Hidden Inflation your shop in the Retail Battleground

These days, operating a physical store can be challenging. It would be best to consider how to respond to consumer complaints regarding manufacturers' deceptive practices of shrinking products (think lighter cereal boxes or smaller chip bags) while maintaining the same price. It's like getting less bang for your buck, frustrating you and your customers.

The Cherry Ripe Caper: A Real-World Example

Is there currently a fuss over Cadbury's Cherry Ripe? This beloved chocolate bar is shrinking in free fall. About a year ago, the smaller versions were 52g. Then, about nine months ago, they shrunk to 48g. They are only 44g, a 15% fall, with the price staying put. People are not happy. Several report feeling ripped off on social media and calling the practice "dishonest." I tend to agree with them, but it seems to me to be deceptive.

I think rather than admit to a price rise, they are sneaky, reducing the product costs by reducing the size and hoping no one will notice.

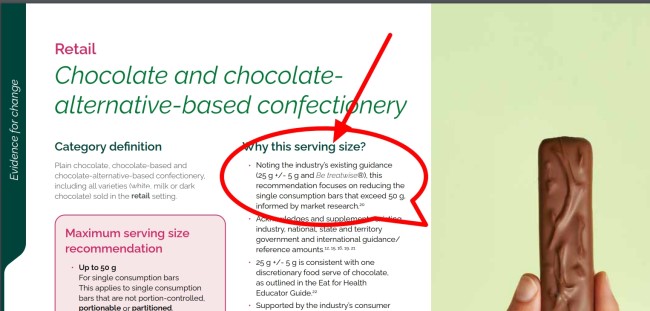

When questioned, Cadbury explained that it was to comply with government health targets and to make healthier sweets. As a parent of a teenage girl, I am all for healthier sweets, but I do not find this argument convincing. If the bar is smaller, it should be cheaper. To make healthier sweets smaller, they should tell people what they are doing and let the consumer make their own choices about portion sizes. Besides, the government health targets apply to bars under 50 gm, which it was below.

In many countries, laws have been passed requiring manufacturers to reduce the size of their products and put a note on the packaging to say what they have done. Some manufacturers have complained that this change to the packaging adds to the inflation problem. They do not seem to have a problem when they make something better to add to the label.

But we can do little about the reality of what is happening. We all understand manufacturers are dealing with rising costs, but your customers expect transparency and value, and you can get caught in the crossfire of customer frustration. Here are some ideas to consider:

Regaining Trust Through Transparency

The good news is there are ways to navigate this tricky situation. Transparency is key. Here's how you can build trust with your customers:

- Highlight Unit Pricing: Showcase the price per kilogram or litre. This empowers customers to compare brands and sizes, helping them find the best value.

- Offer Alternatives: When a product shrinks without a price drop, consider offering alternative products with better value.

- Educate and Engage: Sometimes, it is best to admit that you cannot do anything about it and must live with it. I would not suggest that you try to defend the practice.

Collaboration is Key

Ultimately, we are all dealing with this stubborn inflation that is not going away. Few could pass on rising costs during COVID-19, and now we are all catching up. Acknowledge their frustrations and explain the challenges you face. This fosters a sense of transparency and builds trust. Solidifying your position as a trusted source of value and informed shopping would be best.

PS If you are a member of an industry group, contact them and ask them to look into this problem because the public is getting more annoyed with it.