Experiencing an EFTPOS/credit card processing outage means your business cannot accept card payments resulting from a system malfunction. Such occurrences can be aggravating and financially disastrous.

Based on my experience, such an outage can cause a typical retailer to lose about 50% of their business. Many people today do not have cash on them. They cannot buy if they cannot use the electronic funds available.

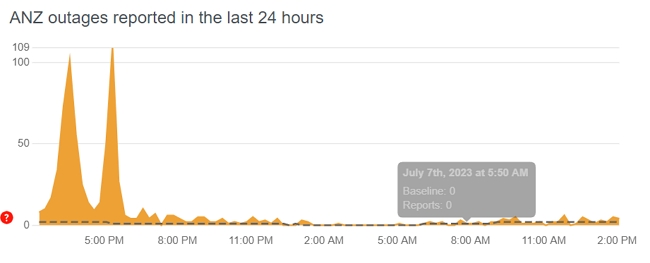

You should be prepared for that, as although such outages are rare, they are actually more common than many realise. Here are the ANZ outages recorded yesterday. Many of these will be EFTPOS and Credit Card problems. If I made a bet with you that next week, someone would report a problem with EFTPOS, and I would probably win.

They can occur due for many reasons; in our experience, the most common reasons are:

>Power outages

>Telephone and Internet service disruptions, do not believe the Telecom quoted figures; they go down much more than they say.

>Hardware or software failures, ultimately, the EFTPOS works through mechanical devices, and it is only a matter of time before they fail.

>Human error, a dropped EFTPOS unit broke a few days ago.

Whatever the reason, having such an Outage can affect your sales, customer service, and reputation.

The leading three EFTPOS providers we work with are, so these are the most important to our clients so that I will quote these as examples.

> Tyro

> WestPac through MX51, although now the MX51 interface is so popular it is moving into other banks.

> UrPay

How to Prepare for Such Outages

Here are some points you can prepare:

Make sure you have alternative methods of accepting payments, such as cash or checks.

Local mode

This means the unit can work when the internet or mobile data goes down. We had a client in an area where the internet and telephones went down, but the EFTPOS kept working as it could use mobile internet for electronic payments.

So check with your EFTPOS provider if they have given you local mode. Note that not all local modes are the same WestPac; for example, has automatic switching so often in an outage you will not even know it's happening. Tyro has a local mode, but it's manual, and you will almost certainly need their support to activate it. The other advantage I like is that WestPac is everywhere with local support. Not having to send units to the head office in Sydney for replacement by post is a big plus if you are not in the CBD in Sydney.

UPS

If power is a problem, consider investing in a UPS (Uninterrupted Power Supply) to keep your system running during power outages. These as well protect your electronic devices from power issues. Today, UPS units are more affordable than ever, providing excellent value for money. Please consider this to keep your system running smoothly during power outages.

MOJO Payments

In addition to cash and checks, consider having an option like MOJO payments. Although this comes with additional costs, it can be helpful in emergencies.

Spare EFTPOS units.

Often the problem is on one terminal. The others may function correctly. It may be worthwhile to have more than one terminal. Urpay, for example, offers EFTPOS terminals with no fees on many of its plans. having an extra terminal can be a plus, in everyday operations.

Here are some steps you can take to handle credit card processing outages:

When an outage occurs, you must act quickly and calmly to minimise the impact on your business. Try to establish where the actual problem is:

> If it is the computers, contact us.

> If your computers are working, they are probably the internet/mobile or the EFTPOS provider.

>Communicate with your EFTPOS processor.

They can tell you if the problem is them and whether it is local or widespread, and how long it might take to fix it if it is them. They can also advise you on offline terminal options.

>If it is the internet/mobile well, contact these people and ask for an ETA

>Communicate with your customers. Let your customers know about the outage. Explain the situation and offer them other ways to pay, such as cash or check.

> Keep detailed records of the incident, including when it occurred, its duration, and whom you spoke with. Insist on being quoted the incident number for your reference. Large companies are notorious for losing track of your problem.

Conclusion

Handling credit card processing outages requires proactive planning and quick response.