Issuing credit to a customer in a business is often an unwelcome necessity.

This our point of sale software can do, but because of the recent changes in credit laws, we have had to change our system slightly. Today with many of my clients, the number of people who credit has been issued too and the outstanding figures are becoming now extremely high so much it has become a necessity to charge their clients costs.

As a retailer, you are exempt and so not need to be in some way licensed with ASIC. However, I doubt whether you are exempt from the ASIC provisions. So I do strongly recommend that you do not issue a credit limit of over $2,000 to any of your clients as this figure does pass a legal threshold. I would suggest that you give all your clients in your system a credit limit of less than that.

To find the credit limit in your system, click on the main menu to customer > customer maintenance

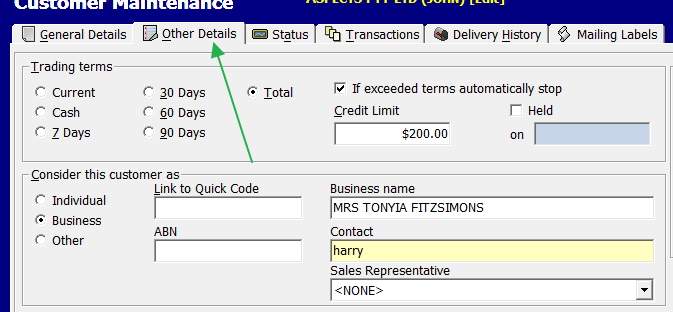

Now call up a customer, now click Other Details. (see green arrow below)

Now you can see trading terms and a question what to do if a credit limit is exceeded to either stop the account or merely warn you if it's exceeded.

However, two new conditions that are confusing my clients.

The first is that you must give the person 16 days minimum to repay the amount. If someone comes to your shop and says "The money with my wife, I will pay you back in an hour", well there is little legally you can do for 16 days. Conversely, you may have problems collecting the money lawfully if the amount outstanding goes over a year so here you need to act in the twelve-month.

The next point that is confusing people is that you are not allowed to charge interest, but you can change a monthly account keeping fee of 4% (maximum) of the amount that is on loan which is pretty close. So if I have a credit limit of $2,000 but only owe you a $100, I can be charged $4 a month. That adds up. I estimate that 4% a month is about 53% a year in fees.

What I do recommend is that you do a careful analysis, establish appropriate credit limits that will reduce your risk while maximising your income. One point I do suggest is that if possible that you get your clients to sign a form clearly stating your terms and conditions. Without this form, if you need to go legal you may be in big trouble. Most industry bodies do have such a form, so speak to them.