What is happening now is both EFTPOS/Credit card usage, and fraud rates are way up. What fueling the increase in fraud rates is that more EFTPOS/Credit transactions are not done in the shop.

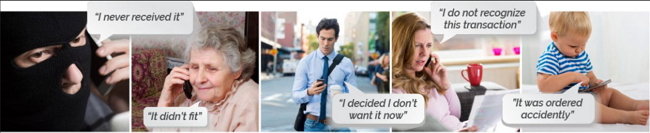

Of the EFTPOS/Credit fraud, by far the biggest category, 71% is friendly fraud.

Friendly fraud started when a customer queries what looks like a legitimate item on their account. If it proceeds, what generally happens is that the bank will cancel the transaction. They will then debit the merchant. These people tend to prioritise consumer rights over merchant rights. Still, they do not like it, and since the rate is going up, we participated in a meeting to see what could be done.

The responsibility to prove friendly fraud is on the merchant.

Here are some points you can do to reduce the risk.

1) The new DTI system that we are rolling out can help a lot the merchant. If you have not yet, signed up, do it while it is free. If it costs you nothing and can help, why not use it?

2) If they are in the shop, process all transactions under the camera. Video evidence is something courts do accept.

3) Check the order, if the transaction amount is higher than usual.

4) Another often larger order comes from the same customer after delivery. A fraudster who gets away with it will often try again.

4) Save delivery documentation. Signed documentation is a big help.

5) If in doubt, contact your EFTPOS/Credit provider.

Hope this is of help.