This article discusses the importance of stocktaking for businesses and addresses common objections. We also explore the advantages of performing a stocktake, even when facing challenging circumstances. Additionally, we highlight the potential risks of skipping a formal stocktake and how implementing regular rolling stocktakes throughout the year may offer better results.

Objections to Stocktaking:

Stocktaking can be viewed as a tedious and resource-intensive task, with several arguments against its necessity:

It consumes time and effort

It incurs additional costs without generating revenue

Disruptions to daily operations can negatively impact sales

These concerns are legitimate; however, there are compelling reasons to perform a stocktake despite them.

Legal Requirements for Stocktaking:

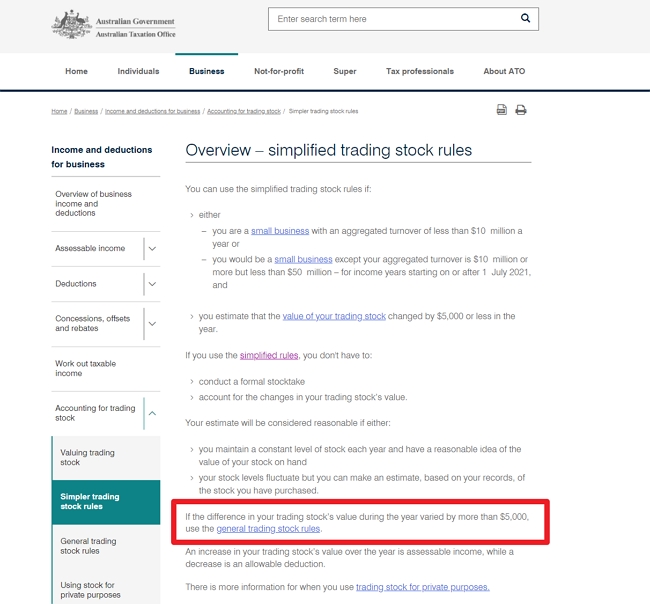

According to the Australian Taxation Office (ATO), businesses must perform a stocktake if they cannot accurately estimate their current stock levels based on historical data and do not meet specific conditions. These conditions include:

The difference in stock values between the previous financial year and the current financial year is less than $5,000

Using a reliable method, you can reasonably estimate your current stock levels and maintain sufficient evidence to substantiate your estimates.

Please read this page from the ATO here on this question and pay particular attention to the square I marked in red.

Let me ask you, has your stock level varied by more than $5,000 this year than last year?

From the ATO's view, it is up to you to prove your stock figures to the ATO to their satisfaction.

Rolling Stocktakes vs Formal Stocktakes:

A competitor suggests replacing traditional annual stocktakes with rolling stocktakes throughout the year. While these approaches can provide real-time insights into inventory levels and conditions, they are more expensive and time-consuming than formal stocktakes. However, the ATO recommends that businesses ensure accurate stock valuations for tax purposes, regardless of whether they choose rolling or formal stocktakes.

Advantages of Performing a Stocktake:

A well-executed stocktake offers numerous benefits for businesses, including:

Identifying discrepancies between actual stock and record inventories, enabling improved stock ordering, inventory management, and loss prevention strategies.

Reviewing the quality and quantity of stock on hand, allowing for identification and disposal of damaged, expired, or obsolete products, thereby freeing up valuable storage space and resources.

Gaining greater visibility and control over the business's inventory position, ensuring long-term success.

Conclusion:

Ultimately, whether to undertake a formal or rolling stocktake depends on each business's unique circumstances. Regardless of the chosen approach, it is crucial to understand the legal requirements and potential benefits associated with stocktaking. By staying informed and proactive, business owners can make smarter decisions and set their ventures up for continued growth and success.

Whatever you decide, I wish you all the best for your business.