A Retailer's Guide to Managing GST in Australia

Australian retail businesses must ensure accurate GST compliance to stay financially healthy. Mistakes can lead to excess tax, losses, or costly audits. Most handle GST quarterly. Many struggle with mixed-item sales, some of which are GST-applicable, while others are not.

Common GST Problems in Retail

Shops are likely to encounter inevitable GST mistakes that can result in time and money losses.

- Incorrect Item Codes: A common and expensive mistake is using the wrong code for an item when it's sold. If you charge GST on an item that is GST-free, or vice versa, it creates problems immediately. This becomes complicated because different products have varying rules, as not every business expense is subject to GST. Some examples include loan interest payments, water, sewerage, and food.

- Complex GST Rules: Services such as lottery tickets, insurance, and bill payments have distinct tax rules compared to other goods and services.

- Errors on Supplier Invoices: Suppliers may send invoices with GST errors that are automatically imported into your system. Just because it's electronic, you do not get out of the need to verify the information manually.

- Understanding Sale Types: Differentiating between 10% GST sales, GST-free sales, and input-taxed sales can be confusing, but correct classification has a significant impact on the GST owed and available credits.

Checking Your GST Each Quarter

Our POS software has a powerful GST auditing tool. This makes your life easier. Here's why it's a game-changer:

Integrated Solution: No more jumping between programs.

Speed and Accuracy: Powered by Microsoft SQL for lightning-fast results.

User-Friendly Interface: Designed with retailers in mind, not tech gurus.

To ensure your BAS is accurate, follow this method to identify and fix discrepancies:

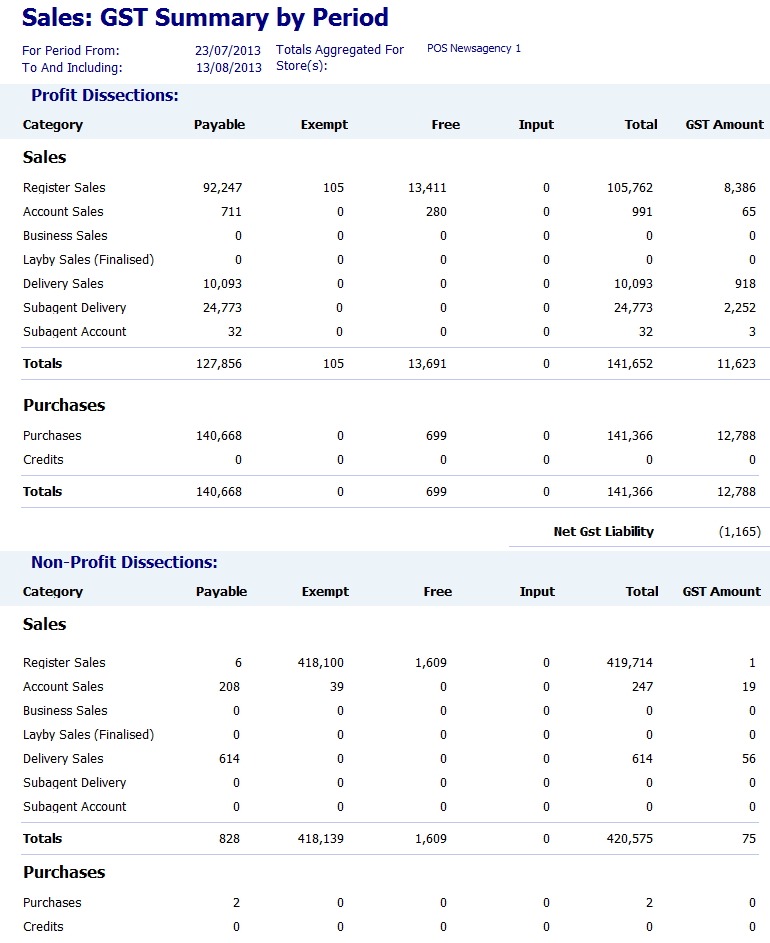

Get a Full GST Report: Run a GST summary for the quarter in your sales system, showing total sales, GST collected, and GST-free sales.

Let me walk you through how simple it is to use:

- Go to Register Reports > Sales > GST Summary

- Select your desired period

- Review the detailed report, including a comprehensive GST breakdown.

This will provide you with a detailed report that includes this information.

- Compare Reports: Match this with your accounting software's GST report and your total sales, as GST is about 10% of that figure.

- Find Differences: If totals don't match, compare the monthly and then the daily totals to locate the error.

- Investigate and Fix: Review the problematic transaction for coding or data entry errors, correct it, and document the change. Believe me, you do not want to have to explain to the ATO why the figures in one report are different from those in another system.

Real-World Example: Finding a $2,000 Mistake

A newsagent was preparing their quarterly BAS and found a $2,000 difference between their sales data and their accounting software. Using the detailed reports in their sales system, they traced the problem to a single day. The investigation revealed that an insurance payout, which should not have been subject to GST, had been incorrectly entered as a taxable sale. This mistake wrongly increased their GST payment by $2,000. By quickly locating this transaction, they avoided overpaying the tax office and corrected their financial records with minimal effort.

Best Practices for Managing GST

Document Everything: In particular, keep a detailed record of all changes. You need documentation to explain your figures to the Australian Taxation Office (ATO).

- Utilise Automation: Maximise the features in your sales and accounting software. Set up automatic reports, use the correct item codes from the beginning, and ensure data flows smoothly between your systems.

- Review: Check your GST records before finalising your BAS. I had one customer who submitted a report stating that they owed $480,000 in GST that quarter, and spent hours on the phone trying to correct it after the ATO contacted him for the money.

Ready to Make Your GST Easier?

An integrated sales system can automate the application and verification of GST, significantly reducing errors, saving you time, and protecting your profits.

*The information provided is general. We recommend consulting a qualified tax advisor for personalised advice tailored to your needs.