Australian LPO POST in a Declining Letter Era

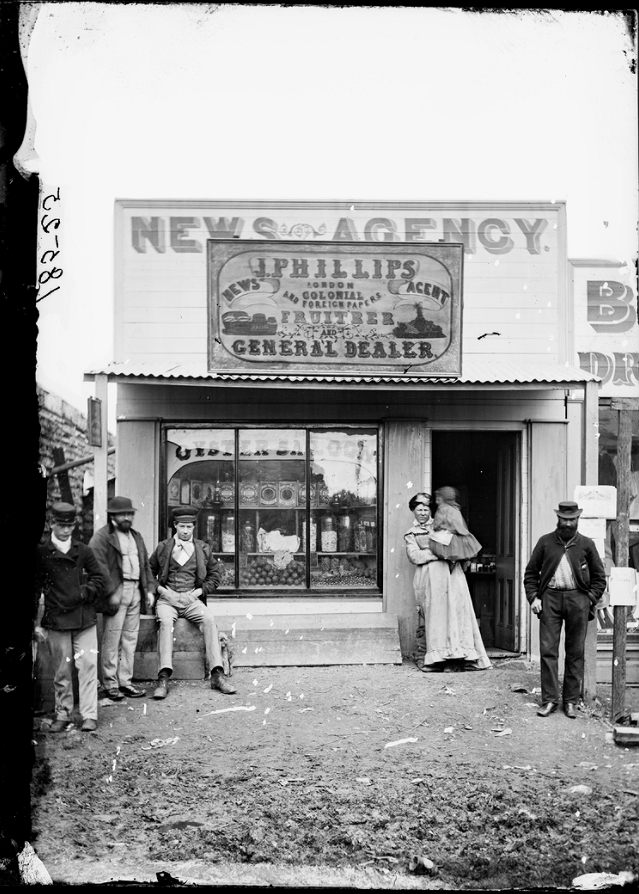

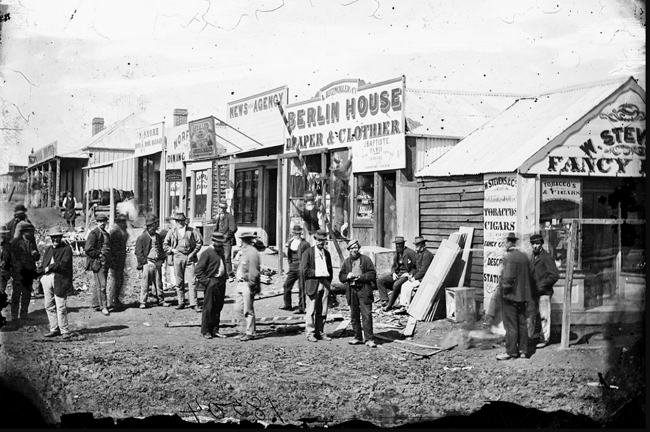

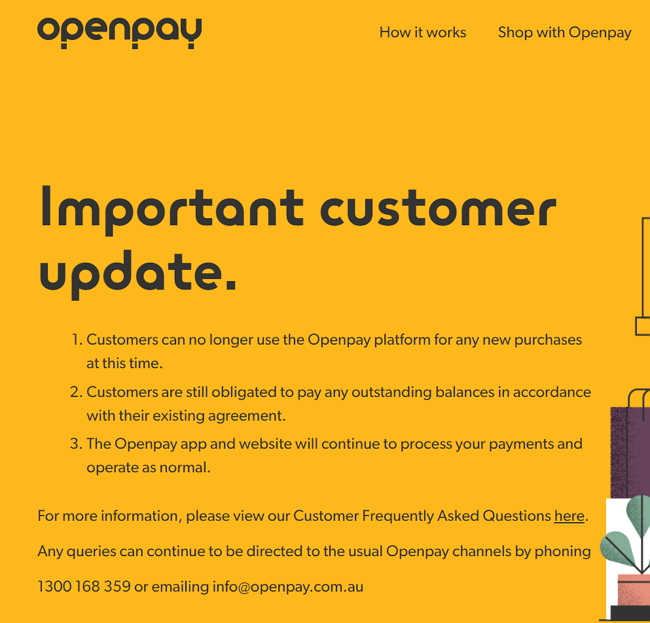

Denmark's PostNord's decision to completely cease letter deliveries by 2025 is today's critical warning for Australian Licensed Post Office (LPO) operators. They also face a worldwide trend of declining letter volumes. What is left of the post there will be done by private companies. If the Danes follow the pattern that Australian media companies did with newsagents, I would not expect much help to their agents when the system privatises.

It's a preview of what lies ahead for our postal system.

Current Australian Postal Trends

Australia Post's letters business has been experiencing an unstoppable decline for many years. I know personally as many of my customers are LPOs.

In the 2023-24 financial year, letter volumes in Australia fell to levels not seen since the 1950s. In 1950 we had only a third of the population!

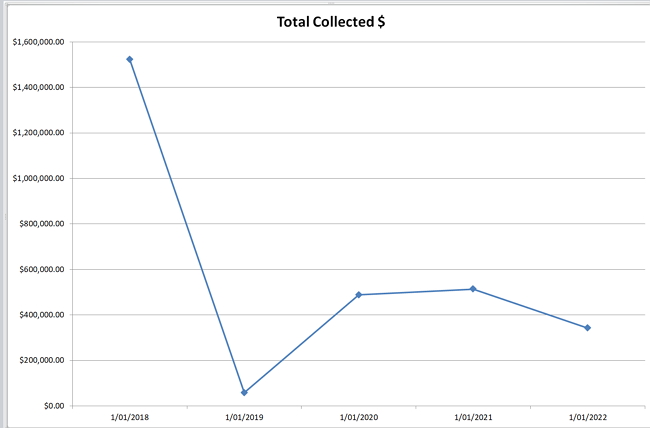

The statistics are getting worse:

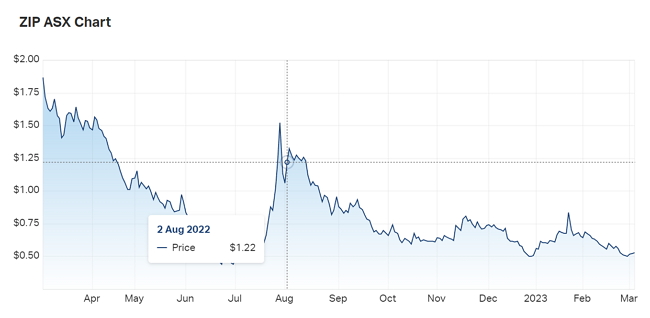

- Domestic addressed letter volume has decreased by 72% from 2006/07 to 2023/24

- Typically households now receive approximately two letters per week, this is estimated to drop in five years to less than one letter per week

- Letter volume decline has reached 72% from 2006/07,

- Letter volumes are expected to fall by about 10% a year.

- Letter costs are up as there are more delivery points.

"Ask yourself this: When did you last get a personal letter? I cannot remember. I know it was a long time ago."

For LPO operators, these declining letter volumes translate to reduced revenue streams.

Australia Post's Modernisation Response

Since April 15, 2024, Australia Post delivers non-urgent letters every other day rather than daily. These operational changes directly impact LPO operators through altered delivery schedules.

The organisation has now fully implemented its New Delivery Model:

- Posties deliver priority mail, express letters, and parcels every day

- Standard letters and unaddressed mail are delivered every second day

- Australia Post is increasing its postage charges.

Finding Opportunity in Disruption

Despite these challenges, LPO operators have a significant opportunity as there is a growing parcel delivery business driven by e-commerce. When ever I go to my local LPO, I can see a lot of traffic.

Strategic Adaptation for LPO Survival

To thrive in this changing landscape, Australian LPO operators must consider the following strategies: Like newsagents, they must offer other goods and services. What works well in LPOs are complementary business lines that sell more to existing customers, such as greeting cards, packing supplies, office supplies, and printing services.

Looking at the business for sale figures, you can see that many LPOs are doing well.

Looking Ahead

The future of postal services in Australia will look very different. LPO operators must embrace change.

About the Author

As founding Director of POS Solutions, I've spent over four decades providing point-of-sale software solutions to retail businesses across Australia, including numerous Licensed Post Offices. My company has been a major supplier of POS systems to newsagencies, pharmacies, and specialty retailers, giving me firsthand insight into the operational and financial challenges these businesses face.

Throughout my career, I've witnessed the digital transformation of retail and postal services and helped hundreds of business owners adapt their operations to changing market conditions. My experience working directly with LPO operators has provided me with unique insights into their revenue streams, operational challenges, and adaptation strategies.

Much of the statistics cited in this article come directly from Australia Post's Annual Reports (2023-24) and industry briefings I've attended as a service provider to the postal retail sector.