Accountancy Software for Retail Businesses

Running an efficient retail business requires keeping careful track of your finances. With the right accountancy software, you can organise expenses, track inventory, simplify payroll, gain insights into your profit margins, and prepare for tax time. Here, we explore the most popular accounting platforms Australian retailers use today and key factors to consider when choosing a solution.

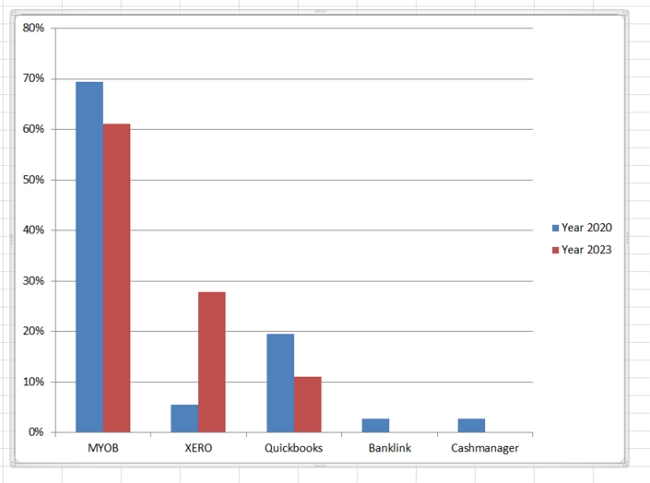

Our Annual POS Software Survey Reveals Downward Trend

At our company, we survey clients annually to gauge satisfaction with our point-of-sale (POS) system and understand their broader technology needs. Over the years, the survey has evolved into a broader barometer of retail technology adoption.

A few years ago, we introduced a new question asking retailers about their accountancy software usage. The results revealed a worrying trend - many retailers do not use an accounting package, and the number that do is decreasing. This trend has continued over the past few years.

Now if you have not yet filled out our annual Support and Customer Perception Survey and are our client, please do so - we appreciate your feedback.

Why Accounting Software Matters for Retailers

Tracking financials using spreadsheets or paper receipts alone is cumbersome. When records exist across disconnected systems, it is easy to lose track of transactions, miss recording expenses or payments, and encounter hassles at tax time.

Accounting software centralises all your financial data into one accessible system. Features like mobile invoicing, automated bank imports, and reporting dashboards save retailers significant time. Most importantly, these platforms provide real-time visibility into the fiscal health of your business.

From cash flow analysis to profitability insights to streamlined tax preparation, accountancy software delivers immense value for retailers of all sizes. Continue reading to learn about the most widely used programs in Australia.

MYOB Still Most Popular Despite Dropping in Adoption

MYOB has long been the dominant player in Australian small business accounting. However, its popularity has waned amongst retailers in recent years.

I suspect MYOB's decline is tied to transitioning from standalone desktop software to a cloud-based subscription model. For some retailers, shifting to paying a monthly platform fee per user is a turnoff.

Many retailers appreciate its highly structured, ledger-like interface.

MYOB remains the top choice.

Xero Soaring in Popularity

Cloud accounting specialist Xero has rapidly risen in Australia's online accounting landscape. More retailers are using it as shown by our survey.

As a fully cloud-native solution, Xero simplifies real-time collaboration across locations and external accountants.

Xero does come with a higher monthly cost, depending on your needs.

QuickBooks/Reckon - Popular But More Complex

QuickBooks and Reckon One have long competed neck-and-neck for the second spot behind MYOB in Australian retail accounting but no longer, but its popularity in our survey is down. I think this is due to its complexity, meaning it demands a steeper learning curve than the others. It does, however, I feel give much more in terms of advanced reporting and everything in between. In the hands of an experienced operator, few can match its capabilities.

Cashflow Manager Surprisingly Overlooked

Cashflow Manager has simplified accounting and cashflow management for Australian small businesses for many years. I have regularly recommended it to retailers because of its approachability and neatly designed interface.

Yet surprisingly, Cashflow Manager did not tally a single mention amongst retailers in our survey.

I am not sure why.

Key Factors When Choosing Accounting Software

With so many options on the market, selecting the right accounting platform can feel overwhelming for retailers. Keep these factors in mind while evaluating solutions:

Cost

Pricing varies widely based on the size of your business, number of users, complexity of needs, and add-ons required. Be sure to understand the total recurring costs plus any upfront license fees.

Ease of Use

Look for simple dashboard designs that allow managers an accessible financial snapshot and detailed tracking for accountants. Prioritise solutions so you can learn them quickly.

Integration

Our POS Software can integrate into many accounting systems, and so can your bank. Using these integrations will save you a lot of time.

Mobility

The big question here is do you need cloud? Cloud means it can be used anywhere in the world. As a rule, the cloud is dearer.

I hope this all is of help.