One of my clients sold for a $550 some headphone. The purchaser put down $50 and took out a layby. About a week later, he came back into the shop and put down a further $100. He then cames a few days later and wanted to cancel the layby and get his money back. What happened? Apparently, Bose QC35 type ii which the purchaser considers to be a better headphone was discounted and came on the market for $360 and less a discount, that the other retailer offered it will cost the purchaser $330. This situation is all too common. The retailer can charge an admin fee on a cancelled layby after all the law accepts that the retailer has had to store the product, administrating the payments and had their cashflow compromised but the bulk of the profit of the sale was lost by our client plus the proposed purchaser was very stroppy about the admin fee. If the retailer had a “Buy Now, Pay Later” service, the sale would have gone through immediately with no subsequent loss of goodwill by the proposed purchaser over the admin fee.

Word is getting around as this type of sign is now quite common in shopping centres as most shops that are now offering a buy now and pay later option so some retailers now, have about 20% of their sales are currently going through with these “Buy Now, Pay Later” services.

In the “Buy Now, Pay Later” services there are several companies, the two most prominent are afterpay, the biggest and zippay. According to Google Trend in Australia, I calculate they have between them about 95% of the market interest. Nothing else comes even close to them in public interest.

I think a retailer in our market space that selects a small player in the “Buy Now, Pay Later” services is kidding himself that a typical customer will sign up for that service just to buy their product. Would you sign up to take a $1,000+ credit obligation on a service that you never heard of and think you will not be able to use much? So if you agree with me on this, then that leaves you two options, and I have spoken at length to both these companies. Note we can supply both solutions.

Afterpay

We have spoken to Afterpay on numerous occasions and about a direct link to bypass Tyro. Currently, I expect not soon we will get an answer. So at present, our Afterpay solution works through Tyro. If you do not have Tyro, you cannot use it.

Currently, the merchant fees are about 4 to 6% of the sale depending on how much you put in and how much they think you are worth. Plus you will probably pay to use it some fees to Tyro. People tell me it will take one to two days to get the money.

One problem, which does concern us is that the consumer repayment scheme is fixed and the consumer has to make payments to a schedule, making it not as flexible as the layby system it is supposed to replace.

Zippay

Works directly, the merchant fees are about 2 to 4% of the sale again depending on what the offer is from them. The money is paid daily.

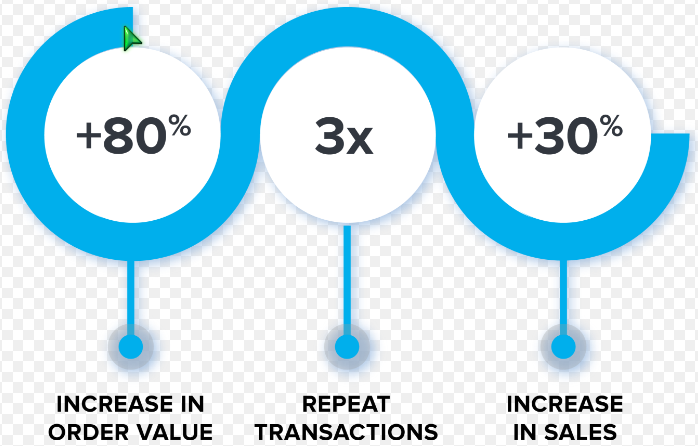

The consumer has a lot more flexibility to pay whenever they like. They do seem to want this as there is an analysis done of zippay in stores done by my competitor which would have a similar market space to us. I presume it was on people before and after using zippay.

Both systems

You can have both systems, and from my experience most do.

Both have sizeable existing user bases.

Both have promotions to benefit the merchants.

Although most of the shop should be okay, both systems do put some limits on what can be purchased using their systems, for example, a merchant will have a lot of trouble with selling tobacco products using either of these systems.

Overall

So overall I would say that most of our clients would be better off starting with zippay now. There is no risk as there are no setup fees, no monthly charges, no commitments and so no surprises. The only cost to the merchant is a service fee for each sale.