions. For instance, a POS system designed for Australian newsagents inherently understands the complexities of magazine returns, lottery sales, and newspaper subscriptions. This level of specialisation is rarely found in international solutions and can significantly boost your operational efficiency.

Responsive Updates and Enhancements

Local companies are often more responsive to customer feedback and local market changes. They provide updates and enhancements that address the actual needs of Australian retailers, ensuring the software grows with your business.

Integration with Local Systems

Beyond understanding local business needs, Australian POS systems offer seamless integration capabilities with our local software and services.

Key Integration Features

- Seamless connection with Australian accounting software

- Direct integration with local payment gateways

- Compatibility with Australian loyalty programs and gift card systems

These integrations streamline your stock management, sales tracking, and financial reporting, giving you a comprehensive view of your business.

Market-Specific Advantages

Australian-made POS software offers unique benefits tailored to our market:

- Built-in compliance with Australian tax regulations

- Support for local payment methods and banking systems

- Understanding of Australian retail terminology and practices

Supporting the Local Economy

While technical capabilities are crucial, choosing local POS software has broader implications. By selecting Australian-made POS software, you're getting a better solution for your business and supporting the local economy. Your investment fosters Australian innovation and drives local tech growth, creating a positive ripple effect throughout our communities.

Conclusion: The Smart Choice for Aussie Retailers

Australian-made POS software offers a unique combination of local knowledge, tailored solutions, and responsive support that international alternatives struggle to match. By choosing a Local solution, you're not just getting a product - you're gaining a partner who understands the intricacies of Australian retail technology and can help maximise your retail success.

✓ Compare top local providers

✓ See feature-by-feature analysis

✓ Read honest retailer reviews

We’ve all heard it before: shop locally whenever you can. When you buy locally, your dollars are doing a lot more for our community.