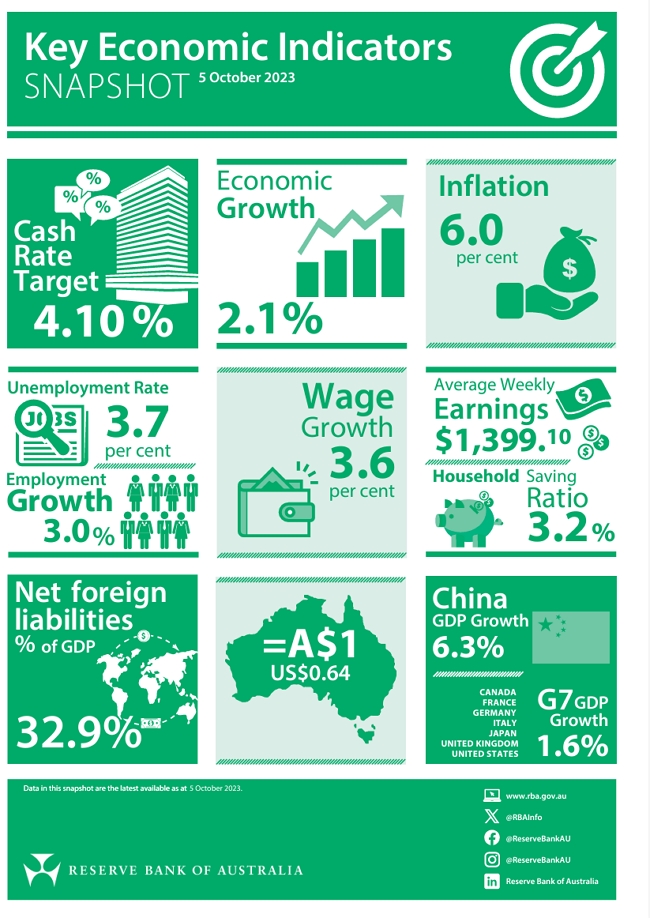

Here is the Reserve Bank of Australia (RBA) latest economic snapshot. I like it as it provides a simple view of the Australian economy. The full details are above, and supporting information here.

For us in retail, there are some concerning signs and a few positive takeaways in the report. Let's get into it.

Interest Rates on the Rise

As we're all painfully aware, interest rates have steadily climbed over the past year. Higher interest rates increase our loan repayments and cut into our profits. Most economists seem to think that one more rate rise is ahead, but who knows what the RBA will say. I doubt it can go up much more.

Inflation Taking Its Toll

The snapshot shows inflation is high, only slightly down from a year ago. The government policy of allowing interest rates to go up to reduce inflation is not working well at all.

Inflation is a worry as rapid inflation erodes consumer purchasing power. This puts pressure on retailers as consumers become more selective with their spending. I suspect more shrink inflation (when the product stays at the same price but gets smaller, have you noticed our burger size is sinking), and we need to source cheaper products?

Wage Growth Failing to Keep Pace

Wage growth is up, which is usually positive news. But with inflation running so high, we are falling behind even with the wage growth. This means Australians will have less actual purchasing power. Retailers, therefore, can't rely on rising wages to drive spending growth.

The other problem is that wage growth is higher than our national growth. Businesses will have to increase salaries without the increase in revenue to pay for it. This is just pure inflationary and cannot be maintained without increasing unemployment.

Household Savings Declining

The household saving ratio is meagre. We cannot count on people using their savings as before to maintain spending.

Strong Population Growth

Australia's annual population growth is up, a positive for retailers. More people means more potential customers and demand for consumer goods and services.

Conclusion

Overall, the snapshot presents a mixed view for Australian retailers.

What's your perspective on what the RBA report means for retailers? I am keen to hear your insights!