Surcharging is an extra charge levied on a customer at the point of sale for the cost of processing electronic payments. Dynamic is when it changes by pay type. Fortunately for our clients, we have a simple and safe solution for those wanting to introduce this fee, which is automatic with no investment or cost to set up it up, which can save their business money.

The amounts involved are NOT trivial. The Reserve Bank Of Australia (RBA) here which presumably the ACCC will use for a guide, stated that Visa or MasterCard debit transactions may cost a business around 0.5 per cent of the transaction value. Credit cards usually have a higher cost for businesses, and may cost the business up to 1-1.5 per cent for Visa and MasterCard. How they got those figures is beyond me, my figures based on some of my clients figures just on direct bank charges would be that for Visa and MasterCard debit and credit transactions about 1.65% which I think you should be using as a guide for your costs for an initial calculation.

Some points for NOT using surcharging

Almost all consumers dislike surcharges; one study showed "more than 90% of consumers want surcharges eliminated; one in four don’t return to a business if surcharged, and three in four tell others to avoid a business because it surcharges."

Cash is not free; it has to be in a collation, then counted, balanced, stored in a safe, then a trip to bank and then banking fees. Plus there are losses due to mischange, the increased the overall security risk of the premises, etc. The cost of cash handling and its associated costs in a business are commonly put down at about 2% to 2.5%, which is actually higher than the fees of the electronic payments. If so why discourage people from using cards with fees?

Some points for using surcharging

Surcharges allows retailers to offer cheaper prices as they are not subsidising those consumers who use more expensive payment methods.

Most people have a backup form of payment method, and if you offer them a choice, they can select the payment method that best suits them.

Some items the margin is so wafer-thin that they cannot be sold with some payment methods without surcharges.

Finally and for many, this is the biggest problem it allows retailers to offer more payment types, for example, American Express (AMEX), paypal and Diners, which a number of businesses do not accept due to higher costs. A lot of corporate cards are AMEX. Many people work in such organisations, and if they are doing company-related work, they need to go to a place that accepts AMEX. If corporate customers are important for your business, then you must accept AMEX.

I am sure you can add more to the list for and against.

Now assuming that you do want to introduce surcharging at least for some payment methods. We have two alternatives, Tyro is a good option here and we do recommend that you use it. It is automatic and easy to set up; the main problem is that it cannot handle most of the payment types, although it can handle the most popular.

However, our point-of-sale system can handle it all. This is how.

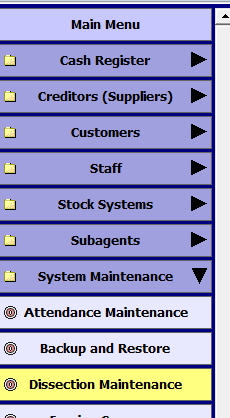

Go into the main menu, select Dissection Maintenance.

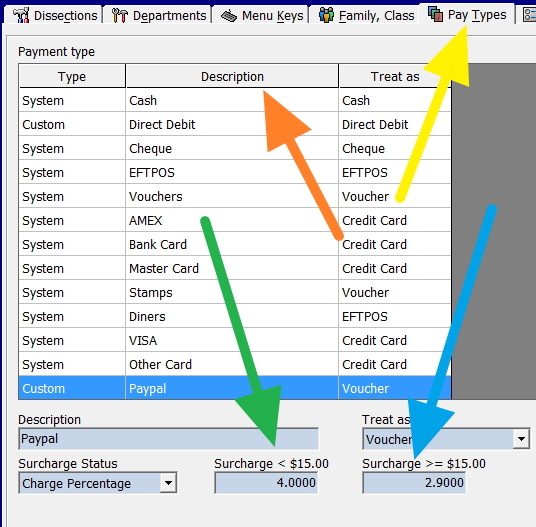

Now in Dissection maintence, where the yellow arrow is click the tab "Pay Types"

Where the orange arrow is you can read the existing pay types this business offers, note it does accept some of the expensive payment types like AMEX and paypal.

When clicked on paypal, look where the green arrow is pointing for what appeared.

In view of Australian standards, we do recommend that In Surcharge Status, you use "Charge Percentage" as shown here because that is what the goverment prefers although other formulas do exist here.

The $15 point, which is the generally accepted cutoff figure for micropayments soon unfortunately for most payment types you will not be able to use as the standards state it should be the same or lower then costs for all amounts. Although in this example, Paypal is not covered under the new goverment standards. As paypal rate is 30 US cents plus 2.9%, so what they did here is make it a bit higher under $15, 4% (see green arrow) and over $15 use the 2.9% (see blue arrow).

You will find extra details on this page too which I will discuss later.

Using this you can offer more flexibiltiy to your clients in their selection of payment types.

If you have any questions, or want to know more please let me know.