Should You Add Surcharges to Customer Card Transactions? A Retailer’s Perspective

As you run a retail business, you’ve likely grappled with whether or not to add surcharges to customer credit card and EFTPOS transactions. With card processing fees eating into your margins, applying a surcharge seems easy to defray costs. But at what expense to your customer relationships and loyalty?

Here, we’ll examine the pros and cons of adding transaction surcharges, alternatives like cash discounts, and key compliance considerations in Australia if you move forward with surcharging.

What is a Card Transaction Surcharge?

A surcharge is an additional fee added to the total customer payment amount to cover a retailer's card acceptance costs. When a customer pays with a card, the transaction incurs interchange fees charged by banks and card companies, plus merchant service fees charged by payment processors - together referred to as the cost of accepting credit cards.

Surcharging allows retailers to pass some or all of these credit card processing fees directly onto the customer instead of absorbing the costs themselves. A typical charge on a $100 credit card transaction today might be $1.50. That $1.50 will add up over time.

The Case Against Transaction Surcharges

I always suggest that before charging a surcharge, you carefully consider the potential drawbacks, plus consider creating an option for cash.

Customer Frustration

Do not believe customers do not care; research shows most customers dislike transaction surcharges. Many places do not charge it, so why do you? As such, the fees feel arbitrarily unfair and wreck the customer experience at checkout. Customers do know.

Revenue Loss Risk

Will the extra surcharge revenue compensate for potential revenue losses if some customers take their business elsewhere? Some clients have told me that surcharging brings in less than the business they lose. Crunching the numbers is essential.

Consider Cost Comparison

What about cash handling costs - transporting it safely, potential lost revenue due to theft/loss, managing change funds, bank deposit runs and fees? For many businesses, these costs add up to more than card processing costs. Make an apples-to-apples comparison before deciding cash is “cheaper” than cards.

Security and Theft

Handling more cash brings added security risks for both staff and stores. Safes, security systems, insurance and more may be needed to manage the risk properly. Theft, fraud, or losses due to mishandling cash can quickly erase surcharge profits.

Alternatives to Consider First

Before jumping to apply surcharges to card transactions, explore alternatives like:

Cash/Debit Discounts

It does not have to be much. A shop near me has a big sign at the point of sale, a free can of drink for any sale over $25 paid in cash. It seems to work well.

Minimum Purchase Rules

Small transactions incur proportionally higher card processing fees. Applying a $10 minimum purchase for card payments reduces associated costs rather than alienating customers with small basket values.

Key Considerations if You Do Surcharge

If surcharging card transactions still make sense for your business after weighing it up, proceed.

Clear Disclosure is Critical

Prominently display surcharge rates at the point of sale so customers are informed before checkout. Clerks must also proactively disclose if transactions will incur a fee besides, lack of transparency only breeds customer frustration and accusations of “hidden fees.”

How to Add Surcharges on Card Transactions

If you decide the benefits outweigh the risks, adding credit card and EFTPOS surcharges takes just a few simple steps:

Through Your Payment Provider

Most payment processors offer dynamic surcharging. They calculate your average merchant service fees. You can then set it up to add surcharges to applicable card transactions while they provide the reporting.

Pros:

- Easy to set up

- Built-in compliance checks

- Reporting includes surcharge totals.

Cons:

- Limited control

- Some fees are excluded, so a common complaint is that the surcharge does not cover the costs.

- Manual invoicing for GST calculations on surcharges may be required

- Payment provider figures of what they calculate and what you are available to the ACCC. The problem is that many terminals do not give the information on surcharging to your POS System, so your Payment provider and your figures are different. This can make it very hard to justify.

- Because of surcharge undercharging, the store cannot accept many payment types.

Through POS System Settings

Our POS systems can be used to calculate and charge your custom card payment surcharges.

Pros:

- More control

- It is easy to set up.

- Actual figures of costs are charged.

- It is very transparent. The surcharge figures can be displayed on a prominent sign at the point of sale.

- You do get the surcharge total in your POS reconciliation reports

- Figures what the POS System has and what the customer receives are always balanced.

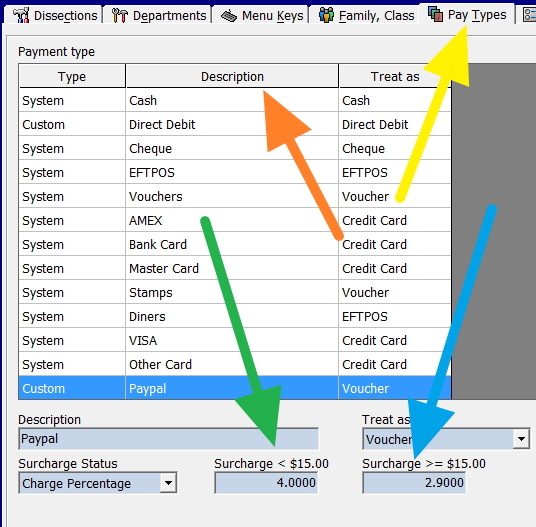

- You can accept many more cards and payment methods, e.g. PayPal.

- All reporting and calculations are handled in one system.

Cons:

- You need to calculate your costs. This is not hard, but worrying as you must ask yourself for every item if it is justified. Your payment provider can help you with this.

- You need to ask how it will be paid during every transaction. A problem can occur if the customer changes their mind. Some customers like to say debit, which has a lower fee, and then book it as a credit card.

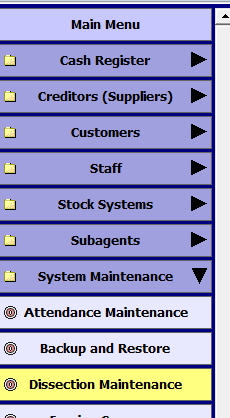

To do it manually.

Go into the main menu.

Select Dissection Maintenance.

Now, in Dissection maintenance, where the yellow arrow is click the tab "Pay Types"

You can accept a much wider range of cards as your POS System will adjust for some expensive payment types like AMEX and PayPal.

In Summary:

- Approach surcharging carefully - assess risks

- Prioritize alternatives like cash discounts

- If moving ahead, follow strict rules and disclosure requirements

- Keep rates reasonable and aligned with actual costs

I hope this provides a balanced overview of the pros and cons when considering card-surcharging decisions for your small retail business. What’s worked in your business experience - surcharging, cash discounts or absorbing costs? I welcome feedback and discussion in the comments!