Managing a retail business in Australia now requires financial agility. While many shops start with a single bank account, growth often demands juggling funds across multiple institutions to secure the best loans and merchant rates. However, without a central information centre, this strategy can cause issues. Over the years in retail, I've seen the challenges owners face when reconciling transfers across different banks. It's called Banking Chaos, but it's easier to use our POS System.

Why Multiple Accounts Are Happening

Retailers rarely choose this complexity; business necessity drives it.

1. Smart Financing Requires Flexibility

We all need a business loan at some point in our ventures. Different institutions offer various interest rates and terms. Often, the best financing deal may not come from our current bank. If we choose a better offer, we need to open a secondary account solely for loan disbursements.

2. EFTPOS Savings

We all want to save on merchant fees. Sometimes, a third-party EFTPOS provider offers a much better rate or service than your main bank. To get that 0.5% saving or faster transaction processing, you often need to settle funds into a specific account provided by the EFTPOS provider.

3. "Bucketing" for Tax and Bills

Experienced retailers often place GST, PAYG withholding, and superannuation into a separate holding account to avoid accidentally spending this money.

This leaves many retailers splitting their finances. But this doesn't have to be a major headache. You can keep it under control by using your point-of-sale system as your financial hub, managing as many bank accounts as you need.

Separating Your Funds

Beyond external bank accounts, you also need to manage our fund allocation. Think of your revenue like a stream of water. If funds are mixed, it becomes difficult to determine the intended purpose. It looks like you have a lot of money, but a lot of that money might already be spoken for. This is a common problem with GST and lotteries.

Maintaining separate accounts simplifies your tracking for accurate cash flow analysis even if physically they sit in the same account.

Centralise Control: Your POS as a Financial Dashboard

This is where a modern POS system shines. It acts as your central dashboard. It doesn't matter how complex your banking is in the real world; your software should make it as simple as possible.

Our system allows you to define all these different accounts, loans, savings, trading, and tax holding rights in the setup.

Receipting to the Right Landing Spot

When a customer pays at your counter, our system allows you to receive the payment to the specific bank account the funds will be deposited into.

If they pay using a specific card terminal that settles into Bank A, the POS System records the payment for Bank A. If they pay cash and you deposit it into Bank B, the system records it as a Bank B deposit. This means your records match reality in real time.

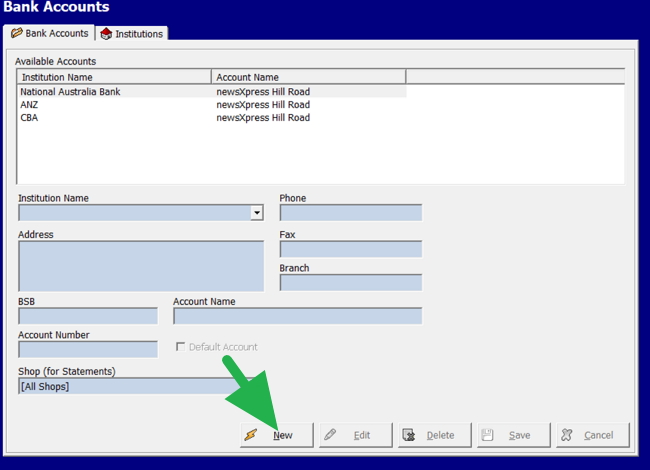

How to Set Up Accounts in Your POS

We have designed this to be as painless as possible. Adding a new bank account or a new "bucket" to your POS system is quick.

- Navigate: Go to the main menu and select "Bank Accounts."

- Add New: Click the green "+ Add" button.

- Details: Enter the details. This serves as your label. You might name one "NAB Trading" and another "Lottery Holding." You can add BSB and account numbers for your own reference.

- Repeat: Do this for every distinct place money lands or needs to be tracked.

That is all there is to it!

The Result: Total Financial Flexibility

The POS stores these details securely. You can access any linked account at any time.

With the ability to add unlimited accounts and switch between them at will, your POS software makes managing your business banking easier.

Written by:

Bernard Zimmermann is the founding director of POS Solutions, a leading point-of-sale system company with 45 years of industry experience, now retired and seeking new opportunities. He consults with various organisations, from small businesses to large retailers and government institutions. Bernard is passionate about helping companies optimise their operations through innovative POS technology and enabling seamless customer experiences through effective software solutions.