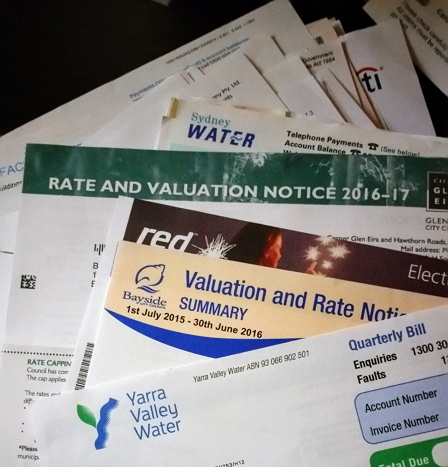

What surprised me is that several people jumped at us, following our recent announcement of our Bill Payment services. I doubt any of them put much thought into it or know much about it. Just to correct the initial errors the BPAY system is not operated by Australia Post. Australia Post operates POST BILLPAY, which is their payment system. This POST BILLPAY operates almost exclusively the over-the-counter payment market for bill payments in Australia. The BPAY system is operated by a group of companies owned by the major banks and is primarily an Internet service. The product we have is an over-the-counter payment system, generally called OTC payments.

That over-the-counter payments are on the decline I agreed. However, it is important to realise that it is still a big market, and it promises to be a big market for the next five years as there is a huge market for cash service as many people today pay in cash. We are not just seeing older people, there are large numbers of young and middle-aged people pay in cash too and there are also transient people such as people on temporary residence who have limited access to Australia's banking. These people need and use phones, electricity and heating. Plus even plenty of Internet today is paid for in cash over-the-counter.

That statement of an 80% figure of over-the-counter payments sales buying nothing else, comes from older systems then ours when people tended to put the over-the-counter counters away from the main counter. There is no reason to do this with our system as any point-of-sale unit can handle these payments. This is the reason; I am sure that our figures are higher.

As far as the small fees for each transaction that is being quoted. These are recommended fees. You can charge more if you want by introducing a service fee. No-one can stop you because it is not an agency. No one is telling you how to run your business, if you put in over-the-counter payments. NO ONE!!! You are not signing up to an agency.

The proposed connection to the Bill Express company made by some is I feel is false and misleading and irrelevant. Unlike Bill Express with our over-the-counter payments, the merchant has nothing to pay, no fees and no commitments. If it does not work for the merchant, they can stop it whenever they like, no questions, and it will have costed them nothing. Unlike Bill Express, the billers are paid the same day, and the merchant does not take the credit risk. Furthermore, let me say that the over-the-counter products worked well for merchants until Bill Express as a company went south. The failure for the merchants had nothing to do with the over-the-counter payments itself and the loss by many of them of this over-the-counter payment was greatly regretted by merchants.

The big point is that it is about foot traffic, getting more people in the door probably about 40 to 200 a month. Here is a thought experiment for you, how much would you pay someone in a suit and tie, who came into your shop and gave you a proposal that he would get you 40 to 200 people every month coming into your shop and buying something? As Bill Express proved people paid thousands of dollars, and it is now available for you free.

Try it. It costs you nothing. You can leave any moment. Chances are that you will want to stay once your customers realise that you are offering them yet another convenience. Plus if we get enough people involved there is the potential to promote over-the-counter bill-payment services directly on the bills themselves which will generate plenty of free advertising.