One big plus and probably unique advantage that our users have is that so much of their stock data can be imported from the suppliers direct without them having to manually enter in the information. It does, however, present a problem that despite our best efforts, some of the information submitted by the suppliers is wrong and as such this incorrect information gets into our clients' information. For this example sometimes, some of the GST rates in the suppliers' files are wrong; these inaccurate figures are imported into our clients' system, and so this results in the problem.

Note this problem does also occur when people manually enter in the products and make mistakes or follow the suppliers' documentation which is incorrect.

So what I do suggest is that you audit the GST figure regularly.

You will find it in here in your point of sale software.

Cash register> Register reports > Stock > Details Listing (Excel)

This allows you to use ad-hoc reporting.

As it can be much faster to check if you all departments at once, but you may prefer to do it by one department at a time.

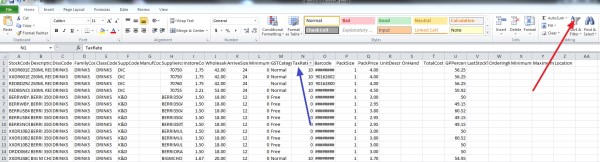

Now you will get a screen that looks like this.

Where the red arrow is click on that "Sort & Filter", now click where the blue arrow is "Tax rate" and now click all the rates that are not 0% or 10% and review them. Then do it again only for 0% tax items and review them too.

Overall, I find this particularly useful is in tracking down GST errors.

Give it a try and see how you go.