Every year, retail businesses lose billions to cash mismanagement and theft. For small business owners, implementing proper cash handling procedures is essential. One of the biggest now is handling cash properly. With multiple employees on registers, busy trading floors, and the pressure to serve customers quickly, it isn't easy to keep tight control over cash. Allowing sloppy cash procedures to creep in can quickly lead to errors, unexplained shortages, or even theft.

This is a general problem in retail and has led to a significant problem.

Implementing standardised cash handling protocols using your point of sale (POS) system can provide the oversight and security needed to prevent these issues. The "X-off" report reconciles each cashier's sales and cash on hand and is essential for balancing registers and tracking transactions. Retailers can transform cash management into an efficient, secure process using X-offs and other simple controls.

The Problems of Mishandling Cash

The pressure of busy retail environments often leads to rushed cash-handling procedures. When staff prioritize speed over accuracy, mistakes happen. These daily discrepancies, whether from errors or theft, steadily erode your profits. Yet, with proper cash management procedures, it is easier for small retailers to prevent mistakes and losses.

These concerns aren't just theoretical. Recent research highlights the magnitude of the problem,, according to Griffith University report

Co-author and Griffith Criminology Institute Professor Michael Townsley said

“We estimate crime costs Australian and New Zealand retail economies about $4.3 billion per year, and that’s a 28 per cent increase over four years from when the last similar study was conducted,” Professor Townsley said.

“Customer theft was the largest category of retail crime making up 53 per cent of losses followed by employee theft which made up 24 per cent of losses.

“While employee theft is less frequent than external theft incidents, each employee theft incident is typically of a much higher value.

This shifting attitude toward workplace theft reflects a broader cultural change, making systematic cash controls more crucial than ever. Today, a person caught stealing from his employee's view is that if the employer is so stupid as to let him steal, it's the employer's fault. It was not like that in the past.

This is why you need such standardised cash drawer reports like X-off; otherwise:

> The register can quickly become unbalanced.

> Without accountability, dishonest staff may be tempted to pocket the difference.

These issues are worse as too many shops have a lack of control over cash.

Benefits of Systematic Cash Handling Procedures

The best measure is implementing retail cash management tailored to your shop. When integrated with a modern point-of-sale system, simple procedural controls enable store owners to secure their cash flow against errors and deception.

Improved Retail Loss Prevention

Standardised cash handling procedures ensure all transactions are verifiable and recorded in the POS system. Daily X-off reports act as a balancing mechanism to reconcile cash register drawers with sales activity. This makes unexplained shortages or theft much easier to identify and resolve. Adherence to protocol also reduces miscues like walkaways or improper voids.

Better Visibility into Sales Data

With reliable X-offs, Z-outs and reporting, owners can trust the accuracy of their sales and inventory data. Detailed sales reports down to the register and cashier level provide better control.

Increased Accountability and Security

I suggest you consider adding extra tills and assigning one till per employee. Our POS system can handle many cash draws, so this is easy to do once you have it set up. Setting individual cash drawers for each employee improves accountability. Proper oversight leaves less room for error or impropriety.

More Efficient Operations and Inventory Management

Accurate sales data enables more intelligent inventory planning, waste reduction, and stock takes. Staff shifts and registers can be scheduled efficiently based on traffic patterns. Owners gain peace of mind knowing that cash flow is secured against leakage.

Cash register reconciliation protocol (X-off report)

Now that we have covered the critical importance of cash management let's examine how X-offs help retail businesses balance registers and lock down their cash-handling procedures.

What is an X-off?

An X-off is an end-of-shift report that provides a snapshot of the cashier's sales activity and cash at any time. At the minimum run at the end of each shift, X-offs reconcile the physical cash and receipts in the drawer with what is recorded in the POS system. This balancing mechanism ensures proper cash controls in a busy retail environment.

Balancing registers

For each cashier, the X-off prints a detailed report of their:

- Register log in time

- Sales totals are divided by payment type (cash, check, card, etc.)

- Voids and returns

- Expected cash that should be in the drawer to cover sales

- Actual counted cash and any over/short

By comparing the system sales data to the physical cash counted, the X-off identifies any variances that could indicate errors or theft for that cashier's shift. Used daily, X-offs make unexplained shortages quickly apparent rather than accumulating hidden losses over time.

Running X-offs on a Modern POS

1. Assign Register Access

Sets up employee passwords to log into assigned registers in the POS, creating accountability for each cashier's transactions.

2. Set Up Cash Drawer Floats

Every cashier logs in with a starting float at the start of each shift.

3. Print X-off at the End of the Shift

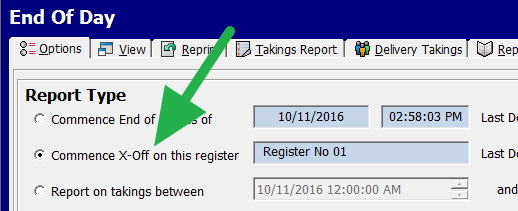

Go to the End of the Day in the cash register to run an X-off.

Select on the end-of-day page.

Choose the X-off option below the EOD option marked in green.

Notice that the report's period will default to when the staff member assigned to the register started and the current time.

Now run.

4. Improved accountability

The cashier manually counts the cash in their drawer and then compares the X-off totals to the receipt count. Any discrepancies require an explanation.

Surprise Cash Drawer Counts

In addition to X-offs, managers commonly do periodic surprise X-offs of register drawers.

How to implement X-off Procedures for Maximum Security

An X-off report is critical for maintaining cash control in retail environments. It provides a detailed snapshot of cash-handling activities during a shift, enabling precise reconciliation and accountability.

Understanding X-off Reports

An X-off report captures:

- Register login time

- Sales totals by payment type

- Void and return documentation

- Expected cash drawer balance

- Actual counted cash and any discrepancies

System Requirements

To implement effective X-off procedures, ensure your POS system supports:

- Multi-user authentication

- Individual cash drawer tracking

- Real-time transaction monitoring

- Automated report generation

- Secure data storage and backup

Step-by-Step Implementation

-

User Authentication Setup

- Configure unique login credentials for each staff member

- Assign appropriate access levels to ensure security

-

Cash Drawer Configuration

- Establish standardised float amounts for shift starts

- Set up automated alerts for cash levels exceeding thresholds

-

X-off Report Scheduling

- Configure automated X-off generation at shift changes

- Implement random security checks throughout the day

-

End-of-Shift Procedure

- Navigate to the End of Day menu in the POS system

- Select the X-off option below the EOD option

- Verify the correct period is selected

- Generate and print the report

-

Reconciliation Process

- The cashier manually counts drawer contents

- Compare physical count to X-off report totals

- Document and explain any discrepancies immediately

Security Protocols

Enhance your X-off procedures with additional security measures:

- Implement surprise cash drawer audits

- Integrate CCTV monitoring with POS transactions

- Establish clear escalation procedures for discrepancies

- Regularly update and review cash handling policies

Troubleshooting Guide

Common issues and solutions:

- System Connectivity: Maintain offline procedures as backup

- Discrepancy Resolution: Document all variances immediately

- Staff Training: Conduct regular refresher sessions

- Technical Support: Establish clear escalation protocols

By implementing these comprehensive X-off procedures, retailers can significantly enhance their cash management security, reduce losses, and improve operational efficiency.

Cash management

> Do not be complacent about cash control

> Implementing a few simple procedures can have a substantial financial impact.

> Ready to protect your profits? Schedule a free consultation to discover how our POS system can strengthen cash controls and prevent losses. Call us or click here to get started.