When valuing a business for resale, particularly at the time of sale, one problem that sometimes appears is the Breakage Revenue.

What is Breakage Revenue?

When you issue points or give discount vouchers to your customer through your loyalty program, strictly in accounting, you should deduct the value of these items from your sales. Say you issued today 1,000 discount vouchers at an average price of $2; then you should remove $2,000 of sales revenue from your books. This is the Breakage. Now as the vouchers are claimed, the value comes off this Breakage. So say of the 1,000 discount vouchers issued, 50 are claimed, well now $100 comes off the $2,000, so the amount outstanding is $2,000-$100= $1,900.

As only a few discount vouchers are claimed, and most expire, this is often ignored except when the business is for sale.

The Breakage must be resolved to ensure a fair deal for all involved in a business transfer.

Valuation of Breakage Revenue

Taking the example above, it is quick to see that the figure is not trivial. If we assume these discount vouchers are claimable for 30 days, then we have outstanding about 30 x 1,000 x $2 = $60,000. What do we do with this figure? Remember, only part will be claimed in reality, but who can say what a fair figure is at the time of sale?

Compliance with legal and regulatory requirements

After the business is sold, all valid discount vouchers are likely an obligation on the new owners, but often the old owner finds that they have to reimburse that amount. So the new owner said 5,000 were claimed, so he wants $10,000 from you.

Also, if the old owner has claimed the Breakage in their tax return, I don't know what the ATO would do if they made an audit of the business. You need to check this too.

The best treatment for Breakage Revenue

Some people avoid the problem by stopping 30 days before the transfer and issuing these discount vouchers or points. A better solution is to give discount vouchers that can only be redeemed before a specific date, the transfer date or 30 days, whatever is earlier.

Customer Perception

The issue of customer perception is the final one. Adverse publicity and company reputation damage can result if customers believe their discount vouchers are devalued. There are good marketing reasons why these discount vouchers were issued.

We provide you with a scientific approach to collect data on how your customers use your loyalty VIP program to comprehend its impact better. By analysing the sales data on your customers' purchase histories, you can determine the effects of your loyalty VIP program. Doing this lets you decide what kinds of goods or services are being bought, how often they are bought, and other important metrics that will help you make better decisions about your program.

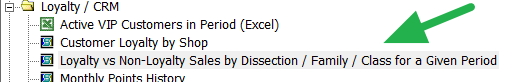

The "loyalty vs. non-loyalty sales" report, highlighted in green on your cash register reports, is one helpful report to examine.

It is best to keep things straightforward and select the most recent year's data to analyse. When you run the report, a list of items purchased by regular and devoted VIP customers can be compared.

Pay close attention to the profit section because VIP customers account for over a third of a modern retailer's profit. They also typically generate more revenue per visit than regular customers.

The percentage of gross profit is another important row to consider. This row highlights VIP customers' high-margin purchases, which may help locate new products to offer only to VIP members.

Last, examining the cost row to determine the exact costs associated with your VIP clients is essential.

Summing up

Consideration must be given to the valuation of Breakage, its treatment in the sale agreement, compliance with legal and regulatory requirements, and customer perception.

As always, when selling a business, I recommend that you seek professional advice to ensure that all issues are appropriately addressed.