Clearly electronic products sell well and there are heaps of them but there is always a *but* as I will show.

With our clients its dominated by two big player's Touch and ePay and even before the recent problems that we had with ePay, Touch is by far the biggest and growing rapidly. The main reason I think is because Touch seems to be more active in the marketplace, and they have a better range. Range is everything here. If people want an ABC voucher, and you do not have it, then they are most likely to go elsewhere, that is why people tend to have touch, they may not have anything else, but they will have touch because they need the range.

Here is a graph of ePay sales over the last eight quarters done about three months ago, before they had all this problems and its fallen since then again.

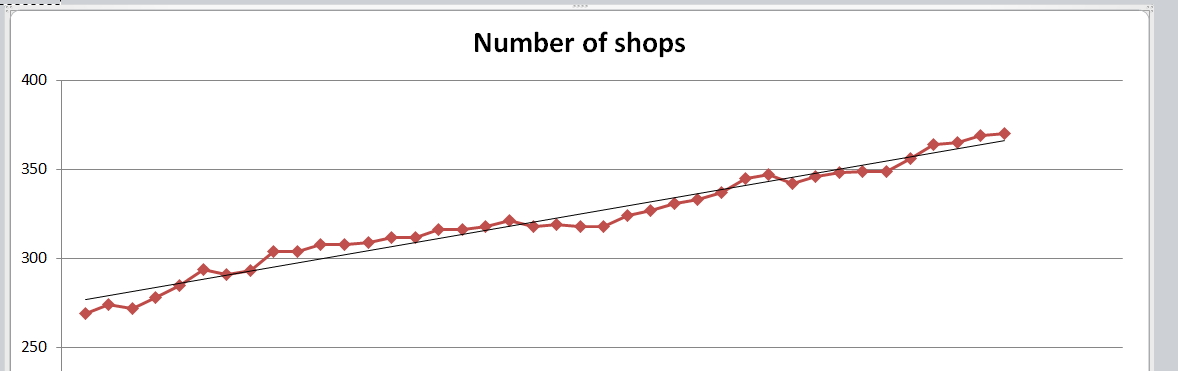

Conversely, here is a graph of Touch sales in our client base.

Every year sales are going up about $100,000.

We are debating now whether it's even worth supporting ePay much longer.

When looking at it from an individual shop perspective, one problem I do have is that as I am dealing with averages, some only use Touch to buy discounts for what they and their family personally already use and do not bother to market it, which mucks up the figures.

Still I can only look at what I have.

Overall the number of electronic products sold has gone up. Overall every month, our clients are increasing their sales of electronic products by over 200.

The value of the unit price has gone up too by about a $1 each year.

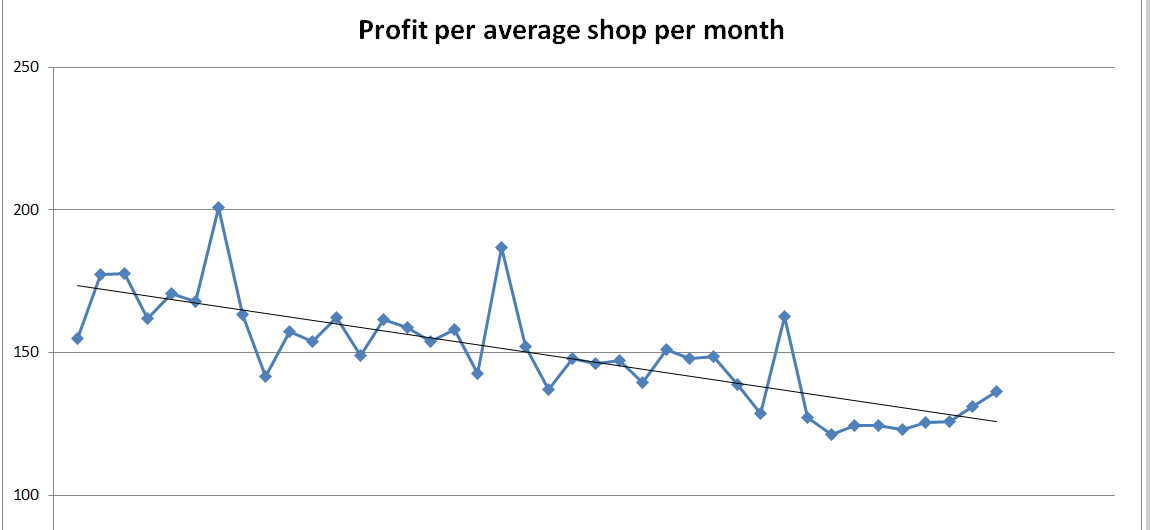

The problem is that the margins have been falling.

When I looked at it per shop, what I found is despite an increase in sales both in quantity and unit price, the profit per shop is falling by about $15 a year, although if you look at the recent figures, it does look like it is going now steady.

The problem in Australia is that this market is dominated by a few large players, who do not see the retailer as important in the sale process other then supplying an outlet.

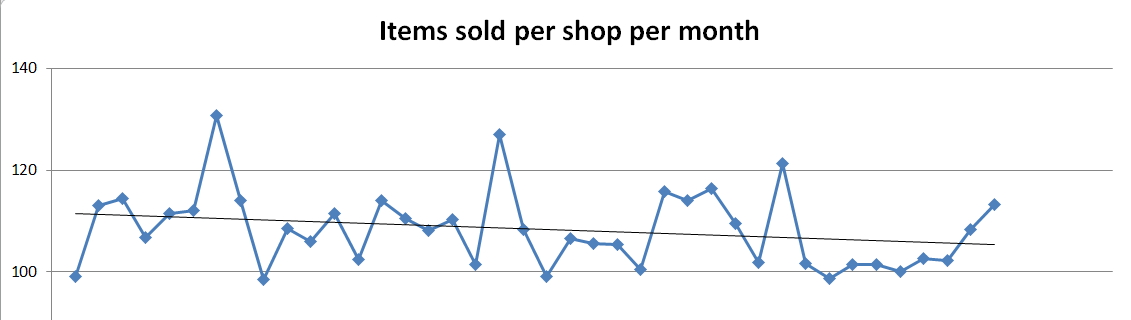

Still that is not the way to look at it, looking at this graph you can see the number of items sold is about 110 a month or about 4 a day in an average shop.

So the average retailer for simply adding a service with our software and putting a sign up on the wall so is getting about four people a day coming into their shop and hopefully buying more stuff in the shop and getting paid about $140 a month which is clearly why people are delighted with Touch. You can see that from the number putting Touch into their stores, which has been increasing every month. Currently, we are putting Touch service into our clients at a rate of about two to three shops every month.

Overall though I think you can say this, it does pay its own way and there is nothing wrong with an extra 1a0 people in the shop every month, but it's not a game changer. It certainly worth getting before summer hits.

If you want to know more, please let us know. As you can see we have heaps of data.