Setting credit limits for your customers

In my experience, the biggest issue in business is cash flow. Bad cash flow and your business is dead. It is the most significant cause of companies collapsing.

The primary tool used here by businesses is credit limits. This sets the largest amount that they are willing to risk in a person.

As times change credit limits need to be revised often. Well, times have changed. It is a good idea to review your credit limits now to see if they are appropriate in the current conditions.

Our POS system gives you extensive controls on how to control these credit limits.

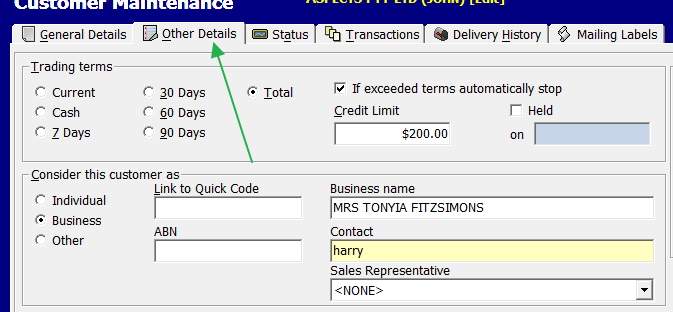

Go to the main menu> customer > customer maintenance. Now call up a customer, click Other Details. (see green arrow below)

You can see trading terms and a question of what to do if a credit limit will be exceeded. If it was exceeded, you could select to either stop the account or warn you. Now you will have to decide what amount you will give for that customer. There is, of course, no precise method of determining this. A simple policy that works well in retail in my experience

Do a review of what you are prepared for your total exposure to be. You may need to redo your figures. If say you can afford $50,000 and you have 100 active accounts, that is $500. That gives you a benchmark.

2) Determine what they usually buy off you on credit in a period. Now, look at what payment period they need so if they buy $10 to $20 a week and pay on 60 Days for them to trade with you requires at least $150. Since your benchmark is $500, you may want to go up a bit on that figure.

3) Consider your gut feeling are they as a credit risk good, average or low.

3) Consider whether they are low and high-profit customers. A buyer that purchases low margins items means you are putting up more money than someone who buys high margin items.

4) Now go through and look at their trading history.

Here is a tip to make the process go much faster!

Once you come up with a figure for one person, write it down and compare the accounts to that person. Now use that figure, and go up or down.

If you want more here is a formal discussion, on how to do credit limits.

What does present a problem is letting your client know what their credit limit. Many people will hold off paying if until their credit limit is reached. Others get upset, "you cannot trust me with $200?", "you have trusted me with $5000, and I have been coming for years a loyal customer now when I need it, you are not letting me take this ?" As a rule, I suggest you say its the computer, not me that set it and let us look at it together now.

What you are trying to do is establish appropriate credit limits that reduce your risk while maximizing your income.