Many people before they take on a big customer want to do a credit check before they set in their pos software a credit limit.

Although you can get this credit check free if you like a credit report about yourself (links provided) to see what it looks like you need to pay, to get a credit report about your clients or potential clients.

The four biggest agencies in Australia, in order, I have put links into the free plan here, to test for yourself for your score.

Veda

Experian

Dun & Bradstreet

Tasmanian Collection Service is local but very important to people in Tasmania.

If you want a full report

Veda [Link removed] Experian

One point I warn you is many complain after filling out a Veda free credit file, they get a call from Veda asking why they need the information, and then the Veda salesman starts explaining why it is important to get a paid report. Just say NO.

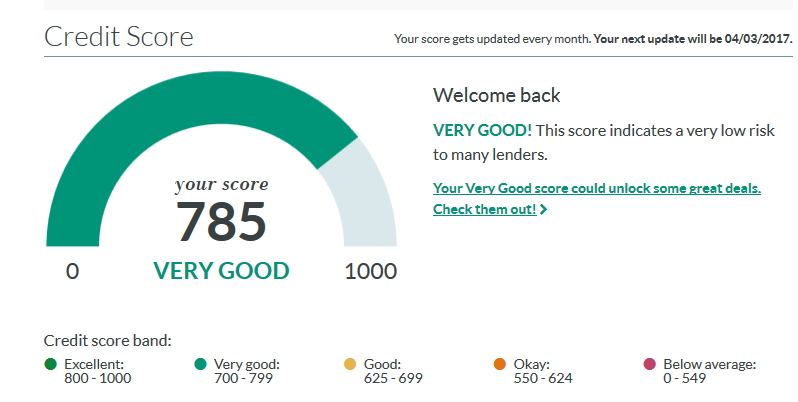

As there is no standard for credit scores, you will find that these companies produce their own score based on whatever they decide, and they all use different rating systems. As such, they sometimes give a very different result for the same person, so you get rejected for one lease, which used Veda and another agency that uses Experian, a different credit agency, accepts you.

VedaScore

As Veda is the most popular system used, I will discuss it. What you get is something like this; note the old system was up to 1200, so your old score might be very different.

Using the Veda system, everyone gets a credit score between zero to 1200.

Note The national average is 550, so do not be too upset if you get a score about that.

What you decide to do once you get the score of someone is up to you, but I will note, I have not noticed a good relationship between the score and the subsequent debt history being much help.